(Bloomberg) — The euro zone’s crawl toward steady consumer prices will probably advance next week with data offering policymakers limited progress just before they set interest rates.

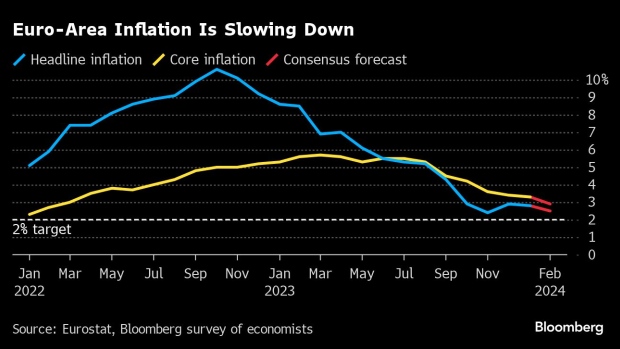

Inflation in the 20-nation region probably slowed to 2.5% in February, according to the median forecast of economists surveyed by Bloomberg. That report is due on Friday after a 24-hour flurry of numbers from the region’s largest economies.

While the consensus outcome would be one of the lowest readings in more than 2 1/2 years, it’s still too far above the 2% goal targeted by the European Central Bank for its officials to be comfortable.

That’s even more so regarding the underlying measure that strips out volatile elements such as energy, which is anticipated to slow to 2.9%.

Any setback for the ECB in the numbers could influence financial markets, just as the strength of recent US inflation data cast some doubt among investors over the prospect of imminent rate cuts.

The reports are the final batch due before the March 7 meeting, which will feature new forecasts that will be scrutinized by investors seeking a roadmap toward monetary easing. The publication of data during a pre-decision blackout period precludes officials from offering immediate reaction to it.

The spate of releases starts on Wednesday with numbers from Belgium. Reports from France, Spain and Germany all arrive on Thursday, and all are anticipated to show slowing price growth.

What Bloomberg Economics Says…

“Euro-area inflation figures are likely to show broad-based deceleration in February. That will still not be enough to swing the European Central Bank’s view. The central bank will probably want further confirmation of softening trends before it feels confident to loosen policy – we expect the first cut in June.”

—For full preview, click here

The numbers in Italy, where inflation is already well below 2%, will be published concurrently with the euro-zone data the following day.

While the ECB is watching such reports closely, it’s also keeping a close eye on wages for any signs of faster price growth getting entrenched. On Friday, President Christine Lagarde shared some optimism, noting that pay numbers for the fourth quarter were “encouraging,” while highlighting that more information is required.

Speaking in Ghent, Belgium, where she’s attending a meeting of European finance ministers and central bank governors, she said that “the Governing Council needs to be more confident that the disinflation process that we are observing will be sustainable and will take us to the 2% medium term target.”

“There are many sectors and employees that are covered by negotiations that will be completed in the course of the first quarter of 2024,” she said. “I think that those numbers will — especially if they continue to be encouraging — will be important for us to assess going forward in order to reach confidence.”

©2024 Bloomberg L.P.