An old adage is ringing true right now: “Markets take the stairs up and the elevator down.” After months of steady climbs, many global markets have suddenly nosedived. Just look at Japanese stocks: their 25% gain from earlier this year evaporated in a blink, leaving them sitting 5% lower than where they started 2024 off.

One driver behind this violent global downturn is the existence of feedback loops. That’s when the outcomes of certain market actions exacerbate the following movements, much like dominoes toppling over and over.

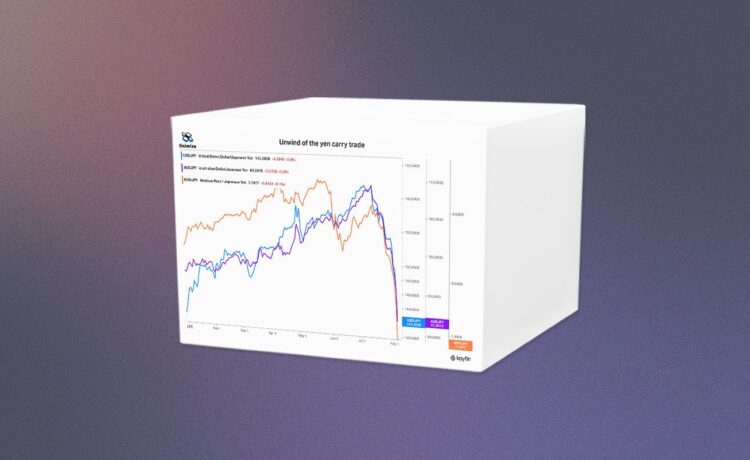

A textbook case is the unraveling of yen carry trades. Traditionally, investors have borrowed yen at low rates to invest in currencies that pay more interest, like the Australian dollar, the Mexican peso, and even the US dollar. By using leverage, carry trade investors can pocket a steady profit from the difference in interest rates between the two currencies.

The problem comes when the funding currency spikes, which is a matter of when, not if. That’s exactly what’s happened with the yen recently: a cocktail of economic, political, and technical factors have pushed the currency upward, catching carry trade investors off guard.

The unwind of the yen carry trade exacerbated the reversal in currencies. Here, the line down means the yen is rising. Source: Koyfin, Finimize

The rebound in the yen meant many investors were forced to buy back the Japanese currency and sell their higher-yielding ones to cover their losses. And because that was hardly a hidden trade, traders were headed for the exit in their droves – and that sudden shopping spree pushed the yen up even higher. That exacerbated losses for the remaining investors, encouraging them to join the mass exodus in classic feedback-loop fashion.

And it wasn’t just currencies involved. The more those losses pile up, the more likely leveraged investors are forced to sell off other assets, like US and Japanese stocks. Plus, major losses in these markets tend to make investors more risk-averse, so they often sell some of their other assets to protect from potential further losses, perpetuating the cycle.

Now, this doesn’t mean that the unwinding of the yen carry trade is the sole cause of the sell-offs we’re seeing. In fact, there are many other factors at play, some of which are probably more important. But it certainly illustrates how a feedback loop can swiftly amplify losses in one market and ripple across others.

And if several other carry trades start to unwind simultaneously – as they are now, with the strategy of shorting volatility coming undone, for one – that could help explain the big, fast sell-offs we’re currently seeing.