Market scorecard

US markets rebounded nicely on Thursday from a sharp selloff the previous day. Both the S&P 500 and the tech-heavy Nasdaq posted gains of over 1%. Eight of the S&P 500’s eleven sectors closed in the green.

Here’s how some of the magnificent seven performed: Meta Platforms (NASDAQ:) soared 15% in late trade on strong earnings and the announcement of its inaugural dividend of 50 cents a share, accompanied by a $50 billion share buyback, the holy trinity of investing. Amazon (NASDAQ:) also popped as much as 9% after the bell following results that showed strong sales. Lastly, Apple (NASDAQ:) is down 3% pre-market as iPhone sales slowed down in China.

In other company news, Peloton (NASDAQ:) dropped 24% after the fitness equipment company reported falling sales and cut its 2024 outlook. Furthermore, Qualcomm (NASDAQ:) eased 5% after the mobile phone chip company released revenue estimates that were a little sluggish. Finally, Etsy (NASDAQ:) gained 9.1% following a statement saying it would add a member of hedge fund Elliot Investment Management to its board.

At market close, the JSE All-share closed down a tiny 0.12%, the rose 1.25%, and the was 1.30% higher.

Byron’s beats

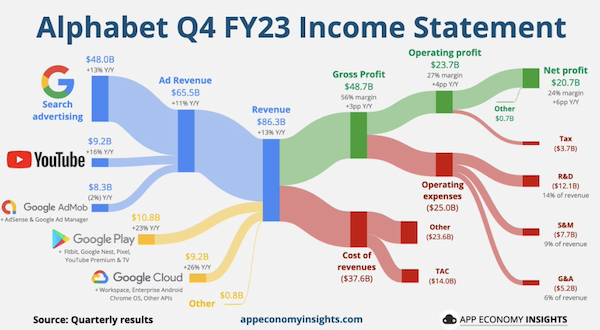

On Tuesday night Google (NASDAQ:) released Q4 . Revenues were up by 13%, its fastest sales growth since early 2022. Earnings also came in ahead of consensus due to better margins, while shares in issue declined by 2.5% year over year thanks to share buybacks. This business is in fantastic financial shape. They have net cash of $100bn and quarterly free cash flow of around $18bn. Lovely.

Sadly the share price took a hit after the release. It coincided with a day the Nasdaq was down 2%, thanks to the Fed, but underperformed badly by dropping 7.5%. The general consensus is that they missed slightly on advertising spend. Nothing to lose sleep about.

Naturally, there was a lot of AI speak. Unlike Microsoft (NASDAQ:), they are not charging customers immediately for AI services which means the upside is not yet tangible. Instead, Google is using AI to enhance the search and advertising experience for both customers and advertisers.

Their technologies are creating more targeted and relevant advertising which has been shown to raise conversion for advertisers by 18%. With image discovery campaigns they expect the conversions to rise by another 6%. A more effective product for clients means more money for Google.

The cloud business is still growing fast at 25.5%, but not quite as quick as their competitors Microsoft and Amazon. We still see a lot of potential for this division which will also see big AI improvements over time.

Google’s subscription roster now brings in $15 billion a year. This includes YouTube Premium and Google One. Google One does not get talked about enough. It is the main competitor to Apple’s IOS. Android (owned by Google) phone users buying apps, storage, music, etc is a huge profit driver.

Based on fundamentals Google remains one of the cheapest tech stocks, trading at 20 times 2024 earnings. It goes as low as 17 times on 2025 projections. This stock ticks all the boxes and remains one of our favourite. The image below shows you where all the money is being made.

One thing, from Paul

Ah, Friday advice time. Here’s a useful tip, plan your vacations far ahead. It’s been widely observed that the anticipation of a holiday is more fun than the event itself.

So, plan a family trip away to a foreign or local destination in 2025. You’ll find yourself daydreaming about it for the whole year.

Discovering beautiful places with your loved ones. Imagine the people you will encounter, the meals you’ll eat, the hikes you’ll take, and the back streets you’ll explore. Making memories that will last a lifetime.

Bright’s banter

The Kansas City Chiefs have secured a spot in the Super Bowl. Lately, they have been winning more than just American football matches.

According to Apex Marketing Group, since Taylor Swift began appearing at Kansas City Chiefs games in September, her presence has generated $331.5 million worth of online, TV, radio, and print media exposure.

Taylor’s influence has created something even more spectacular. The NFL has seen its highest spike in female viewership in over two decades. Now that’s what I call the Taylor Swift effect!

Signing off

Asian markets are mostly higher this morning. Benchmarks edged higher in India, Hong Kong, Japan, and South Korea while mainland China lagged. The index is headed for a second week of gains as equity markets maintained strength.

US equity futures are flat pre-market. The is trading around R18.57 to the US Dollar.

Today we’ll see US confirm payrolls data which are expected to show a slowdown in new jobs added to the economy.

TGIF!