With satellite communication becoming inalienable to the formation of 6G and growing in strategic importance, Taiwan’s satellite industry development is gaining traction as well. While governmental organizations like the Taiwan Space Agency (TASA) primarily focus on the development and deployment of satellites, more and more companies from the private sector also jump on the wagon, supplying payloads and ground equipment for both national space programs, defense projects, and commercial applications. In 2022, the output of Taiwan’s space industry reached US$7.19 billion, while 98.7% of it came from the ground segment.

When it comes to the design and manufacturing of antennas and RF components, prominent players like RapidTek Technologies, TMY Technology, and Tron Future Tech have also emerged on the horizon, focusing on slightly different industrial verticals. Among these startups of a younger generation, RapidTek, founded in 2015, is perhaps the most well-versed and mature. The company saw NT$320 million (approx. US$10.14 million) in investment from Taiwan’s Quisda Corp in 2023, with the ICT giant becoming RapidTek’s fourth-largest shareholder. In the same year, RapidTek was also listed on the Emerging Stock Board of Taipei Exchange (TPEx).

In fact, the company can trace its origin to its precursor which started out in 2006 as a sales representative of various US companies specialized in reed relays and switches. Even today, RapidTek is still the sales representative of relay suppliers like Coto Technology and Comus Group. By 2013, RapidTek moved beyond the role of a mere sales representative and ventured into the RF business, becoming a supplier of testing equipment for RF switches, before advancing further to become a testing equipment provider for a wide range of RF components. Between 2019 and 2021, leveraging its know-how in making antenna testing equipment, RapidTek gradually learned the ropes and successfully broke into the antenna design market.

Overseas expansion currently underway

In November 2023, RapidTek marked its first presence in Europe, participating in the Space Tech Expo Europe in the German city of Bremen. It was also one of the two Taiwanese companies partaking in the event. At the expo, RapidTek demonstrated its satcom turnkey solutions and ground terminal, notably its front-end module with tailor-made active phased array radar (AESA) supporting KA/Ku band.

Sean Lee, Business Development Director of Rapidtek, pointed out in an interview with DIGITIMES Asia that the end of the pandemic and RapidTek’s continuous growth allowed the company to deploy enough resources to explore the European market, with in-person visits and trade show participation in the region only began in 2023. According to Lee, RapidTek is inclined to form partnerships with the top three national/regional players and has been spending significant time identifying partners with the right strategic fits, even though RapidTek adopted a flexible strategy allowing it to develop different cooperation forms with partners that have different capabilities.

Currently, the business development director indicated that cooperation has begun with partners in the UK, France, Germany, and other regions, with proof of concept (POC) underway. In such expos, Lee said, participants come in various sizes and diverse application scenarios, but usually have concrete demands to be addressed, making it quicker to develop cooperation.

As Taiwanese satellite supply chain players cast their sights overseas and begin to expand their footprints abroad, Lee indicated that the relations between RapidTek and other peer antenna makers aren’t always competitive, noting the different offerings. In fact, some complementary offerings even open the path to potential cooperation opportunities among peers to broaden their overseas presence together. Notably, as Lee observed, the more established antenna providers in Taiwan are predominantly focusing on satellites in the geostationary orbit (GEO) which, according to Lee, often just need mechanically scanned arrays rather than the more sophisticated AESA technology used by RapidTek and other suppliers targeting low-Earth orbit (LEO) satellite applications.

Branding will be a major challenge

Apart from Taiwan’s advantage of having a price-competitive high-tech supply chain, the RapidTek business development director sees speed as a key winning factor for Taiwanese companies exploring foreign markets. While the Taiwanese ICT industry can undoubtedly muster its supply chain from upstream to downstream to provide competitive final products, according to Lee, branding will be the biggest challenge for Taiwanese players seeking to sell final products abroad, especially when it comes to defense-related markets where a certain proportion of components have to be domestically sourced.

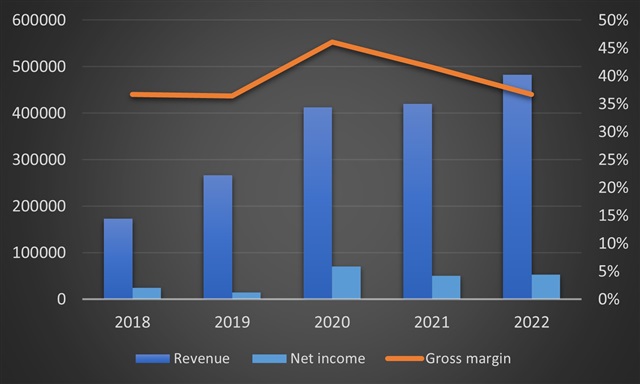

Taking such factors into consideration, Lee pointed out that RapidTek still focuses on antenna design, and leaves system-level integration to customers. Lee, however, emphasized that RapidTek is fully capable of sub-system-level integration: apart from the baseband processor, the company is able to design other components in an RF front-end module. According to the company’s official data, revenue in 2022 was NT$482 million, a 14.9% growth from 2021, though the sales from advanced phased array antennas were only NT$1.3 million, accounting for 0.28% of total sales. In contrast, testing equipment, switches, and others still accounted for 78.13% of sales, while its relay-related agency business accounted for 21.59%. The share of antenna sales will only increase though. As Lee puts it, given the current growth pace in the satellite market, it wouldn’t be a problem to maintain an annual growth rate of around 2-3%.

RapidTek sales 2018-2022 (Unit: Thousand NTD)

Source: RapidTek, compiled by DIGITIMES