The broader equity market sell-off continued last week, propping up safe-haven assets. Gold’s rally reflected this situation, as the yellow metal broke the $3,000 level for the first time in history.

Not even the better-than-anticipated CPI print of 2.8% on Wednesday stopped the trend, which eventually showed signs of exhaustion by Friday. The Bank of Canada held the interest rate at 2.75%, which was in line with expectations, while the UK’s GDP unexpectedly shrank by 0.1% as the production sector fell short of expectations.

The Australian dollar, a commodity currency, gained ground against most currencies except New Zealand’s Dollar. The US Dollar paused its steep decline, while the Japanese Yen (JPY) stalled without giving a valid setup on CHF/JPY and EUR/JPY, two pairs in focus. Interestingly, while the former’s retail sentiment is still equally split between longs and shorts, the latter’s has flipped over 70% short, positioning it as a better pick for a long setup sometime soon.

The US will kick off the news-busy week by publishing retail sales data on Monday, while Canada will publish its CPI expectations (2.7% forecast consensus) on Tuesday. The Bank of Japan (BOJ) could cause significant volatility on Wednesday if it delivers another rate change, as the consensus forecast is to hold steady at 0.5%. Still, if Governor Ueda unveils any deviation from the forecasted monetary policy path, the market reaction could be swift.

Later on the same day, the FED will discuss the funds rate, with the consensus expectation of holding at 4.5%. On Thursday, the Swiss National Bank (SNB) is expected to deliver a 25bps cut, bringing the rates down to 0.25%. From a fundamental standpoint, this would explain why the Euro materializes as a better candidate to buy against the JPY since the policies between the SNB and BOJ diverge.

The Bank of England is expected to hold at 4.5%, while Friday’s Canadian retail sales will close the news-heavy week.

Key News:

- Monday: USD – Retail Sales

- Tuesday: CAD – CPI

- Wednesday: JPY – Interest Rate, USD – Interest Rate, NZD – GDP

- Thursday: AUD – Unemployment, CHF – Interest Rate, GBP – Interest Rate, USD – Unemployment Claims

- Friday: CAD – Retail Sales

Pairs In Focus

1. EUR/JPY

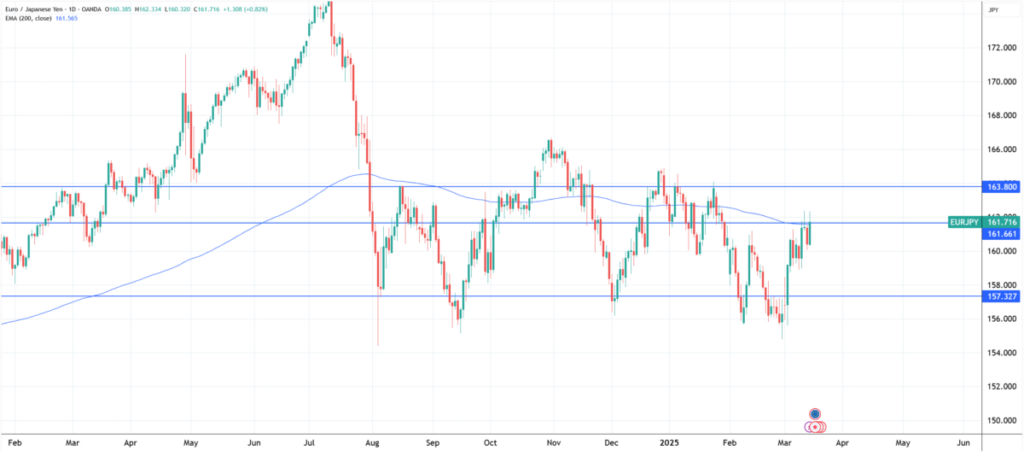

EUR JPY remains on the watchlist after failing to break and close above the key level, barely edging higher by the end of the week. Retail sentiment is 71% short, giving it good odds of moving higher toward the key level of 163.800.

The ideal long setup would be for a new daily close to exceed the previous week’s high before the price pulls back toward support. Owing to numerous fundamental news, this scenario will be tricky to execute.

EUR/JPY Daily Chart, Source: TradingView

2. AUD/NZD

This pair has broken the uptrend, signaling the desire to move lower, likely toward the middle range established between 2023 and 2025. However, seeing a minor pullback before this occurs would be unsurprising. Since AUD currently has a 4.10% interest rate and NZD a lower one at 3.75%, this potential short has a negative carry. Still, retail sentiment is overwhelmingly long at nearly 80%, making a retail squeeze lower a realistic possibility. The near-term downside potential is around 100 pips, but price action will determine the entry.

AUD/NZD Daily Chart, Source: TradingView

Notes:

- AUD/CAD: In a short-term ranging pattern, but long-term bullish.

- AUD/SGD: It pulled back after a prolonged decline; however, to confirm a turnaround, it has to close above 0.85200.

- AUD/JPY: Made signs of a turnaround, the key resistance above is around 95.250.

- AUD/CHF: Pulled back to the key level at 0.56. A deeper pullback towards 0.56500 is possible.

- CHF/JPY: Repeatedly failed to establish a new close above the key level.

- EUR/AUD: Closed as a shooting star on the weekly timeframe; pullbacks are highly likely.

- GBP/NZD: Turned around after a big bull run, it is likely to undo some of that movement until the end of the month, offering scalping opportunities.

- GBP/JPY: Overall bullish, reclaimed the 190.110 level and turned higher.

- GBP/SGD: So far, it has stayed above 1.71530. A healthy pullback will be a good test to see if it can prepare for the next leg towards 1.74400.

- GBP/AUD: Closed the week with a strong pullback, erasing all the weekly gains. Deeper pullbacks are possible toward 2.03040.

- NZD/JPY: Kept above the key level of 84.800. It might move back toward the long-term resistance at 88.400.

- SGD/JPY: Pulled back toward the key resistance at 111.400 but failed to close above. It is the level to observe in the coming week.

Disclaimer: Any opinions expressed in this article are not to be considered investment advice and are solely those of the authors. Singapore Forex Club is not responsible for any financial decisions based on this article’s contents. Readers may use this data for information and educational purposes only.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.