- Fractional Reserve banking allows for economic growth but does have its risks.

- Heightened surveillance and traceability of CBDC are highly concerning.

- But, CBDC gives the Fed even more power.

- The banking system will change, hopefully for the better.

Before you read our thoughts on Central Bank Digital Currencies (CBDC), pull out your wallet and count the cash in it. Then, add any cash under a mattress or in a bank vault to that amount. That total, be it $12 or a couple of thousand dollars, is the only cash you have.

The bank holding your savings or checking account does not have a pile of cash in a large vault with your name on it. It resides in the ethernet as a series of digital 1s and 0s.

In addition to most of your non-physical cash, your stocks, bonds, and other assets are mostly or entirely stored digitally. Whether you write checks or pay bills online, your credit card, mortgage, and car payments occur digitally. Like it or not, we have evolved into a digital financial system.

Given this reality, it’s worth exploring the trepidation some have about the eventual rollout of CBDC.

Banking and Fractional Reserve Magic

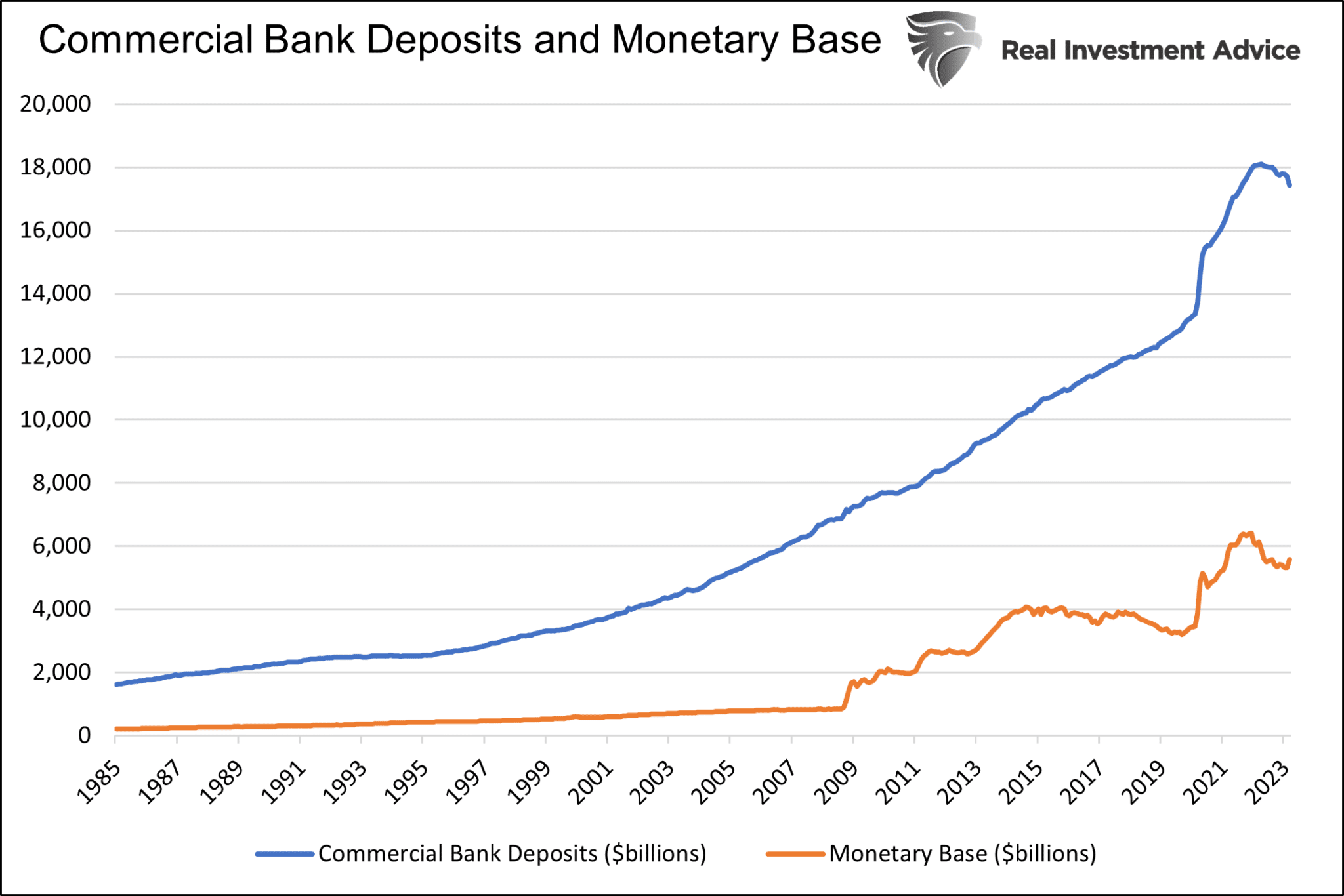

There are $17.2 trillion in deposits at commercial banks. In addition, other types of banks, credit unions, brokerage accounts, and financial institutions hold cash deposits. Compare that to the nation’s monetary base of $5.5 trillion.

Under our fractional reserve system, the amount of money in the banking system is far less than the amount people and businesses think they have. In , we share the example below to highlight how fractional reserve banking creates money.

Under the fractional reserve banking system, on which America’s financial system operates, money is “created” via loans. Here is a simple example:

- You deposit $1,000 into a bank.

- Your neighbor borrows $900 from the same bank to buy a TV from Costco.

- The bank holds the remaining $100 as reserves.

- Costco deposits the $900 into its account at the same bank.

- The bank turns around and lends $810 of Costco’s $900 deposit.

- The cycle continues as money multiplies despite the actual cash in the financial system remaining at $1,000.

Whether or not your neighbor pays back the $900, you and Costco have a combined $1,900 in your accounts. In this case, the $900 the bank created via the loan to your neighbor is new money out of thin air.

Given a good percentage of “money” is simply a figment of our imagination, why are people so trusting of today’s financial system but so wary of CBDC?

Pros of CBDC

We elaborate on the cons in this article, but appreciating digital currency’s advantages is worthwhile.

- Digital transactions are more efficient and often more secure, thus are less costly

- The Fed can more effectively conduct monetary policy if they choose. As we will discuss, some may also view this as a con. We are in that camp.

- Instaneious transactions and settlements.

- Reduces the need for middleman banks, further lowering the economic costs of banking.

- Illegal financial activity is easier to trace.

- They can provide financial inclusion for those without a bank or reside where banking services are limited.

Cons of CBDC

Monetary Policy

In 2020 and 2021, the U.S. government wrote stimulus checks directly to its citizens. Never has the nation witnessed such a quick and impactful stimulus. The government can do the same with CBDC but even quicker and more impactful. In seconds the government could credit your CBDC bank account.

Further, the government could put a “use by” date on said stimulus. Use it in three weeks, or it vanishes. They might also decree that stimulus deposits can only be used on specific goods or services they want to help. CBDC help ensures that stimulus effectively generates economic activity in a timely and directed fashion.

Of course, the likely abuse of such a system, which is inevitable, is a significant flaw. As we have been learning, showering citizens with cash can be very inflationary. Further, it can result in an unfair distribution of funds and potentially where the stimulus is spent.

Unfortunately, the MMT cat is out of the bag. Whether it’s a physical check or CBDC, the government discovered the holy grail of stimulus during the pandemic.

The other monetary policy concern is that the Fed can administer negative rates and not worry about cash fleeing the banking system. Negative rates stimulate economic activity as they disincentivize savings in favor of consumption. Money-like surrogates that offer liquidity, like gold and bitcoin, may be more valuable in such an environment.

Tracability & Surveillance

Many people fear that with CBDC, the government can more easily monitor and control your transactions. Such should be a big concern. However, they can watch all your non-cash transactions today and are likely doing it. Further, the government can access more information than you can imagine between cameras on many street corners and our devices like phones, computers, and many home products.

With CBDC, the government could theoretically freeze your bank account or even take your money. While also a concern, this already happens at banks. It would just be more efficient.

CBDC will make it a little easier for the government to infringe on our privacy and freeze our spending. But, with technology and the proliferation of the Internet of Things, such privacy and rights have already been lost with or without CBDC. The surveillance ship has sailed.

Banking Sector Difficulties

People do not need to hold CBDC at a bank. As such, deposits, a cheap source of bank funding, will vanish. As we see with the banking sector today, bank assets must decline as deposits exit the banking system.

If CBDC results in fewer bank deposits, the supply of bank-originated loans may decrease. In step, interest rates on mortgage, auto, corporate, and all other loans would likely increase. Other entities may replace banks, but it will probably come at a higher cost to the borrower.

Summary

With technology comes fear. The traceability and expanded government powers that accompany CBDC are alarming.

Given the inflation outbreak and the widening gap between wealth classes, giving the Fed expanded monetary policy latitude is concerning.

However, like it or not, while CBDC provides the government with more access to surveillance and more powerful monetary policy tools, they will likely attain those abilities with or without CBDC.

CBDCs are the next step in financial innovation. Regardless of what we think, the government will do what it deems in its best interests. CBDC will replace physical currency; it’s just a question of when.