Australian Dollar encountered significant headwinds in today’s Asian session, weighed down by the latest Australian Q4 CPI data. The lower than expected inflation confirmed that RBA would hold interest rate unchanged in the forthcoming meeting next week. The central bank could also be finally ready to indicate completion of the tightening cycle. Market speculation is intensifying around rate reductions in the second half of the year.

Compounding Australian Dollar’s weakness, ongoing slump in stock markets across Hong Kong and China weighed heavily on the currency. Despite slight improvement in China’s NBS PMIs, investor confidence remains subdued. The market continues to await more robust and concrete measures from the Chinese government to bolster market confidence, particularly in the wake of prolonged underperformance.

In contrast, Dollar is gaining slight ground against its major counterparts, as market’s attention is riveted on the upcoming FOMC rate decision. The consensus is firmly set on Fed holding rates steady at 5.25-5.50%. In this context, the probability of any significant surprises appears minimal.

General sentiment suggests that March may be too premature for Fed to initiate a rate cut too. The most probable outcome is that Chair Jerome Powell will reiterate the commitment to data-driven decision-making, and counter any premature market speculations about imminent rate cuts. Because of that, any unexpected indications from Powell regarding a rate cut in March could trigger significant market volatility.

As of now, the probability reflected in Fed fund futures for a rate cut in March stands at around 45%, with a more pronounced likelihood of 87% for a cut in May. However, it’s crucial to note that these probabilities are highly contingent on the upcoming ISM Manufacturing and Non-Farm Payroll data, which are anticipated later this week.

As for the week, New Zealand Dollar is currently the strongest one, as supported by hawkish comments by RBNZ Chief Economist yesterday. Yen is the second strongest, with today’s BoJ summary of opinions affirming that a rate hike is on the radar, though not imminent. On the other hand, Euro is staying as the worst, as the lift from yesterday’s GDP was weak and brief. Markets are looking to tomorrow’s Eurozone CPI for the excuses to add to speculation of an April ECB cut. Sterling is the second weakest, followed by Aussie. Dollar, Swiss Franc, and Canadian are mixed.

Technically, as a follow up to yesterday’s post, AUD/JPY’s dip and breach of 96.89 is affirming the bearish case discussed. That is, rebound from 93.70, as the second leg of the pattern from 98.56, is possibly completed at 97.86 already, on bearish divergence condition in 4H MACD. Deeper fall is in favor as long as 55 4H EMA (now at 97.30) holds, to 95.82 support. Decisive break there will confirm this case and target 93.70 support again.

In Asia, Nikkei closed up 0.61%. Hong Kong HSI is down -1.53%. China Shanghai SSE is down -1.11%. Singapore Strait Times is up 0.18%. Japan 10-year JGB yield rose 0.0220 to 0.734. Overnight, DOW rose 0.35%. S&P 500 fell -0.06%. NASDAQ fell -0.76%. 10-year yield fell -0.032 to 4.059.

BoJ summary of opinions suggests rate hike within reach

The Summary of Opinions from BoJ’s meeting on January 22-23 signaled the central bank’s intensified focus on initiating its first rate hike since 2007 and moving away from its long-standing negative interest rate policy. The deliberations, however, stopped short of providing a clear timeline for these policy shifts.

A notable hawkish sentiment within BoJ pointed to the “growing possibility” of significant wage revisions in the upcoming spring, at “relatively higher levels” than in the past. This perspective is underpinned by the recognition of “improving trend” in both economic activities and price. Such developments suggest that the necessary conditions for revising monetary policy, including ending the negative interest rate regime, are increasingly “being met”.

Concurrently, the impact of Noto Peninsula Earthquake on is a key factor under close observation. One opinion suggested that, after a thorough assessment of the earthquake’s effects over “the next one or two months”, BoJ is “highly likely to reach a point where it can normalize monetary policy”.

On the other side of the spectrum, a more cautious stance was also expressed. While acknowledging that the probability of achieving the BoJ’s 2 percent price stability target is becoming “more realistic”, it was noted that certainty in reaching this goal is not yet fully established. However, this view also supports the initiation of discussions regarding the exit from the current monetary policy stance.

Japan’s industrial production rises 1.8% mom in Dec, a bounce in seesawing pattern

Japan’s industrial production rose 1.8% mom in December, rebounding from prior month’s -0.9% mom contraction, but missed expectation of 2.4% mom.

Manufacturers have tempered expectations for the coming months, predicting a -6.2% mom drop in production in January, followed by a modest 2.2% mom increase in February. The Ministry of Economy, Trade and Industry maintains its assessment of “seesawing” on production.

As an METI official indicated, the recent Noto Peninsula earthquake’s impact on manufacturing appears minimal for January. However, production forecasts are clouded by the suspension of operations at Daihatsu due to issues with collision-safety test irregularities.

“Although we believe that the production sentiment of companies is gradually getting out of the bearish phase, for the time being, we need to pay attention to the impact of the suspension of auto manufacturers’ operation,” the official said.

In separate release, retail sales grew 2.1% yoy in December, well below expectation of 5.0% yoy.

Australia’s CPI down to 4.1% yoy in Q4, monthly CPI down to 3.4% yoy in Dec

Australia’s inflation data for Q4 show notable easing in price pressures. CPI rose by 0.6% qoq, a considerable slowdown from the previous quarter’s 1.2% qoq and below expectation 0.8% qoq. This marks the smallest quarterly increase since Q1 2021. On an annual basis, CPI decelerated from 5.4% yoy to 4.1% yoy, coming in lower than the forecasted 4.3% yoy.

RBA’s trimmed mean CPI, which is a measure of core inflation, also reflected this trend. It increased by 0.8% qoq and 4.2% yoy, down from 1.2% qoq and 5.2% yoy respectively in the previous quarter. These figures were below the expected 0.9% qoq and 4.3% yoy. Notably, this represents the fourth consecutive quarter of declining annual trimmed mean inflation, falling from a peak of 6.8% in Q4 2022.

Additionally, monthly CPI showed a sharp slowdown from 4.3% yoy to 3.4% yoy, undershooting expectation of 3.7% yoy.

NZ ANZ business confidence rises to 36.6, inflation expectations lowest since Nov 2021

New Zealand ANZ Business Confidence rose from 33.2 to 36.6 in January. However, Own Activity Outlook fell from 29.3 to 25.6.

In a significant development, inflation expectations decreased from 4.61% to 4.28%, reaching their lowest point since November 2021. Despite this decline in inflation expectations, a high number of firms still plan to increase their prices, with the pricing intentions index only marginally decreasing from 50.2 to 49.7. Cost expectations also saw a slight reduction, moving from 76.2 to 75.6, but they remain at elevated levels.

ANZ’s commentary on the situation pointed out that the New Zealand economy is at a critical point, expressing a cautiously optimistic outlook. They anticipate that RBNZ has implemented sufficient tightening measures and expect a gradual realization of their impact, leading to a possible initiation of “a steady stream of OCR cuts” by August.

China’s NBS PMI manufacturing ticks up to 49.3, contraction continues

China’s manufacturing sector remained in contraction for the fourth consecutive month, with NBS PMI Manufacturing index marginally rising from 49.0 to 49.3 in January, slightly below the expected 49.3.

The continued manufacturing contraction is evident in the subindexes: new orders was 49.0, marking the fourth month of contraction, while new export orders index stood at 47.2, contracting for the tenth consecutive month. A concerning detail is the employment subindex, which fell to a 13-month low of 47.6, indicating contraction for 11 straight months.

On a positive note, the manufacturing sector’s production index attained a 4-month high, advancing to 51.3, and has sustained expansion for eight consecutive months.

In contrast, PMI Non-Manufacturing saw a slight improvement, rising from 50.4 to 50.7, marginally above the forecast of 50.6. Consequently, PMI Composite, which encompasses both manufacturing and services sectors, reached a four-month peak of 50.9, up from 50.3 in the previous month.

ECB’s Lagarde emphasizes wage growth as key determinant for rate cut decision

ECB President Christine Lagarde emphasized that the central bank is not yet ready to initiate rate cuts, underscoring the need for comprehensive data analysis

In a CNN interview, she stated, “We are not there yet,” added that the decision to loosen monetary policy hinges on “all sorts of data”. She also singled out the significance of wage data as “critically important.”

Despite acknowledging a clear disinflationary trend, Lagarde noted that ECB requires a deeper understanding and progression into this trend to make a well-informed decision. “We are on a disinflationary trend — no question about it,” she confirmed, “But we need to be further into that process.”

Lagarde’s remarks also touched upon the consensus within the ECB regarding the direction of the next policy move. “I think we all agree that the next move” will be a cut, she said, aligning with the general anticipation of eventual rate reductions. However, the timing remains uncertain and subject to thorough examination of upcoming economic data.

A key factor in the timeline for interest rate cuts is the availability of wage growth data, which is not expected until after ECB’s April meeting. This positions the June meeting as a more likely juncture for the consideration of rate cuts.

Looking ahead

Germany will release import price index, retail sales, unemployment rate and CPI flash in European session. Swiss will release retail sales and Crudeit Suisse economic expectations. Later in the day, Canada GDP will be a focus in US session. US will release ADP employment, employment cost index and Chicago PMI. But the main event will be FOMC rate decision and press conference.

AUD/USD Daily Report

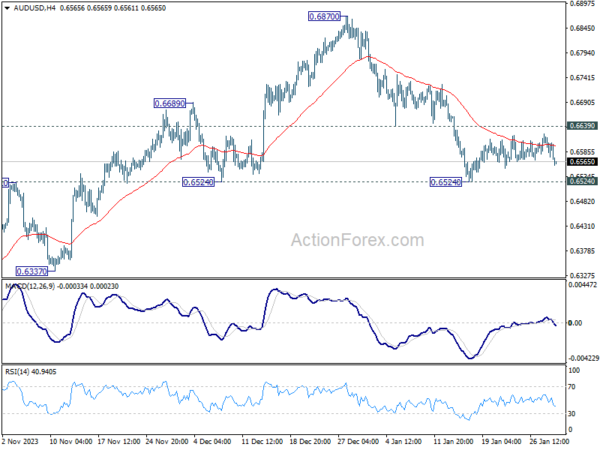

Daily Pivots: (S1) 0.6577; (P) 0.6601; (R1) 0.6626; More…

AUD/USD dips notably today but still stays in range of 0.6524/6639. Intraday bias remains neutral and further fall is still expected. On the downside, firm break of 0.6524 support will argue that whole rebound from 0.6269 has completed, and bring deeper fall to this support. On the upside, however, firm break of 0.6639 will turn bias back to the upside for stronger rebound instead.

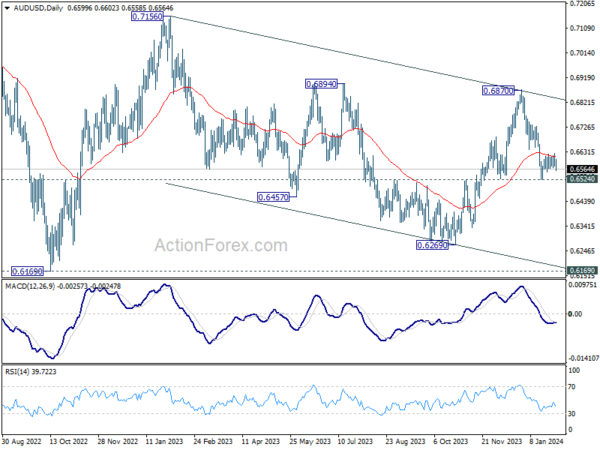

In the bigger picture, price actions from 0.6169 (2022 low) are seen as a medium term corrective pattern to the down trend from 0.8006 (2021 high). Sideway trading could continue in range of 0.6169/7156 for some more time. But as long as 0.7156 holds, an eventual downside breakout would be mildly in favor.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BoJ Summary of Opinions | ||||

| 23:50 | JPY | Industrial Production M/M Dec P | 1.80% | 2.40% | -0.90% | |

| 23:50 | JPY | Retail Trade Y/Y Dec | 2.10% | 5.00% | 5.30% | 5.40% |

| 00:00 | NZD | ANZ Business Confidence Jan | 36.6 | 33.2 | ||

| 00:30 | AUD | CPI Q/Q Q4 | 0.60% | 0.80% | 1.20% | |

| 00:30 | AUD | CPI Y/Y Q4 | 4.10% | 4.30% | 5.40% | |

| 00:30 | AUD | RBA Trimmed Mean CPI Q/Q Q4 | 0.80% | 0.90% | 1.20% | |

| 00:30 | AUD | RBA Trimmed Mean CPI Y/Y Q4 | 4.20% | 4.30% | 5.20% | |

| 00:30 | AUD | Monthly CPI Y/Y Dec | 3.40% | 3.70% | 4.30% | |

| 00:30 | AUD | Private Sector Credit M/M Dec | 0.40% | 0.40% | 0.40% | |

| 01:00 | CNY | NBS Manufacturing PMI Jan | 49.2 | 49.3 | 49 | |

| 01:00 | CNY | NBS Non-Manufacturing PMI Jan | 50.7 | 50.6 | 50.4 | |

| 05:00 | JPY | Housing Starts Y/Y Dec | -4.00% | -6.20% | -8.50% | |

| 05:00 | JPY | Consumer Confidence Jan | 38 | 37.6 | 37.2 | |

| 07:00 | EUR | Germany Import Price Index M/M Dec | -0.50% | -0.10% | ||

| 07:00 | EUR | Germany Retail Sales M/M Dec | 0.60% | -2.50% | ||

| 07:30 | CHF | Real Retail Sales Y/Y Dec | 0.90% | 0.70% | ||

| 08:55 | EUR | Germany Unemployment Change Jan | 10K | 5K | ||

| 08:55 | EUR | Germany Unemployment Rate Jan | 5.90% | 5.90% | ||

| 09:00 | CHF | Credit Suisse Economic Expectations Jan | -23.7 | |||

| 09:00 | EUR | Italy Unemployment Dec | 7.50% | 7.50% | ||

| 13:00 | EUR | Germany CPI M/M Jan P | 0.20% | 0.10% | ||

| 13:00 | EUR | Germany CPI Y/Y Jan P | 3.40% | 3.70% | ||

| 13:15 | USD | ADP Employment Change Jan | 143K | 164K | ||

| 13:30 | CAD | GDP M/M Nov | 0.10% | 0.00% | ||

| 13:30 | USD | Employment Cost Index Q4 | 1.00% | 1.10% | ||

| 14:45 | USD | Chicago PMI Jan | 48.2 | 46.9 | ||

| 15:30 | USD | Crude Oil Inventories | -0.8M | -9.2M | ||

| 19:00 | USD | Fed Interest Rate Decision | 5.50% | 5.50% | ||

| 19:30 | USD | FOMC Press Conference |