This was CNBC’s live blog covering European markets.

European markets closed higher on Monday, amid a charge in defense shares after regional leaders held security talks that touched on bolstered military spending.

The regional Stoxx 600 index moved between losses and gains in early deals before closing 1.1% higher. The Stoxx Europe aerospace and defense index rose by 8%, marking its best session in five years.

Among the biggest movers were Germany’s Hensoldt, closing 22.3% higher, Italy’s Leonardo, which was up 16%, and Dassault Aviation, which gained 15%.

Sweden’s Saab, France’s Thales, and Britain’s BAE Systems also crowded the top of Stoxx 600 movers.

Rolls-Royce, a player in defense as well as commercial aerospace which hit an all-time high last week after reinstating its dividend, added 4.4%.

EU Commission President Ursula von der Leyen told reporters in Brussels on Monday that the bloc’s 27 member states would be given details about the so-called rearm Europe plan on Tuesday.

“Tomorrow, I will inform the member states through a letter about the rearm Europe plan. We need a massive surge in defense without any question,” she said. “We want lasting peace, but lasting peace can only be built on strength, and strength begins with strengthening ourselves.”

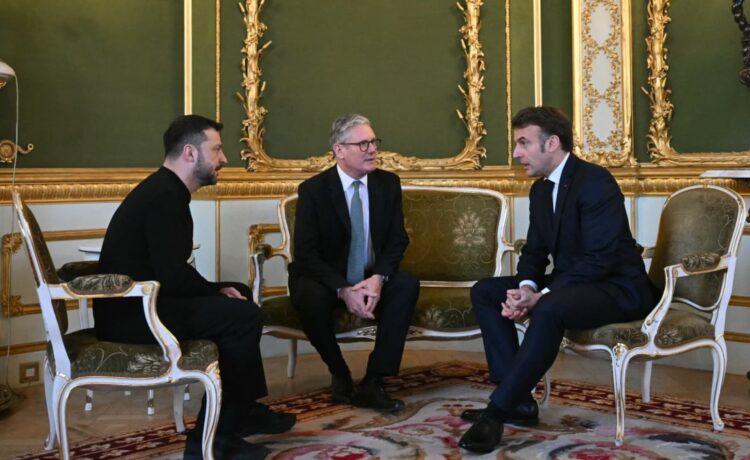

Her comments came after British Prime Minister Keir Starmer hosted a Ukraine peace summit over the weekend. During the talks, the U.K. leader said Kyiv’s allies must step up and continue their support, following the explosive meeting between U.S. President Trump and Ukrainian President Volodymyr Zelenskyy on Friday. The U.K. last week committed to increasing its defense spending as a share of GDP over the coming years — a sentiment echoed by other leaders at the summit.

Reuters reported Sunday that the parties likely to form the next German government were considering setting up special funds for both defense and infrastructure, with the former potentially unlocking 400 billion euros ($416 billion) in spending.

Robin Winkler, chief Germany economist at Deutsche Bank, said in a Monday note that the move would be “a fiscal regime shift of historic proportions.”

Data out Monday showed euro zone inflation dipped to 2.4% in February, slightly above analyst expectations, ahead of the European Central Bank interest rate decision on Thursday.

Economists surveyed by Reuters had expected inflation to dip to 2.3% in February, down from 2.5% in January.

The euro zone Purchasing Managers’ Index meanwhile showed contraction in the bloc’s manufacturing sector eased to its least severe in two years.

U.S. stock futures edged up early Monday and Asia-Pacific markets mostly rose overnight as traders awaited more clarity on President Donald Trump’s plans to impose tariffs on key U.S. trading partners this week.

U.S. Commerce Secretary Howard Lutnick reportedly told Fox News on Sunday that the exact tariff that will be levied against Mexico and Canada starting Tuesday is still “fluid,” which means it could be lower than the proposed 25%. He added that the additional 10% duty on China imports is “set.”

European markets close higher

European stock markets provisionally closed higher on Monday with Germany’s Dax up by 2.6%, the U.K.’s FTSE 100 higher by 0.7%, and France’s CAC 40 closing up 1%.

The regional Stoxx 600 was also higher gaining 1.1%.

— Sawdah Bhaimiya

Winners and losers on the Stoxx 600 index

The biggest winner on the Stoxx 600 index on Monday afternoon was Italian defense and security firm Leonardo, which was up nearly 17%, as European leaders discussed plans to boost defense spending and end the war in Ukraine.

Several other defense names crowded the top of the index including France’s Dassault Aviation and Thales, both up around 16%. Kongsberg Gruppen, Rheinmetall, and BAE Systems were also up around 15%.

Meanwhile, the biggest losers were Danish biotech company Zealand Pharma, and British firms Spectris and Bunzl, all shedding over 6%.

— Sawdah Bhaimiya

Deutsche Telekom to launch ‘app-free’ AI phone this year

Deutsche Telekom’s AI Phone on display at Mobile World Congress.

BARCELONA — German telecommunications giant Deutsche Telekom plans to launch a new “app-free” AI smartphone later this year.

The company announced Monday at the Mobile World Congress (MWC) tech conference that it will open orders for its AI Phone, a new smartphone it’s developed in partnership with several leading AI firms, in the second half of 2025.

The phone comes with a virtual assistant from AI startup Perplexity that can take a series of actions on your behalf like booking a restaurant or taxi and hop between different applications. It also comes loaded with AI tools from Google, text-to-speech software startup ElevanLabs and design platform Picsart.

At last year’s MWC, so-called “AI smartphones” were the talk of the event. But at the time, the AI-centric phones being released by the likes of Samsung and Chinese tech firm Honor were still in the early stages of their development.

This year, phones that come packed with their own virtual assistants and so-called “agentic AI” features that can complete tasks autonomously on smartphone users’ behalf, are finally starting to launch.

– Ryan Browne

U.S. stocks open higher

U.S. stocks kicked off Monday’s session in the green.

The Dow and S&P 500 each added 0.4% shortly after 9:30 a.m. ET. The Nasdaq Composite popped 0.5%.

— Alex Harring

Europe defense spending needs to rise by at least $209 billion: David Roche

Quantum Strategy’s David Roche said Europe’s defense expenditure needs a boost of at least 200 billion euros ($209.7 billion), in a conversation with Steve Sedgewick and Karen Tso on “Squawk Box Europe” on Monday.

European leaders held security talks over the weekend after a clash between U.S. President Donald Trump and Ukrainian President Volodymyr Zelenskyy. The 27 EU leaders are expected to meet on Thursday to discuss “concrete” measures for increasing defense spending.

“Our defense expenditure has gone up 30%, it has gone up to approximately 300 billion euros a year, but it needs to go up by at least 200 billion more, fast,” Roche said.

“The defense spending is not where it has to be to replace the Americans. It has to be much, much higher. It’s very slow…” Roche noted saying it would take five to six years minimum to integrate the 22 different NATO armies and establish supply chains for military hardware and software.

“Putin, who can build the entire armament of the German Bundeswehr every six months, can rearm much faster.”

Roche also pointed out that the U.S. is “the big loser” amidst tensions as many Global South countries will “fall into the Chinese ambit.”

“So you want to buy defense, you want to keep out of the euro and own the yen, which is another new safe haven, as the U.S. is getting to look very dangerous, and U.S. exceptionalism will suffer from the costs of Chinese commercial tariffs.”

— Sawdah Bhaimiya

Von der Leyen touts ‘rearm Europe plan’

European Commission President Ursula von der Leyen gives a press conference at the EU Commission headquarters in Brussels on March 3, 2025.

Defense stocks continued to rise after EU Commission President Ursula von der Leyen said the bloc’s 27 member states would be given details about the so-called rearm Europe plan on Tuesday.

“Tomorrow, I will inform the member states through a letter about the rearm Europe plan. We need a massive surge in defense without any question,” she told reporters on Monday. “We want lasting peace, but lasting peace can only be built on strength, and strength begins with strengthening ourselves.”

The Stoxx Aerospace and Defense index was up 7.5% at 12:45 p.m. London time.

— Chloe Taylor

Autos shares rise

Volkswagen ID.7 electric cars are seen at the Volkswagen (VW) electric fleet lead plant in Emden, Germany, Feb. 18, 2025.

The Stoxx Autos index jumped 1.93% by 12:43 p.m. London time, after EU Commission President Ursula von der Leyen gave a speech about the future of Europe’s car industry.

She said the EU would explore support options for European battery producers and said the bloc would continue to engage with the industry, according to news agency Reuters.

Volkswagen was up 4.4% during early afternoon trade, while Renault gained 3.9% and BMW added over 3%.

— Chloe Taylor

Thales shares jump 11.3%

Shares of French cybersecurity firm Thales were up 11.3% at 11:32 a.m. London time, after the company announced a new partnership with Germany’s SHIFT, which manufactures sustainable mobile handsets.

The deal will see Thales’s eSIM technology integrated into SHIFT’s next-generation smartphones, Thales said on Monday morning.

— Chloe Taylor

Euro zone manufacturing activity best for two years but still in downturn

The ongoing downturn in euro zone manufacturing activity continued in February, though at its least severe level for two years, according to the latest Purchasing Managers’ Index from S&P Global and Hamburg Commercial Bank.

The PMI reading of 47.6 for the sector remained below the 50 mark separating contraction from expansion but rose from the 46.6 reading in January and was the highest since early 2023.

“It’s still too early to call it a recovery, but the PMI hints that the manufacturing sector might be finding its footing,” said Cyrus de la Rubia, chief economist at Hamburg Commercial Bank.

“New orders are falling at the slowest pace since May 2022, and production is edging closer to stabilising. So, after almost three years of recession, we could see a bit of growth in the coming months. A quick formation of a government in Germany, political stability in France, and a deal with the US on key tariff issues would definitely help.”

— Jenni Reid

Euro zone inflation dips less than expected to 2.4% in February

Euro zone inflation eased to 2.4% in February but came in slightly above analyst expectations, according to flash data from statistics agency Eurostat.

Economists surveyed by Reuters had expected inflation to dip to 2.3% in February, down from the 2.5% reading of January.

Euro zone inflation re-accelerated in the fourth quarter, but European Central Bank policymakers remain optimistic about its trajectory. Accounts from the central bank’s January meeting last week showed that policymakers believed inflation was on its way to meeting the 2% target, despite some lingering concerns.

— Sophie Kiderlin

Defense firms set for higher cash flow but pricing remains ‘complex,’ Goldman Sachs warns

The European defense sector may be set for higher national funding in the coming years but it is difficult to price companies accurately based on those expectations, Christian Mueller-Glissmann, head of asset allocation research at Goldman Sachs, told CNBC’s “Street Signs Europe” on Monday.

“I understand why they rally a lot. There will be a lot more spending on defense, and it’s going to be a multi-year process. So you get predictability of cash flows, potentially predictability of earnings. I’m sure that this contributes to people being willing to pay higher multiples,” Mueller-Glissmann said.

However, he added that pricing based on news flow was complex and “increasingly more difficult,” with return on equity in some cases determined by governments.

“The problem is always when you have such a big regime shift, with regards to defense and defense spending, these companies might change how they make money and how they get integrated into the kind of fabric of national security,” Mueller-Glissmann said.

Defense shares have seen numerous sessions of double-digit gains so far this year, generally in response to news regarding government spending commitments or the Russia-Ukraine war. The likes of France’s Thales and the U.K.’s BAE Systems are up more than 38% and 22% respectively in the year to date.

— Jenni Reid

Europe markets cautiously higher

European markets were slightly higher in early deals Monday amid broad gains in defense stocks from across the region.

The Stoxx 600 index, which last week notched a 10th straight week of gains and strongly outperformed the U.S. S&P 500 for a second month, was 0.1% higher at 9 a.m. in London.

Germany’s DAX and the U.K.’s FTSE 100 were both up by around 0.3%, while France’s CAC 40 added just 0.06%.

— Jenni Reid

German defense shares seen jumping after European leader talks

Shares of German arms manufacturer Rheinmetall are set to open sharply higher, according to premarket indicators, after European leaders held defense talks over the weekend at which higher spending was discussed.

Rheinmetall has already made year-to-date gains of more than 60% on expectations of higher military spending by European governments as relations with the U.S. fracture over the Ukraine war.

On Monday, JPMorgan raised its target price on the company to 1,200 euros ($1,248.60) from 800 euros.

Reuters meanwhile reported on Sunday that the parties holding coalition talks to form Germany’s new government were considering establishing two special funds for defense and infrastructure, potentially unlocking hundreds of billions of euros in higher spending.

Shares of German military electronics firm Hensoldt were also seen opening higher.

— Jenni Reid

European markets: Here are the opening calls

European markets are expected to start the week on a positive note.

The U.K.’s FTSE 100 index is expected to open 42 points higher at 8,846, Germany’s DAX up 135 points at 22,621, France’s CAC 34 points higher at 8,124 and Italy’s FTSE MIB 18 points higher at 38,798, according to data from IG.

Earnings are set to come from Euroapi and Bunzl, and data releases in focus include the latest euro zone inflation data.

— Holly Ellyatt