Euro Technical Forecast: EUR/USD Weekly Trade Levels

- Euro snaps five-week losing streak- rallies more than 1.8% off key technical support

- EUR/USD February opening-range preserved into close of the month– US PCE on tap

- Resistance 1.0942, 1.1038, 1.1108– Support 1.0704/23 (key), 1.0587, 1.0483

Euro was set to snap a five-week losing streak on Friday with EUR/USD rallying more than 0.45% to trade at 1.0826 ahead of the close. A rebound off critical support preserves the February opening-range and the battle lines are drawn heading into key US inflation data next week. These are the updated targets and invalidation levels that matter on the EUR/USD weekly technical chart heading into March.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this EUR/USD technical setup and more. Join live on Monday’s at 8:30am EST.

Euro Price Chart – EUR/USD Weekly

Chart Prepared by Michael Boutros, Technical Strategist; EUR/USD on TradingView

Technical Outlook: In my last Euro Technical Forecast, we noted that EUR/USD had, “plunged more than 3.7% off the December highs with the decline now testing a pivotal support zone around the 2022 trendline- risk for price inflection off this mark. From a trading standpoint, a good zone to reduce portions of short-exposure / raise protective stops- rallies should be limited to 1.0942 IF price is heading lower on this stretch with a close below 1.0704 needed to fuel the next major move.”

Euro tested key support last week with price rebounding more than 1.8% off the monthly lows and while there is further upside potential near-term, the broader outlook remains unchanged into the close of February. Weekly resistance steady at the January high-week close (HWC) near 1.0942 backed by the December HWC / 2024 yearly-open at 1.1038. Ultimately, a breach / weekly close above this threshold is needed to suggest a more significant low was registered last week and would expose the 2023 HWC at 1.1108 and beyond.

Critical weekly support remains at 1.0704/12– a region define by the 2023 yearly-open, the 61.8% Fibonacci retracement of the October advance, the December swing lows and the May low-week close. A weekly close below this threshold is needed to invalidate the 2022 uptrend and would threaten another bout of accelerated losses towards the 2023 low-week close (LWC) at 1.0587 and the 2023 opening-range low at 1.0482– both areas of interest for possible downside exhaustion / price inflection IF reached.

Bottom line: Euro has staged a seven-day rally off key support with the February opening-range intact into the close of the month- look to the breakout for guidance here. From a trading standpoint, the focus is on possible topside exhaustion ahead of 1.0942 IF price is heading lower on this stretch with a close below 1.0704 needed to mark resumption of the December downtrend.

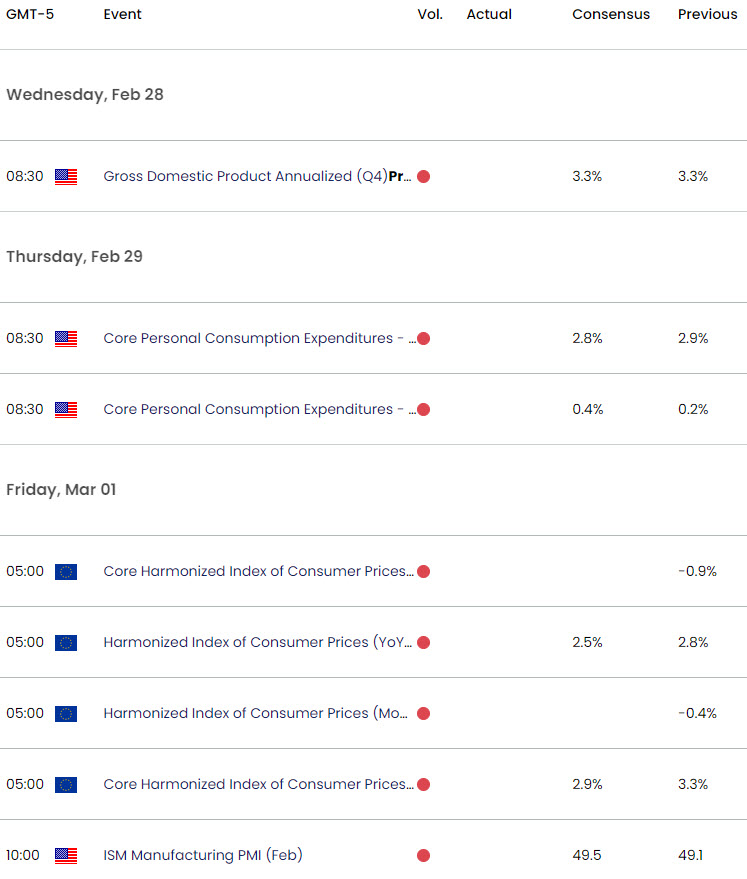

Keep in mind we get the release of key inflation data next week with the US Personal Consumption Expenditure on tap Thursday. Note that this is the Fed’s preferred inflationary gauge and as such, has the potential to impact interest rate expectations moving forward- stay nimble into the March open. I’ll publish an updated Euro Short-term Technical Outlook once we get further clarity on the near-term EUR/USD trade levels.

Key Euro / US Economic Data Releases

Economic Calendar – latest economic developments and upcoming event risk.

Active Weekly Technical Charts

— Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on X @MBForex