(Bloomberg) — Investors are pushing the world’s most expensive currency to ever more dizzying heights, shrugging off the risks from interest-rate cuts, divisive elections and analyst warnings.

Most Read from Bloomberg

Mexico’s peso is the world’s best-performing major currency this year and the highest ranked on a list of real effective exchange rates — a measure of a nation’s competitiveness — compiled by the Bloomberg. According to Deutsche Bank, that rate is now at its highest in Mexico since at least 2005.

The rally has proved so relentless — blasting past milestone after milestone — that investors are now afraid to bet against the currency, despite its high valuation. In fact, options market data show traders see a strengthening of the currency over the next three months as more likely than a decline.

“In the past we’ve tried to go against that strength and it just hasn’t worked,” said Nicolas Jaquier, a portfolio manager for NinetyOne UK Limited in London, who’s betting in favor of the currency. “It does look expensive on a number of models, but I think we have to take that with a big pinch of salt.”

The key to the peso’s strength has been its low volatility and Mexico’s record-high interest rates, which make it attractive to borrow in one currency and lend in pesos, the so-called carry trade.

Ever Higher

Fresh off its biggest annual gain in over two decades last year, the peso has climbed 1.8% against the dollar this year. It now trades at about 16.69 per dollar, near the strongest since 2015.

The gains come despite presidential elections in Mexico in June and in the US in November, which at least in the latter case pose the risk of abrupt policy changes. Some strategists are already urging caution. Deutsche Bank analysts warned last week that valuations are “reaching extremes” and Bank of America dubbed the peso “overvalued.”

Asset managers, though, are brushing aside those concerns, boosting their net-long contracts on the currency to the highest since late 2022, according to data from the Commodity Futures Trading Commission as of March 12.

While Mexico’s central bank is expected to cut its key interest rate next week from 11.25% for the first time in three years, it will proceed at such a slow pace that it’s unlikely to undermine the peso, according to NinetyOne’s Jaquier.

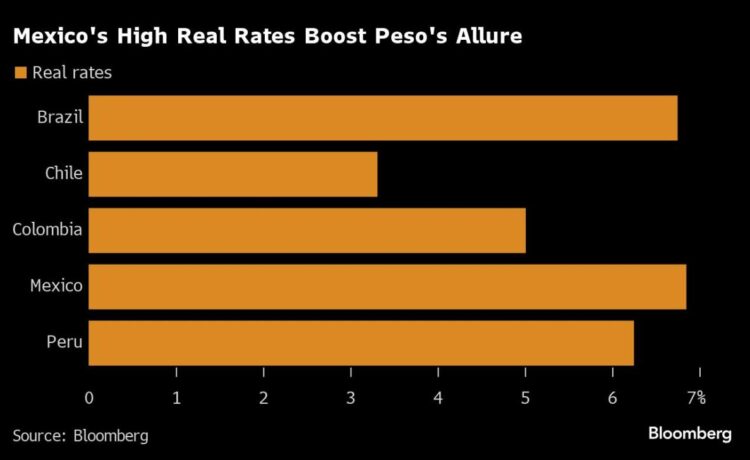

Mexico currently has the highest real interest rates in Latin America and should keep luring money managers, according to NWI Management’s chief investment officer Hari Hariharan. The high rate makes it prohibitively expensive to bet against the currency.

“The peso will continue to be a favorite long for investors funding it by borrowing currencies such as the yuan, the euro and the Swiss franc. I don’t see that dynamic changing,” Hariharan said. “There could be some volatility around elections both in Mexico and in the US, but nothing serious.”

Claudia Sheinbaum, the candidate backed by current President Andres Manuel Lopez Obrador, is widely expected to win June’s election.

And while AMLO, as the president is known, clashed with sectors of the country’s business elite, his fiscal austerity has become one of the peso’s anchors as investors eye ballooning deficits across emerging and developed markets.

Record remittances from the US, stronger-than-expected economic growth and the prospect of more investments into the country by factories looking to be closer to the US are also buttressing the peso.

“It’s pretty much a foregone conclusion that Sheinbaum will be a continuation of the status quo,” said Christian Lawrence, a strategist with Rabobank in New York.

The US election represents a larger risk to the peso, with investors likely to hedge peso exposure as the US vote nears, he said.

Donald Trump’s victory in 2016 sparked the biggest peso losses in more than two decades amid his threats to rip up a free trade deal with Mexico and tax remittances. But in his bid to win back the White House, Trump is proposing tariffs on imports and intensifying the trade war with China, which could drive more investment into neighboring Mexico.

“Mexico will not be singled out the way it was singled out last time, both by Trump, but also by the market,” said Dirk Willer, a strategist at Citigroup. “The carry still dominates and the US election is a secondary thought that will become more forceful over time, but not over the next few months.”

–With assistance from Carter Johnson and Davison Santana.

(Updates CFTC data in eighth paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.