(Bloomberg) — Emerging-market currencies posted their best week of 2024, rebounding from Monday’s brutal selloff with a bang as concerns of a hard landing in the US eased.

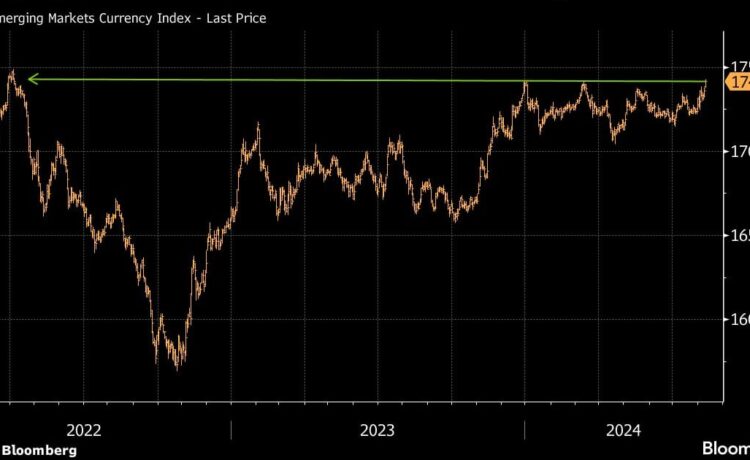

The MSCI EM currency index rose 0.7% during the week, closing at the highest level in more than two years. Brazil’s real rallied after above-forecast inflation data fed expectations its central bank could raise interest rates later this year. Developing-nation stocks rose 1.6% Friday to post a 0.2% gain for the week.

A weaker dollar and a rebound in global equities boosted risk appetite after markets whipsawed this week amid fears of a steep slowdown in the US economy, which labor data helped quell. Strategists are eyeing signs that a massive unwind of yen-funded carry trade bets may have run its course — at least for now — as the yen paused its ascent since July.

“We could soon be reaching a point of stabilization whereby the drawdown of FX carry has run its course,” said Paul Mackel, global head of FX research at HSBC. This could tempt investors to re-engage some higher yielding currencies that have felt the brunt lately, including those in Latin America.”

Even as a global unwinding of carry trades took hold this week, emerging-market currencies showed resilience as a stronger Japanese yen also meant a weaker dollar, with its potential to channel flows into riskier assets.

US data releases next week include inflation, where further easing is needed to likely lock in interest rate cuts by the Federal Reserve. Retail sales and industrial output data will give more readings on the growth outlook for the world’s largest economy, which could fuel more volatility.

“We believe that this higher volatility may not normalize as fast as some expect, suggesting a potential re-calibration higher in EM risk premium,” Citigroup strategist Luis Costa wrote in a report. “The likelihood of down-adjustments in US growth has increased significantly.”

Real Rally

The Brazilian currency posted it best week since late 2022 with a nearly 4% gain after policymakers signaled they could be raising interest rates later this year.

Before the rally, the real had been the worst performing emerging market currency so far this year. Just last Friday it hit its lowest level this year amid concerns about President Luiz Inacio Lula da Silva’s spending plans and fear the monetary authority would become more tolerant toward inflation after Lula names a new governor and two directors this year.

Central bank minutes this week helped calm those fears. Brazil Central Bank Governor Roberto Campos Neto on Friday said that recent unanimous votes showed policymakers’ commitment to hitting their inflation target.

Peru’s central bank unexpectedly cut its benchmark interest rate Thursday, shrugging off concern that core inflation remains stubbornly high, following Mexico’s move. Colombia’s peso lagged most Latin American peers after inflation in the Andean nation slowed more than expected, bolstering expectations for even more aggressive rate cuts.

Meanwhile, Czech policymakers voiced concerns about the recent koruna depreciation, saying it was a reason for caution in further monetary-policy easing after they slowed the pace of interest-rate cuts last week.

In stock trading, shares in Taiwan Semiconductor Manufacturing Co.’s rose after its revenues in July surged 45%.

Shares in Turkish banks saw their biggest weekly drop in more than a year, as the prospect of high-for-longer interest rates prompted investors to take profit off the sector’s massive rally in favor of non-financial stocks.

–With assistance from Ronojoy Mazumdar.

©2024 Bloomberg L.P.