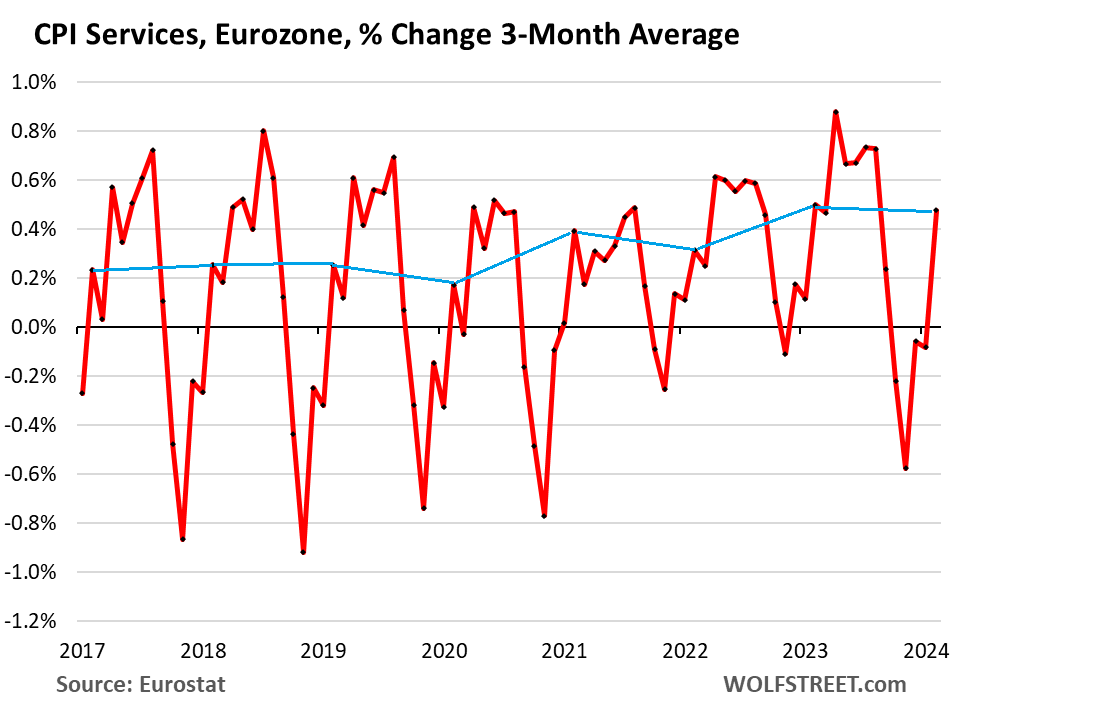

Over the three months through February, services inflation has been running at roughly the same hot rate as during the peak a year ago.

By Wolf Richter for WOLF STREET.

In the 20 countries that use the euro, inflation in services in February has gotten stuck at around 4% year-over-year for the fourth month in a row, and on a month-to-month basis appears to be accelerating with a 0.8% jump in February from January, the second highest for any February in the data going back to the beginning of the Eurozone, after the 0.9% jump during peak inflation a year ago, according to data from Eurostat today. And ECB Council Member Robert Holzmann came out to say, despite the quiet period before the meeting, wait a minute, we’re in no hurry to cut rates.

Hot services inflation is also dogging the Federal Reserve; in services is where inflation has gotten entrenched and is thriving: The US “core services” PCE price index spiked the worst in 22 years month-to-month, as we saw yesterday. So this is a broader problem.

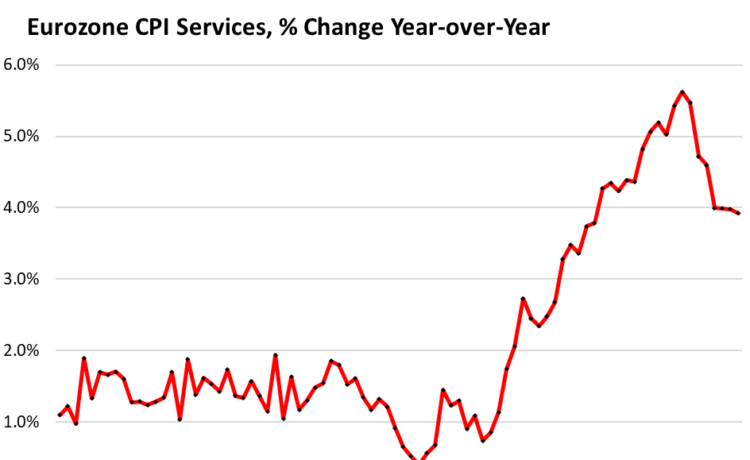

On a year-over-year basis, the CPI for services in the 20 countries that use the euro has been essentially unchanged near 4% for four months, after cooling from the surge through mid-2023. Services is where consumers spend the majority of their money.

Services are huge. It’s where consumers spend the majority of their money. Many services are essential to modern life, such as housing and related services, healthcare, insurance, broadband and telecommunications, auto repairs, transportation, etc. Inflation is notoriously hard to eradicate from services.

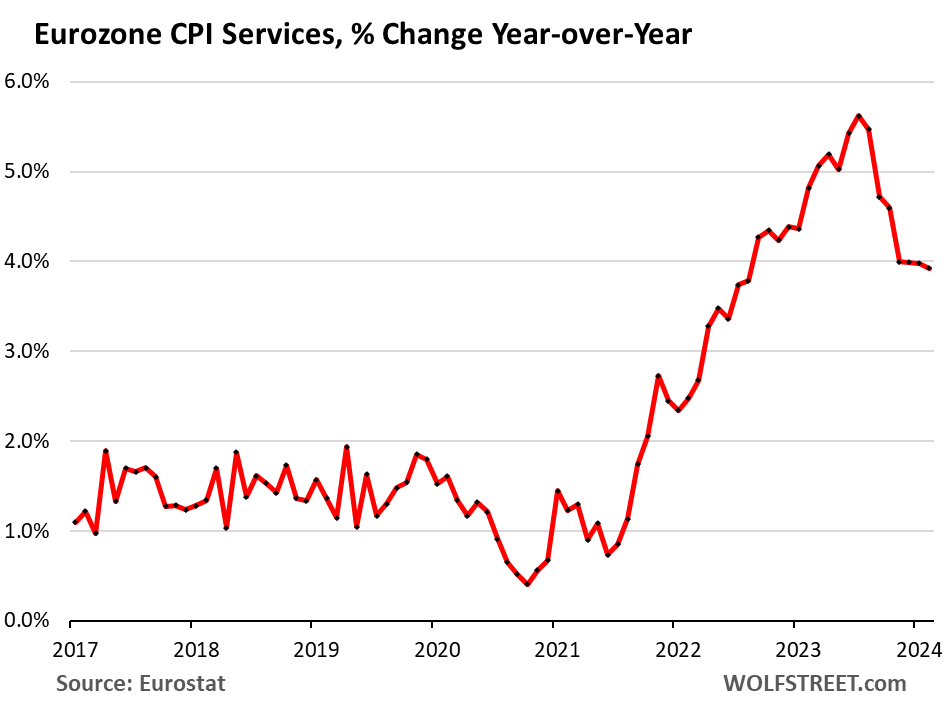

The services CPI as index values shows what is going on here. More on the blue boxes in a moment.

As we can see, before the pandemic, August marked the end of the seasonal surge in services inflation. The index would then decline sharply, but not all the way, to hit a higher low in November (the beginning of the blue boxes), tick up in December, fall back in January to where it would be about the same or just a tad higher than November, with near clockwork seasonality.

The rise in February would bring the index value back to the December level, before the surge through August. That was the seasonal pattern before the pandemic. Seasonality was thrown overboard in late 2020, when November was the low point, and the index then surged every month through August 2021, dipped a little, and surged again for two cycles.

Top blue box in the chart: the re-acceleration. November 2023 was again the low point of the cycle, but unlike before the pandemic, January was substantially higher than November; December barely dipped; and then the index spiked in February. During these most recent three months, services inflation ran at nearly the same red-hot pace as during peak-inflation a year earlier. This is very disconcerting (circled in the chart above).

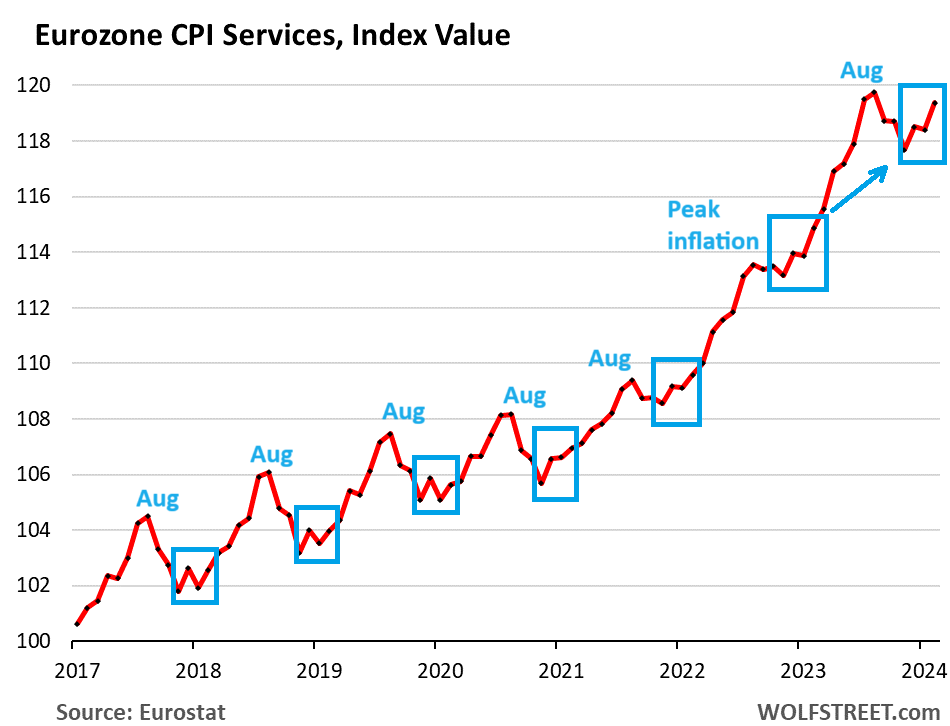

On a month-to-month basis, the services CPI in the Eurozone spiked by 0.82% from January. The index is very volatile with the biggest positive readings in July, and biggest negative readings in September and November. But that was the second highest reading for any February in the history of the index, just a hair below February 2023 (+0.87%), which was around peak services inflation.

The three-month moving average shows a similar picture: in February it jumped by 0.48%, just a hair behind the record February 2023 (0.50%), and both were the highest in the data, and running over double the rate before the pandemic. The blue line connects the Februarys.

What is disconcerting: The month-to-month and three-month moving average in February 2024 is now running at roughly the same rate as during the peak services inflation a year ago. This is an early indication that services inflation, after bottoming out at a year-over-year rate of around 4%, may be headed higher from here. This already occurred in the US, where year-over-year core services inflation hit bottom at 4% and in January already bounced off and headed higher.

ECB governor Holzman reacts to further slow down this rate-cut mania. “We watched inflation data coming in from the European and country level, and what we see is that they confirm my view that we have to wait, have to be attentive and can’t rush to a decision” about rate cuts, said ECB Council member and Austrian National Bank Governor Robert Holzmann on Friday, March 1, thereby sticking his comment edgewise into the seven-day quiet period ahead of the March 7 policy meeting in order to nudge markets further out of their rate-cut mania.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()