© Reuters.

HONG KONG – Lion Group Holding Ltd. (NASDAQ: LGHL), a comprehensive trading platform provider, has announced its impending launch of a new AI-driven multi-currency trading account service. The company, which already offers a range of financial products and services, is set to introduce this upgrade by the end of March 2024.

The new service will facilitate transactions in various currencies, including offshore RMB and US dollars, which is a shift from the traditional settlement in Hong Kong dollars. This multi-currency functionality is expected to offer real-time adjustments to currency accounts and provide a set of investment tools tailored to support diverse investment strategies.

The CEO of Lion, Mr. Chunning (Wilson) Wang, stated that the enhanced services are designed to meet and anticipate the evolving needs of their customers. He emphasized the company’s commitment to leveraging advanced technologies such as AI and web3.0 to foster an intelligent digital operational ecosystem.

The company’s portfolio includes services such as total return service (TRS) trading, contract-for-difference (CFD) trading, insurance brokerage, and futures and securities brokerage. Lion also boasts a specialized SPAC sponsorship team that assists private companies in their public listing journey.

This announcement is based on a press release statement from Lion Group Holding Ltd.

InvestingPro Insights

As Lion Group Holding Ltd. (NASDAQ: LGHL) gears up to launch its innovative AI-driven multi-currency trading account service, investors may be keeping a close eye on the company’s financial health and stock performance. Here are some key insights from InvestingPro that could be of interest:

InvestingPro Data:

- The company’s market capitalization stands at a modest $3.21 million, reflecting its size within the trading platform industry.

- LGHL has a negative Price/Earnings (P/E) ratio of -0.07, indicating that the company has been unprofitable over the last twelve months.

- The Price/Book ratio, as of the last twelve months leading into Q2 2023, is 0.1, suggesting that the stock may be trading at a low valuation relative to its book value.

InvestingPro Tips:

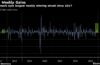

- LGHL’s stock has experienced significant price volatility, which could be an important consideration for investors looking for stability.

- Over the last year, the stock price has seen a considerable decline, falling by 93.43%, which may raise concerns about its near-term prospects.

Investors interested in a deeper analysis of Lion Group Holding Ltd. can find additional InvestingPro Tips by visiting https://www.investing.com/pro/LGHL. There are 9 more tips available that could provide further insights into the company’s performance and stock valuation. For those considering a subscription, use coupon code PRONEWS24 to get an additional 10% off a yearly or biyearly Pro and Pro+ subscription, offering a more comprehensive investment analysis toolset.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.