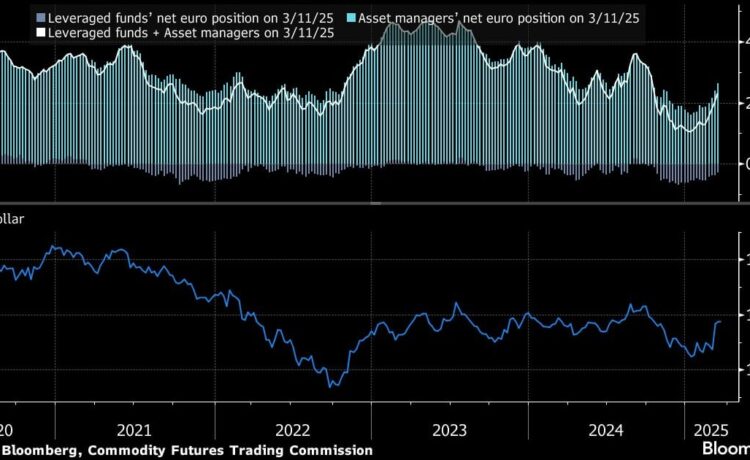

Europe’s historic pivot toward bigger fiscal spending has spurred asset managers to pump up bullish euro positions to a five-month high, while hedge funds have pared bets on the currency’s weakness.

Fund managers boosted positions that benefit from a stronger euro to 262,759 contracts for the week to March 11, a few days after Germany said it would loosen fiscal chains and spend hundreds of billions of euros to transform European defense. Hedge funds simultaneously cut their short euro positions to the least since October, Commodity Futures Trading Commission data showed.

The changes underscore a global rethink on the euro’s trajectory, after Germany’s pledge to loosen fiscal restraints encouraged the rest of Europe to follow suit. Strategists at Societe Generale SA raised their forecast for the shared currency, joining the likes of Goldman Sachs Group Inc. And Deutsche Bank AG in releasing more optimistic projections.

In a note Monday, Kit Juckes, head of FX strategy at SocGen, said the potential changes to Germany’s debt-brake rule mean a return to parity against the dollar is unlikely “for at least a decade.” The French bank now predicts the euro will climb nearly 5% to $1.13 in the fourth quarter, from just below $1.09 currently.

“Stronger fiscal spending should be a powerful antidote to policy uncertainty and other maladies that have plagued the euro,” Goldman Sachs strategists including Kamakshya Trivedi wrote in a Friday note, revising up their three-month forecast on the currency to $1.07 from $1.02.

The euro has jumped more than 7% against the dollar since a February low. The gains have coincided with fading faith over the greenback’s strength as Donald Trump’s policies roil US markets. In contrast, expectations have been growing that Europe’s increased spending will bolster the bloc’s economic growth.

“If ‘diminished’ US exceptionalism gives way to ‘finished,’ the dollar can fall a long way and the euro stands to be a key beneficiary,” the Goldman strategists wrote. They noted, however, that the euro’s valuation is fair on a trade-weighted basis, meaning further appreciation may rest on the dollar’s moves.

German conservative leader Friedrich Merz last week reached an agreement with the Green Party on a debt-funded spending package for defense and infrastructure, overcoming a key hurdle ahead of a crunch vote in parliament.

–With assistance from Ruth Carson and Naomi Tajitsu.

©2025 Bloomberg L.P.