Image © Adobe Stock

The British Pound firmed on Friday following the release of stronger-than-expected UK retail sales for January, which will contribute to evidence that the economy will exit recession this quarter.

The Pound to Euro exchange rate rose to 1.1698 after the ONS reported retail sales rose 3.2% month-on-month in January, beating expectations for a more modest 1.7% figure, in what amounts to a significant improvement on December’s -3.5% reading.

Retail sales recovered to 0.7% year-on-year in January, from -2.4% in December, and beat expectations for -1.4%.

The Pound to Dollar exchange rate rose to 1.2590 in the wake of the numbers. The currency reaction is muted in light of the strong moves that followed this week’s inflation and GDP reports, but the retail sales data contributes to a body of evidence that the UK economy started 2024 on a stronger footing.

“Sterling slipped after yesterday’s weak GDP data but has seen some support from today’s more positive news on retail sales,” says Rhys Herbert, an economist at Lloyds Bank.

“There was promising news as sales volumes rose for the second time in three months, following 19 prior months of decline. This reflected rising levels of consumer confidence, as well as a boost from the January sales,” says Kris Hamer, Director of Insight at the British Retail Consortium.

Charlie Huggins, Manager of the Quality Shares Portfolio at Wealth Club, says UK consumer spending is proving highly volatile from one month to the next.

“The December figures suggested signs of pressure, whereas January’s figures indicate the UK consumer is still in rude health,” he explains, “the reality is probably somewhere in between.”

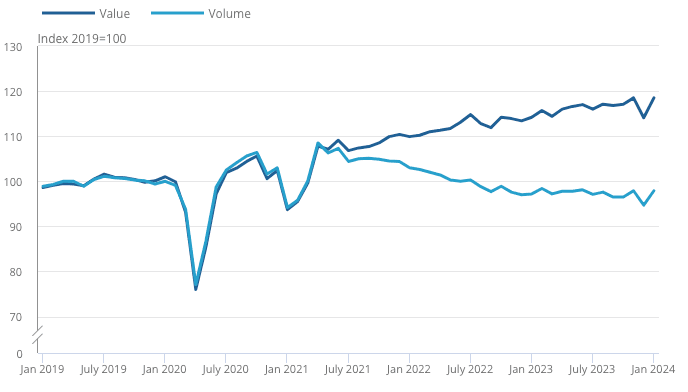

The above shows consumers spent more for less in January 2024, as the 3.9% monthly rise in sales values (the amount spent) exceeded the 3.4% rise in sales volumes.

But the chart also shows the December slump was a blip that has apparently been corrected.

Recall that the December figures caused a selloff in the Pound, convincing one member of the Bank of England’s Monetary Policy Committee – Swati Dhingra – to vote to cut interest rates as she said the fall was evidence of slumping demand.

Sterling bulls might feel aggrieved that there is no stronger recovery in the Pound in response to January’s strong retail figures, given it now appears the market overreacted to December’s slump.

Neil Birrell, Chief Investment Officer at Premier Miton Investors, says the consumer sector bounced back strongly after a weak Christmas period and these numbers suggest that ongoing higher interest rates are not having the dampening effect that was anticipated.

“The Bank of England will tread a careful path in its decision making as these numbers do not provide them with much clarity,” he says.