(Bloomberg) — Emerging-market currencies edged higher Tuesday as bond traders leaned toward bets that the Federal Reserve will kick off its interest-rate cutting cycle with a 50-basis-point cut.

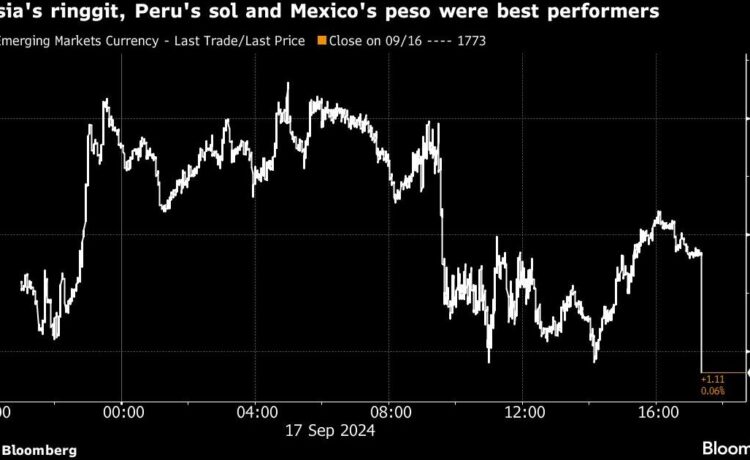

The MSCI index for developing nation currencies closed 0.06% higher, its fifth session of gains. US treasury yields climbed and the dollar advanced.

The market-implied odds that the Fed delivers a half-point reduction were around 55% on Tuesday after retail sales unexpectedly rose in August, signaling resilient US household demand. The data failed to settle speculation over the magnitude of the central bank’s decision on Wednesday.

The “US data, on the whole, isn’t super impactful for the Fed meeting,” said Mark McCormick, global head of FX and EM strategy at TD Securities, adding that he thinks the data will push central bankers toward a smaller-sized cut.

Malaysia’s ringgit, Mexico’s peso and Peru’s sol gained ground, leading their emerging currency peers, buoyed by risk-on sentiment over the Fed’s anticipated pivot.

Mexico’s currency reversed its losses and inched higher against the dollar. Earlier on Tuesday, the currency slipped as traders took profits following a rally last week and expressed some pessimism over President Andres Manuel Lopez Obrador’s controversial judicial reform.

Chile’s peso and Turkey’s lira, however, weakened. Chile’s currency fell against the greenback as copper prices wavered. The lira slid as expectations mount that Turkey’s central bank will be slow to cut interest rates. Its next meeting is on Thursday.

In equity markets, an index of EM stocks advanced for a fourth session and closed 0.41% higher, led by Tencent Holdings Ltd., Alibaba Group Holding Ltd., and China Construction Bank Corp.

In credit markets, Egypt’s dollar bonds rallied after Cairo said Saudi Arabia’s sovereign wealth fund is poised to invest $5 billion, in what would be the latest round of Gulf funding for the North African nation that’s emerging from its worst economic crisis in decades. The nation’s bond due in February 2061 hit 72 cents on the dollar, the highest in at least four months, according to data compiled by Bloomberg.

Citigroup sees upside potential in Sri Lanka’s dollar bonds regardless of the country’s election outcome, expecting the final recovery value to be above current prices.

Across central and eastern Europe, devastating floods rocked the region, handing another blow to economies still reeling from a series of shocks including the energy crisis and global trade disruptions.

The government in Warsaw will prepare a reconstruction plan for the affected regions, using funds from the state budget and the European Union, Premier Donald Tusk said. The Czech cabinet signaled it may need to amend the budget, although it didn’t provide a specific estimate of the damages.

–With assistance from Selcuk Gokoluk.

©2024 Bloomberg L.P.