What’s going on here?

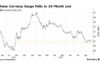

Asian currencies are reaching new heights, with the Chinese yuan leading the charge and boosting the Malaysian ringgit and Thai baht to their best levels since early 2022.

What does this mean?

China’s latest stimulus package has been a game-changer, easing deflationary pressures and benefiting regional currencies tied to Chinese trade and tourism. The Chinese yuan dipped slightly due to profit-taking but still hovers near a 16-month peak, gaining 0.5% this week. This boost has also propelled Chinese equities toward their best weekly performance since November 2008, with an MSCI gauge of Asian emerging market equities climbing 1.4% to its highest level since mid-February 2022. The Malaysian ringgit appreciated by 0.7% to 4.123 per dollar, while the Thai baht hit its highest level since early March 2022, at 32.35 per dollar.

Why should I care?

For markets: EM investors are smiling.

As the US dollar weakens, emerging markets, particularly China, are drawing investor interest with their higher return prospects. The MSCI gauge of equities in ASEAN countries is poised for its seventh consecutive week of gains, signaling strong market confidence. Look out for upcoming data from Indonesia and the Philippines, expected to show a downward trend in September inflation, according to Citi analysts.

The bigger picture: Asia’s economic resilience shines.

China’s stimulus isn’t just boosting its economy but also the broader Asian market. While the Shanghai Stock Exchange deals with transaction issues and Sri Lanka maintains steady rates amid optimistic inflation and growth forecasts, the region demonstrates sturdy economic health. Mitsubishi’s increased stake in Malaysia LNG further signals robust investment and confidence in Asia’s economic future.