(Bloomberg) — Asian equities were primed for gains after US stocks rose Thursday in a rally helped along by positive signs from central banks and ahead of jobs data that will help identify the path forward for the Federal Reserve.

Most Read from Bloomberg

Equity futures for benchmarks in Australia, Japan and Hong Kong all advanced, taking heed from the S&P 500 Index which set a fresh record Thursday, and a 1.6% gain for the tech-heavy Nasdaq 100.

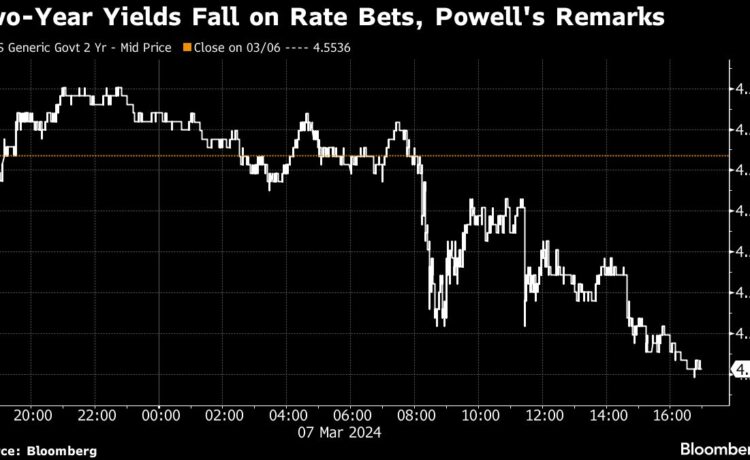

Treasuries were also mainly higher alongside a decline in yields across the curve, with the 30-year yield the notable laggard, ending the session little changed. An index of the dollar weakened, tracking the fall in yields.

The support for stocks and bonds reflected further signs of optimism from Fed Chair Jerome Powell that the central bank will cut interest rates this year.

The Fed is “not far” from confidence to ease policy, while rate reductions “can and will begin” this year while adding policymakers are well aware of the risks of cutting too late. Powell’s comments were broadly echoed by Cleveland Fed President Loretta Mester, who said the central bank should be able to start cutting rates later this year, should inflation continue to cool.

The sentiment dovetailed with comments from European Central Bank President Christine Lagarde, who indicated that officials may be in a position to ease policy in June.

The positive signals from the two central banks came ahead of Friday’s US jobs report. Consensus expectations place the number of new jobs added to the US economy at 200,000. However, a dispersion in expectations could trigger volatile trading when the final print is released. For instance, RBC Capital Markets LLC expects 260,000 jobs, while Citigroup Inc predicts 145,000.

“Friday’s jobs data could be a wild one,” said Andrew Brenner, head of international fixed income for Natalliance Securities LLC. A wide range of forecasts means the 10-year yield could swing dramatically, he said. “If the number is really good we could be looking at a 3 handle for the 10-year, but if it’s bad then 4.3% could be in the cards,” he said.

Gina Bolvin, president of Bolvin Wealth Management Group, bets the most-important item in Friday’s report will indeed be wages — and if they are climbing too quickly. If they are moving up too fast, companies will pass this this cost to the end user which is inflationary, she noted.

“The markets have declined on inflationary data, however it has recovered quickly,” Bolvin added. “It’s a constant buy-the-dip mentality mostly because earnings growth and estimates have been strong.”

BOJ Speculation

The yen ended Thursday 0.9% higher against the dollar on speculation the Bank of Japan will raise interest rates for the first time since 2007 as soon as this month.

Bets on the March 18-19 meeting are gaining traction as reports emerge that some BOJ officials favor an early move while some government officials also support a rate hike.

Elsewhere in Asia, data set for release includes current account balance reports for South Korea and Japan, Taiwan trade data and Philippines unemployment. Markets will be closed in India and Sri Lanka.

In commodities, oil fell, with technical support levels both limiting its losses and providing a barrier to further gains, as traders weighed the outlook for interest rates and tumult in the Middle East. Meanwhile, gold extended its record-breaking rally to a fresh high Thursday, rising to a peak of $2,164.78 an ounce.

Key Events This Week:

-

Eurozone GDP, Friday

-

US nonfarm payrolls, unemployment, Friday

-

New York Fed President John Williams speaks, Friday

-

ECB Governing Council member Robert Holzmann speaks, Friday

Some of the main moves in markets:

Stocks

Currencies

-

The Bloomberg Dollar Spot Index fell 0.4%

-

The euro was little changed at $1.0947

-

The Japanese yen was little changed at 147.93 per dollar

-

The offshore yuan was unchanged at 7.2003 per dollar

-

The Australian dollar was little changed at $0.6618

Cryptocurrencies

-

Bitcoin rose 0.1% to $67,426.76

-

Ether fell 0.1% to $3,871

Bonds

Commodities

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.