(Bloomberg) — Stocks in Asia struggled for momentum as a rally in China took a breather and Toyota wage talks spurred bets that the Bank of Japan’s interest-rate hike is imminent.

Most Read from Bloomberg

Shares in mainland China slipped, with Country Garden Holdings Co.’s missed bond payment weighing on developers. The Hang Seng China Enterprises Index wavered on the brink of surging 20% from its low. The muted moves contrast with record-breaking rallies in the US, Europe and a gauge of global equity index as traders shrugged off a stronger-than-expected US inflation print.

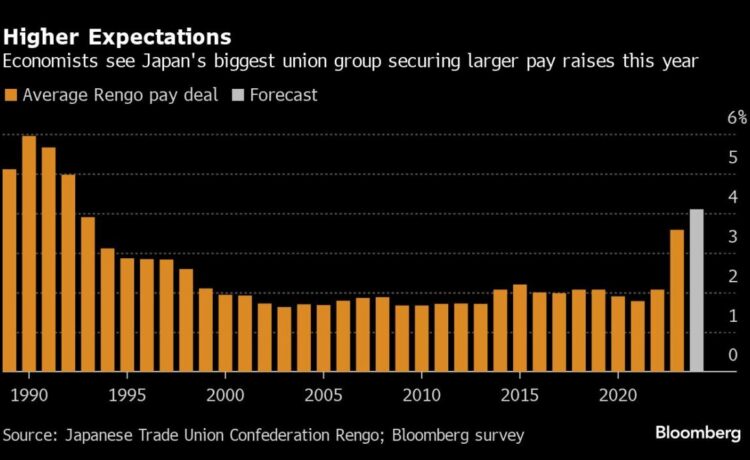

Stocks in Japan reversed earlier gains and the yen strengthened after Toyota Motor Corp. met its labor union’s wage demands in full, adding to signs of a sustainable wage-price cycle. Investors are on the lookout for this week’s union pay deals to determine whether pay increases will be strong enough for the BOJ to raise interest rates as early as next week.

The report on Toyota “strengthened speculation of a BOJ policy revision, leading to a strengthening of the yen and an overall decline in stocks,” said Masahiro Yamaguchi, a senior market analyst at SMBC Trust & Banking Ltd. Still, as Toyota has the biggest impact among all the spring wage negotiations, “there will unlikely be further news that will drag the market lower,” he added.

Treasuries steadied after drifting lower following a $39 billion sale of 10-year notes. A Bloomberg dollar gauge was little changed after rising for the first session in March. Australian 10-year yields gained in early Wednesday trading.

“While traders in the Asian market may feel confused by the combination of hotter-than-expected inflation data and record-high US stocks, Asian stocks are more likely to mirror the optimism from Wall Street,” said Hebe Chen, analyst at IG Markets. However, the CPI report “will undoubtedly prompt the Fed to choose their language with extra caution in next week’s meeting,” she said.

The relative sense of calm in the face of a strong inflation print was unusual. In fact, the advance in stocks marked a break from how stocks have traded on CPI days since the Fed started lifting rates.

An S&P 500 move of 1% or more has only happened on a handful of occasions on the day of the CPI release since March 2022. Most of the time, however, gains were on the back of lower — not higher — core inflation.

The Fed is widely expected to hold interest rates steady for a fifth straight meeting when policymakers gather March 19-20. Much of the focus by investors will be on the Federal Open Market Committee’s quarterly forecasts for rates, including whether fresh employment and inflation figures have prompted any changes.

In the corporate world, China Vanke Co. is in talks with banks on a debt swap that would help the cash-strapped developer stave off its first-ever bond default, according to people familiar with the matter.

In other markets, oil advanced after four days of losses as an industry report pointed to shrinking US crude stockpiles, offsetting wavering OPEC cuts. Gold held a decline that snapped a record-breaking run of gains after the hotter-than-expected US inflation print.

Key events this week:

-

Eurozone industrial production, Wednesday

-

ECB Governing Council member Yannis Stournaras speaks, Wednesday

-

Volkswagen, Adidas earnings, Wednesday

-

US PPI, retail sales, initial jobless claims, business inventories, Thursday

-

China property prices, Friday

-

Japan’s largest union federation announces results of annual wage negotiations, just ahead of Bank of Japan policy meeting, Friday

-

Bank of England issues inflation survey, Friday

-

US industrial production, University of Michigan consumer sentiment, Empire Manufacturing, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures were little changed as of 11:49 a.m. Tokyo time

-

Japan’s Topix fell 0.4%

-

Australia’s S&P/ASX 200 rose 0.2%

-

Hong Kong’s Hang Seng rose 0.1%

-

The Shanghai Composite fell 0.6%

-

Euro Stoxx 50 futures fell 0.1%

-

Nasdaq 100 futures fell 0.1%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.0926

-

The Japanese yen rose 0.2% to 147.36 per dollar

-

The offshore yuan was little changed at 7.1933 per dollar

-

The Australian dollar was little changed at $0.6610

Cryptocurrencies

-

Bitcoin rose 1.3% to $71,957.34

-

Ether rose 2% to $4,029.27

Bonds

-

The yield on 10-year Treasuries was little changed at 4.14%

-

Japan’s 10-year yield declined one basis point to 0.760%

-

Australia’s 10-year yield advanced six basis points to 4.01%

Commodities

-

West Texas Intermediate crude rose 0.5% to $77.94 a barrel

-

Spot gold rose 0.1% to $2,161.21 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Georgina McKay, Eddy Duan and Rob Verdonck.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.