Written by Steven Dooley, Head of Market Insights, and Shier Lee Lim, Lead FX and Macro Strategist

Greenback takes further step lower

The US dollar took another step lower overnight as markets remained focused on the potential for rate cuts from the US Federal Reserve.

The positive sentiment saw more solid gains in US sharemarkets with the S&P 500 up 1.0% and the Nasdaq up 1.4%.

The Australian dollar led the charge higher in FX markets with the AUD/USD up 1.0%. The pair is now less than 2.0% away from the 2024 highs with the Reserve Bank of Australia minutes due at 11.30am AEST.

The NZD/USD was also higher up 0.9%.

The USD/CNH ended at the lowest closing level for the year ahead of today’s key loan prime rate decision due at 9.15am HKT (11.15am AEST). There is no change expected after last month’s surprise cut in the one-year rate from 3.45% to 3.35%.

The USD/SGD extended recent losses to fall below 1.3100 for the first time since February 20223.

Euro at risk of economic slowdown

In other markets, European currencies were also stronger, with the GBP/USD up 0.4% and the EUR/USD 0.5% as it moved substantially above 1.1000 – recently a key level of resistance.

Looking forward, German inflation numbers are due this ahead of Euro-wide numbers later tonight. Based on the manufacturing price survey from Eurostat, we anticipate a 0.2% m-o-m increase in Germany producer prices. Nonetheless, in July, natural gas prices decreased.

After a strong run, the EUR might face the risk of reversal in the medium term because rate differentials that are moving in favor of the euro are countered by the slowdown in European economic momentum.

Riksbank rate cut on the horizon?

The Swedish krone was stronger overnight ahead of tonight’s rate decision – we anticipate a 25bp rate reduction to 3.50% by the Riksbank.

Although it said it would drop rates two or three times in the second half of the year, it kept its policy rate at 3.75% in June. It is doubtful that the Riksbank’s advice has changed much because CPIF ex-energy was in line with its July prediction.

Though it may not have appreciated as much as the Riksbank had planned, the currency’s present value does not seem to be a big reason for concern. At this conference, no new forecasts will be presented.

Although a loss of steam in the momentum for global manufacturing is a danger for the time being, SEK should progressively recover as lower domestic and global yields ease domestic growth and low yielders.

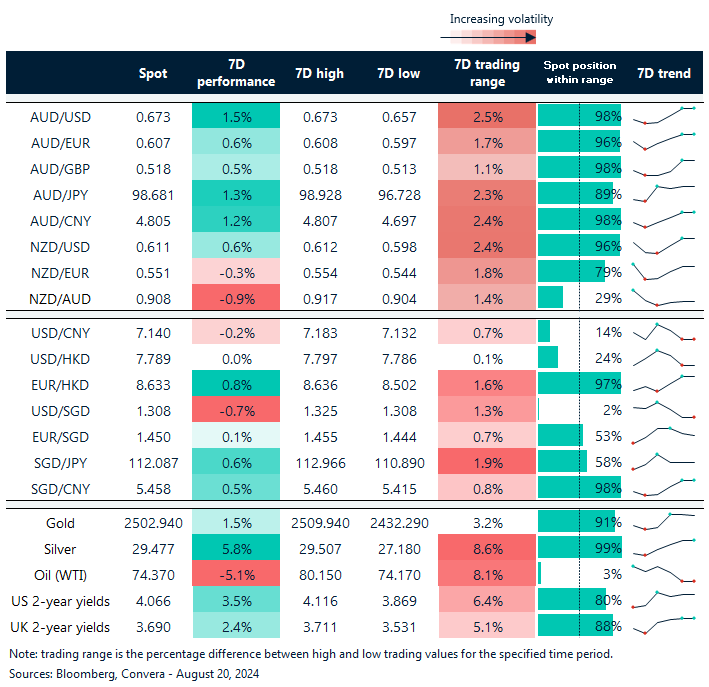

Aussie, kiwi at top of the range. USD/SGD and USD/CNH at lows

Table: seven-day rolling currency trends and trading ranges

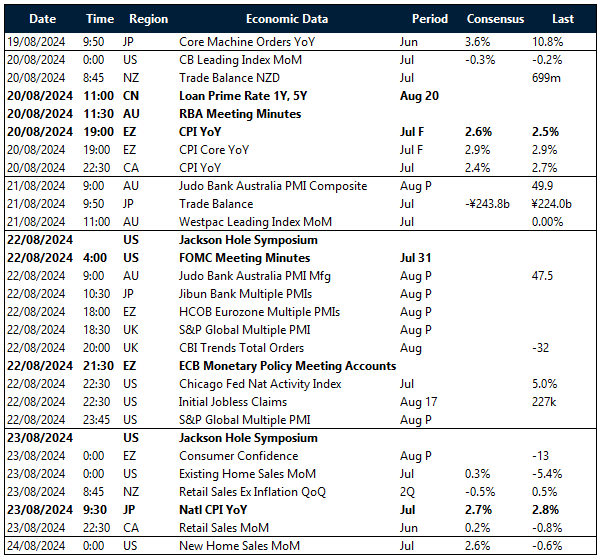

Key global risk events

Calendar: 19 – 24 August

All times AEST

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.

Have a question? [email protected]