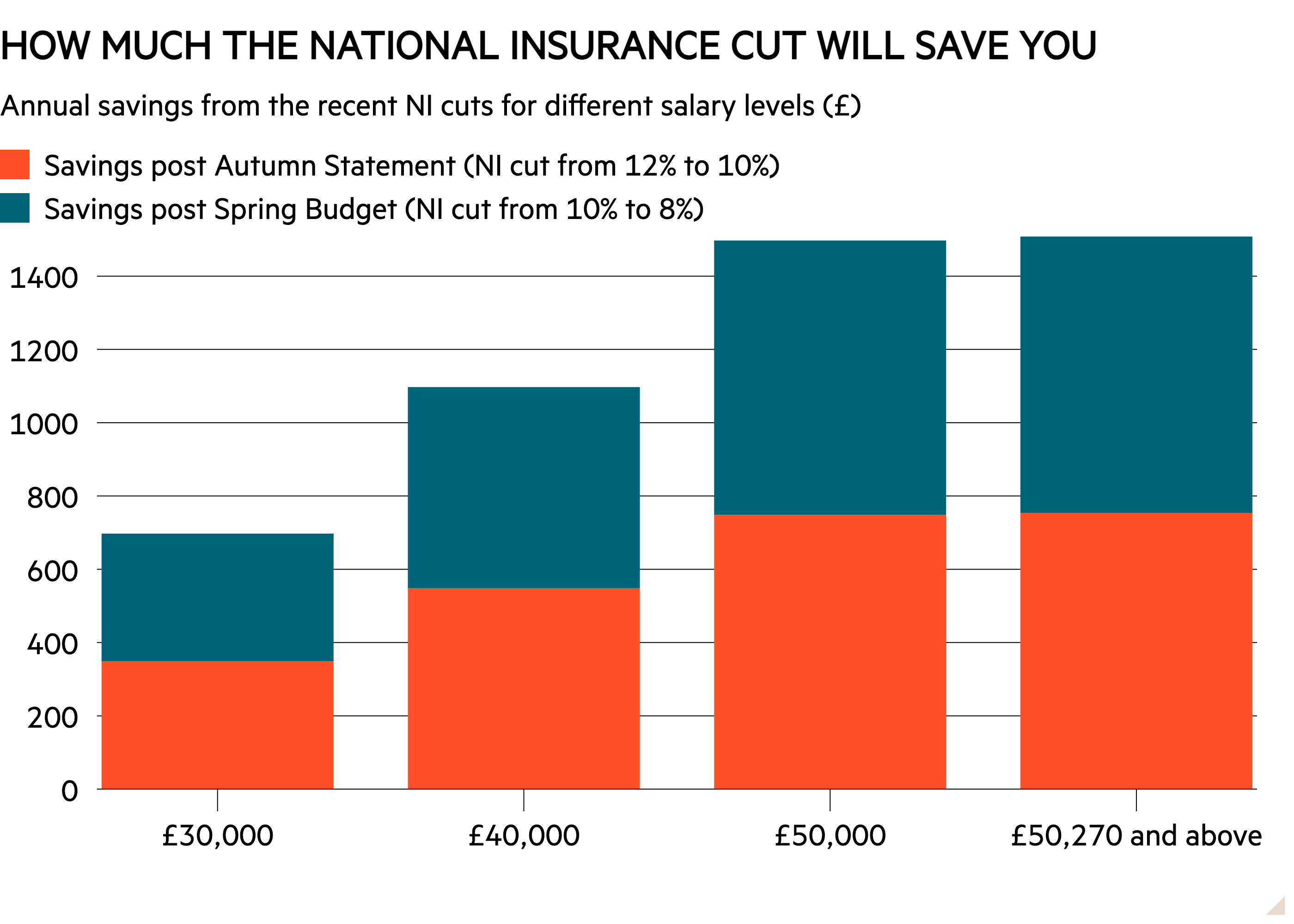

Chancellor Jeremy Hunt announced a further 2p cut to national insurance contributions, telling MPs that he wanted to help families with “permanent cuts in taxation” as part of his ‘Budget for long-term growth’.

This latest cut will reduce the employee national insurance rate by 2 percentage points, from 10 per cent to 8 per cent from April. Self-employed national insurance will also decrease by 2 percentage points from 8 per cent to 6 per cent. Hunt had already cut national insurance for both employees and self-employed in last year’s Autumn Statement which came into effect in January.

According to analysis from the Institute for Fiscal Studies think tank, a 2p national insurance cut will not be enough to prevent taxes rising to a record share of GDP by 2028/29. Despite delivering a minimal bounce in the polls after the Autumn Statement, national insurance cuts have the advantage of being both less inflationary and cheaper than income tax cuts.

Income tax cuts benefit both workers and pensioners, and carry a greater cost of around £7bn for each 1p cut, against £5bn for national insurance. HT and VC

British Isa launched to bolster domestic stocks

Investors will have a dedicated tax-free individual savings account (Isa) allowance for UK shares, under plans announced in today’s Spring Budget by chancellor Jeremy Hunt. The measure is meant to entice investors to allocate more to UK stocks.

Investors will have a tax-free annual Isa allowance of £5,000 to invest in UK equities, on top of the existing annual £20,000 allowance. This will be introduced after a consultation. The same tax advantages will apply, meaning that assets within the Isa will be sheltered from capital gains and dividend taxes. VC

Read more: Isa investors given extra £5,000 for British stocks

NatWest stake to be sold

Jeremy Hunt confirmed that the government’s 31.85 per cent stake in NatWest (NWG) will be sold off this summer, at the earliest, via a sale to retail investors, depending on market conditions. This confirms the government’s policy outlined in the Autumn Statement.

The government bailed out what was then the Royal Bank of Scotland in 2008, and will take a loss on the sale, given the rescue price of around 500p. While the high-street banks have climbed in the past 18 months thanks to higher interest income, share prices have remained subdued compared with US banks. NatWest’s shares are down 12 per cent over the past year, and flat year-to-date.

‘Non-dom’ tax regime abolished

The non-dom tax regime, which offers certain tax advantages to people who live in the UK but who are not settled here permanently, is to be abolished and replaced with a new residency-based system in April 2025. People who move to the UK will not pay taxes on foreign income or gains for the first four years, but later be charged the same way as anyone else.

There are around 37,000 non-doms in the UK taxed on a ‘remittance basis’. UK taxes are not charged on their foreign income or capital gains unless they are remitted to the UK. Labour announced plans to scrap the non-dom rules ahead of the Budget. Hunt criticised the plans at the time but has since decided to bring forward his own version of the policy. The non-dom regime came to the fore politically for being used by Rishi Sunak’s wife, Akshata Murty. VC

Holiday lettings tax relief scrapped

The furnished holiday lets (FHL) regime, which offers tax advantages to those who let out a property as a holiday home, will be abolished in April 2025. Budget documents said this would raise £600mn by 2028-29.

Hunt said this is because holiday lets reduce the availability of long-term rentals for residents. At the moment, landlords who use the furnished holiday lets regime can deduct the full cost of their mortgage interest payments from their rental income and (potentially) pay lower capital gains tax when they sell. About 127,000 properties in the UK are registered under the FHL regime. VC

‘Abused’ stamp duty relief for multiple home purchases abolished

Hunt has abolished stamp duty relief for multiple home purchases, admitting it had failed to bolster the rental market.

“It was intended to support investment in the private rented sector, but an external valuation found no strong evidence that it had done so and that it was being regularly abused,” he said. “So, I’m going to abolish it.”

Known as multiple dwellings relief (MDR), the tax saving will be abolished from 1 June. In the policy paper accompanying the Budget, the Treasury said that deals exchanged “on or before 6 March 2024 will continue to benefit from the relief regardless of when they complete, as will any other purchases that are completed before 1 June 2024”.

It added: “The government will engage with the agricultural industry to determine if there are any particular impacts for the sector that should be considered further.”Lucian Cook, head of residential research at Savills, said the MDR axe combined with the CGT reduction ML

Hunt under fire for Canary Wharf funding

Politicians and campaigners mocked Hunt’s announcement of £242mn in levelling-up funding for development in the Canary Wharf area. Hunt said this investment would deliver nearly 8,000 houses and turn the area into a hub for life science companies, adding the government is “on track to deliver over one million homes in this parliament”.

Plaid Cymru’s Westminster leader “congratulated” the office district in a sarcastic post on X (formerly Twitter). “Westminster’s priorities are clear for all to see,” she said.

Office vacancy rates in Canary Wharf have slumped since 2020 as the financial centre’s multinational corporation tenants downsize amid a rise in hybrid working after Covid. Hunt also used the Budget to mention £188m already allocated to Sheffield, Blackpool and Liverpool. ML