(Bloomberg) — Stocks in Asia were mostly unchanged while currencies in the region ticked higher amid cautious trading and reduced liquidity with some markets closed for holidays.

Most Read from Bloomberg

Benchmarks for mainland China ticked lower at the open and Japanese equities traded flat while other markets including Hong Kong, New Zealand and Australia were shut. The S&P 500 notched an eight-week winning streak on Friday — the longest in more than five years on signs price pressures in the US were easing. Contracts for US stocks and Treasuries were also little changed in Asia trading.

Emerging Asian currencies such as South Korea’s won and the Malaysian ringgit rose as the dollar fell for it’s third straight session.

Some on Wall Street are positioning for further stock gains ahead as the session kicked off the start of the “Santa Claus rally” — a seasonal trend where equities tend to climb into the first few days of the new year.

“The soft landing narrative is fully in charge: The economy remains strong while inflation keeps trending down,” Louis Navellier of Navellier & Associates wrote. The veteran growth investor expects the year to end at highs, “the only ones with lumps of coal in their stocking this season are the bears.”

Oil steadied after posting the largest weekly advance in more than two months, with shipping disruptions in the Red Sea in focus after a spate of Houthi attacks against vessels in the vital waterway. West Texas Intermediate traded near $74 a barrel, after rallying by 3% in the prior week, the biggest advance since October.

Geopolitical tensions however remain front of investors minds into the new year as tensions in the Middle East look set to increase. Iranian President Ebrahim Raisi said Israel will pay a price for killing a senior commander of its Revolutionary Guard in air strike in Damascus on Monday. The US accused Iran at the weekend of an attack on a tanker in the Indian Ocean.

READ: Israel Sees Defense Spending Climbing $8 Billion as War Rages

Elsewhere, Japan’s labor market remained relatively tight in November, keeping pressure on employers to boost wages in order to fill positions. A separate report from the ministry of internal affairs showed the unemployment rate held steady at 2.5% last month.

The benchmark Topix index traded within tight ranges after Bank of Japan Governor Kazuo Ueda’s speech on Monday that suggested he’s in no hurry to end the ultra-easy monetary policy.

“With the Nikkei 225 at high levels, year-end selling to lock in profits and losses is likely to weigh on the upside,” says Hideyuki Ishiguro, senior strategist at Nomura Asset Management.

In the corporate world, Chinese gaming stocks rose after a number of companies announced plans to buy back their own shares following a rout triggered by news of the latest government curbs on the industry.

US Growth Resilience

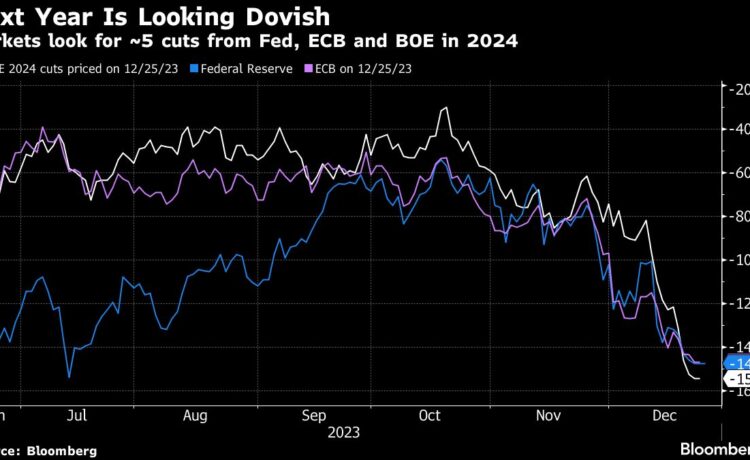

Global markets have been buoyed in recent months as traders bet major central banks including the Federal Reserve will aggressively cut interest rates next year as inflation falls. Bond yields have tumbled while the S&P 500 is nearing a fresh record.

Data released last week showed signs of resilience in US growth while the Fed’s preferred underlying inflation metric barely rose in November. Additional reports Friday showed consumers were also gaining conviction that inflation in the world’s largest economy was on the right track despite a bumpy housing market recovery.

That helped cement investor expectations for earlier and deeper interest rate cuts next year, despite pushback from several Fed policymakers. Swaps traders are betting interest rates will be eased by more than 150 basis points in 2024, double the Fed’s forecast.

Read more: Fed’s Preferred Inflation Gauges Cool, Reinforcing Rate-Cut Tilt

Key events this week:

-

Singapore CPI, Tuesday

-

BOJ releases summery of opinions from December meeting, Wednesday

-

China industrial profits, Wednesday

-

Norway retail sales, Wednesday

-

Japan industrial production, Thursday

-

South Korea industrial production, Thursday

-

Thailand trade, Thursday

-

Mexico unemployment, Thursday

-

Bank of Portugal releases quarterly report on banking system, Thursday

-

South Korea CPI, Friday

-

Spain CPI, Friday

-

UK nationwide house prices, Friday

-

Brazil unemployment, Friday

-

Chile unemployment, Friday

-

Colombia unemployment, Friday

Some moves in major markets:

Stocks

-

S&P 500 futures were little changed as of 10:50 a.m. Tokyo time

-

Nikkei 225 futures (OSE) fell 0.2%

-

Japan’s Topix fell 0.1%

-

The Shanghai Composite fell 0.2%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.1019

-

The Japanese yen was little changed at 142.32 per dollar

-

The offshore yuan was little changed at 7.1442 per dollar

-

The Australian dollar rose 0.1% to $0.6805

Cryptocurrencies

-

Bitcoin was little changed at $43,506.78

-

Ether was little changed at $2,272

Bonds

Commodities

-

West Texas Intermediate crude was little changed

-

Spot gold rose 0.3% to $2,053.08 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Akemi Terukina.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.