When equities and bonds were sinking ships in 2022, weak sterling calmed the storm. Now that global equity markets are rising, however, currency movements are exerting both headwinds and tailwinds, depending on the region.

Currencies are an underappreciated yet potent force in investors’ portfolios. Currencies are usually less volatile than equities, so investors don’t tend to hedge the foreign exchange risk of their international equity portfolios, but some years currencies can move so sharply that they have a dramatic impact on returns.

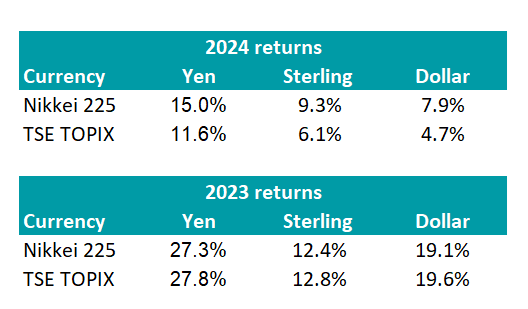

This year and in 2023, the weak yen deprived UK and US-based investors from fully participating in Japan’s equity rally. The Nikkei 225 hit an all-time high last week, but although the index has risen 15% this year alone in yen terms, unhedged sterling investors gained two-thirds of that and dollar investors received only half of the upside.

Japanese equity returns in yen, sterling and dollar terms

Source: FE Analytics, data to 22 Feb 2024

Emerging market currencies are another focal point for investors this year and could provide a tailwind for emerging market equity and debt if they strengthen against the dollar, according to David Aujla, lead fund manager of Invesco’s risk-targeted Summit Growth and Summit Responsible multi-asset ranges.

Yet one of the starkest and most impactful currency movements in recent times was the dollar’s appreciation against the pound in 2022.

The weak pound cushioned the blow of falling stock markets for sterling investors who had substantial allocations to US and global equities (given that the US accounts for about 63-70% of global equity portfolios).

“Aggressive investors got bailed out by sterling weakening more than their bond allocations did,” Aujla explained.

On the other hand, for cautious investors in 2022, the “wound” was rate hikes and “the salt in the wound was looking across at aggressive investors and thinking, why aren’t they suffering as much as me?”

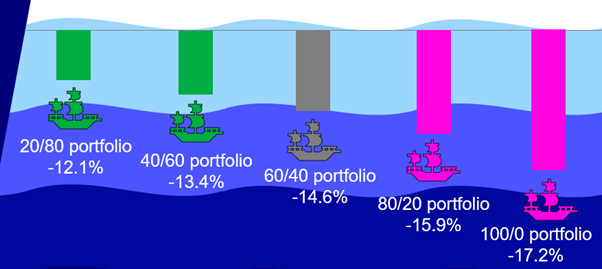

The chart below shows the returns from equity and bond portfolios in 2022. A cautious investor with 20% in bonds and 80% in equities would have lost less money in 2022 than an adventurous investor with everything in equities – if they had used funds with hedged share classes.

Sources: Invesco and Bloomberg. The funds listed above are a blend between the MSCI ACWI Total Returns – GBP hedged (Global Equities) and Bloomberg Global Aggregate Total Return – GBP hedged (Global Bonds).

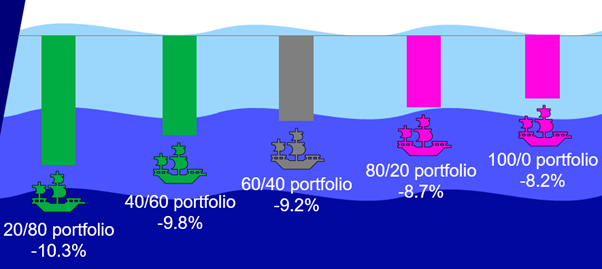

In practice, however, sterling weakness bailed out aggressive investors who did not hedge their currency exposures, as the chart below shows.

Sources: Invesco and Bloomberg.

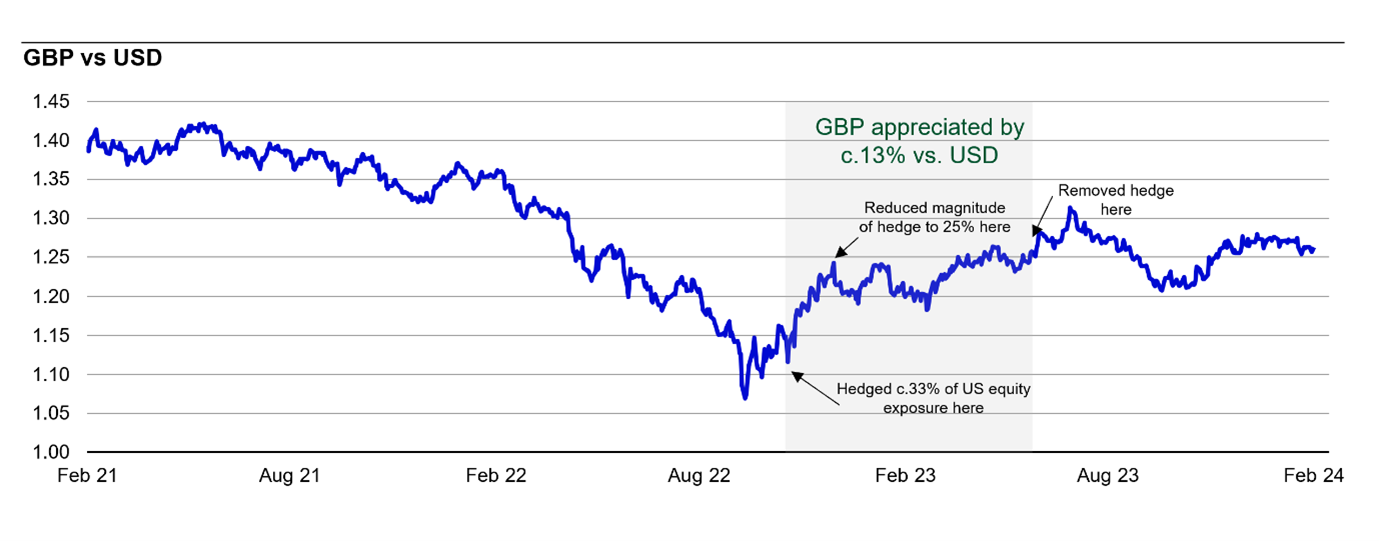

After sterling plummeted, Aujla hedged a third of the Summit Growth funds’ US equity exposure by buying sterling-hedged share classes to “avoid the snap back” of a sterling recovery, as the chart below illustrates.

Invesco hedged its US equity exposure as sterling recovered against the dollar

Sources: Invesco and Bloomberg

Going forward, the dollar/sterling exchange rate is unlikely to move by that order of magnitude, Aujla said.

However, if the dollar weakens it would be tailwind for emerging market debt and equity allocations, and Invesco’s Summit Growth funds are overweight both asset classes. They hold local currency and hard currency emerging market debt funds, with a skew towards local currency debt, which is yielding around 7.5%.

Unlike in emerging market equities, China is less dominant within debt markets. Other countries such as Brazil, Mexico and India come to the fore and are offering “really attractive yields”, Aujla said.

He thinks emerging market debt will perform well this year even without local currency appreciation, but any dollar weakness would be the icing on the cake.