(Bloomberg) — Asian currencies struggled for direction, with global investors wary of taking positions before US jobs data that will offer fresh clues as to the Federal Reserve’s path ahead.

Most Read from Bloomberg

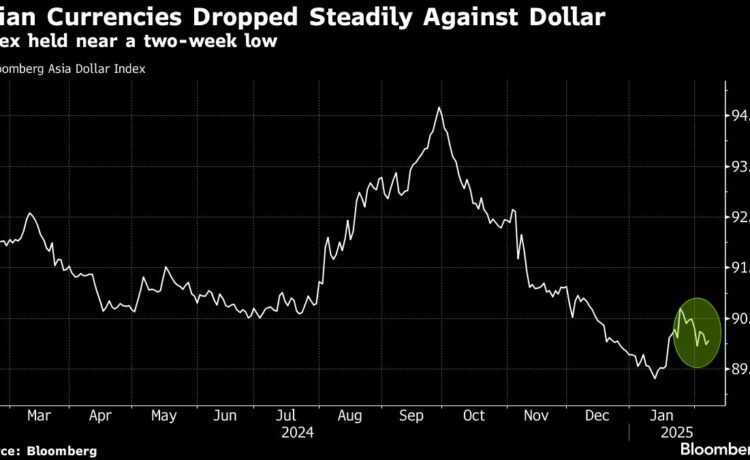

Bloomberg’s Asia Dollar Index held near a two-week low, with moves across asset classes muted ahead of American payroll figures later Friday. The Philippine peso outperformed, heading for its best week since December due to relative insulation from tariff risks, according to HSBC Plc.

Traders have been buffeted by US policy announcements, with President Donald Trump’s tariffs threatening to weigh on growth and inflation globally. Also, Treasury Secretary Scott Bessent told Bloomberg in an interview overnight that he favors a strong dollar and has no plans to alter the government’s debt-issuance plans.

“Markets for today look to be monitoring developments related to Trump administration policies on trade and rates whilst also awaiting US jobs data, keeping USD-Asian pairs generally sideways,” said Alan Lau, a currency strategist at Malayan Banking Bhd. “We stay cautious,” given the unpredictability of US policy.

Asian currencies have faced tough going since Trump’s reelection in November, as his policies are expected to fuel inflation and keep US rates higher for longer. The Bloomberg Asia dollar index posted a fourth straight annual loss in 2024 and has advanced just 0.3% so far this year.

Central banks have resorted to currency-market interventions to limit declines in their exchange rate. Data on Friday showed Indonesia’s foreign reserves rose to a new high of $156.1 billion last month as bond issuance and tax revenues offset the cost of policies to stabilize the rupiah.

The Reserve Bank of India cut interest rates for the first time in almost five years on Friday. The rupee gained on the news, as the easing was widely expected and the monetary policy stance remained neutral.

–With assistance from Bhaskar Dutta.

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.