Speaking on the alliance’s de-dollarization plans, former White House economist Joe Sullivan says BRICS is readying an “economic wrecking ball” for the US dollar. Indeed, Business Insider reported remarks made by Sullivan regarding continued efforts for the alliance’s collective abandonment of the greenback.

The efforts are nothing new, as they have dominated headlines throughout 2023. However, developments that occurred this year have only ensured the continued effectiveness of those efforts. Specifically, in the now five-nation expansion plan announced at this 2023 annual summit.

Also Read: BRICS: UAE & China to Increase Trade in Local Currencies

BRICS Have ‘Economic Wrecking Ball’ Ready for US Dollar?

For much of the last few months, the BRICS alliance and its geopolitical maneuvering have dominated the global discourse. Indeed, its growth plan and anti-Wetsern initiatives have caught the eye of countries across the world. Moreover, what has long been overlooked is how effective the bloc could inevitably be.

Now, former White House economist Joe Sullivan has stated that the BRICS bloc is preparing an “economic wrecking ball” for the US dollar. Specifically, he expressed just how the BRICS developing currency could continue to wreak havoc on the greenback’s declining prevalence.

Also Read: BRICS: 130 Nations Move Toward CBDC, US Dollar at Risk

“The BRICS+ Nations do not need to wait until a shared trade currency meets the technical conditions typical of global reserve currency before they swing their newly enlarged economic wrecking ball at the US dollar,” Sullivan stated.

“The BRICS+ states do not even necessarily need to have a shared trade currency to chip away at King Dollar’s domain,” he added. “If BRICS+ demanded that you pay each member in its own national currency in order to trade with any of them, the dollar’s role in the world economy would go down. There would not be a clear replacement for the dollar as a global reserve. A variety of currency would gain importance.”

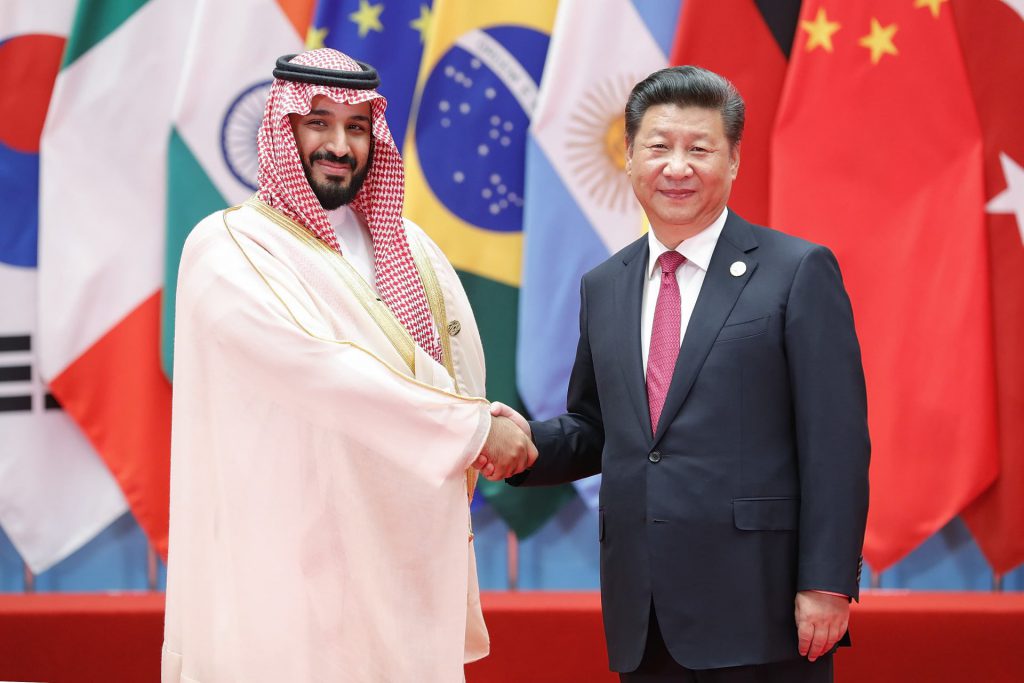

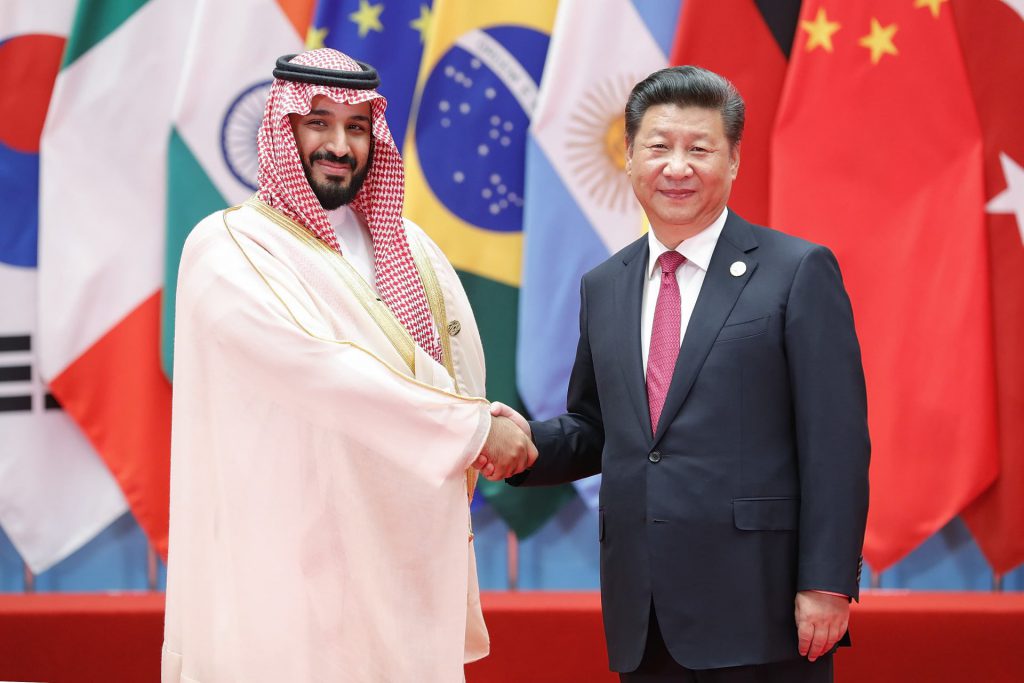

Altogether, the BRICS expansion made this issue even more prominent. United States allies Saudi Arabia and the United Arab Emirates (UAE) have joined the BRICS bloc. Subsequently, they too can lessen their current dollar holdings. Moreover, they could supplant them with a growing acquisition of BRICS local currency to solidify the concerns Sullivan has expressed.