Image © Pound Sterling Live

The Pound to Euro exchange rate has risen six weeks in succession and sits on the cusp of breaking to its highest levels since 2022, although this coming week could be too early for a fresh attempt at new highs.

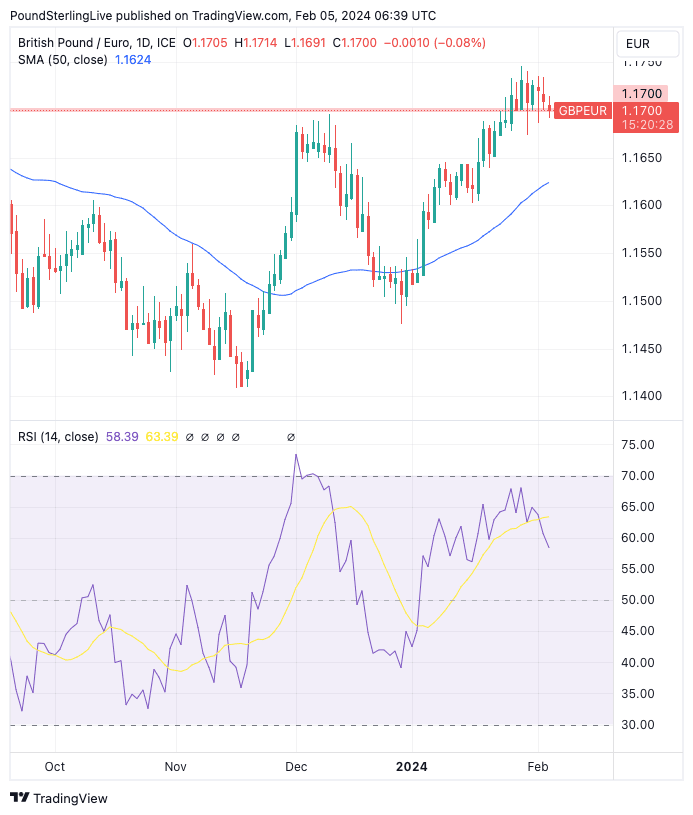

The major momentum indicators are positively aligned and advocating for further advances, with some support at the 1.17 level starting to build.

A series of daily closes above this region sets the 2024 rally apart from those attempts to break higher in 2023; back then, the pair struggled to close above 1.17 for any stretch of time, but we have now seen a succession of daily closes above here of late:

Above: GBP/EUR at daily intervals, showing momentum remains positive, with credible support building at 1.17. Track the GBP and EUR with your own custom rate alerts. Set Up Here

The coming days could well see the Pound-Euro consolidate near current levels in a sign that Pound Sterling is positioning for a break to the 2023 high at 1.1772 ahead of an attempt at 1.18 over the coming weeks.

But, this week could be too early for such an attempt with the Relative Strength Index (RSI) pointing to easing momentum (lower panel in the above), and we would not be surprised to see some lower daily closes emerge.

The hunch that the British Pound will ultimately continue higher in its uptrend against the Euro is underpinned by the supportive fundamental backdrop of fading investor expectations for central bank interest rate cuts.

Odds of a March rate cut at the U.S. Federal Reserve were dealt a blow last Friday when the U.S. non-farm jobs report blew market expectations away.

What is notable is that the Pound has tended to outperform the Euro alongside the Dollar when the market turns more ‘hawkish’ on U.S. interest rates.

This is primarily because of the assumption that the Bank of England won’t cut until after the Fed has done so. In short, what is good for the Dollar is good for the Pound.

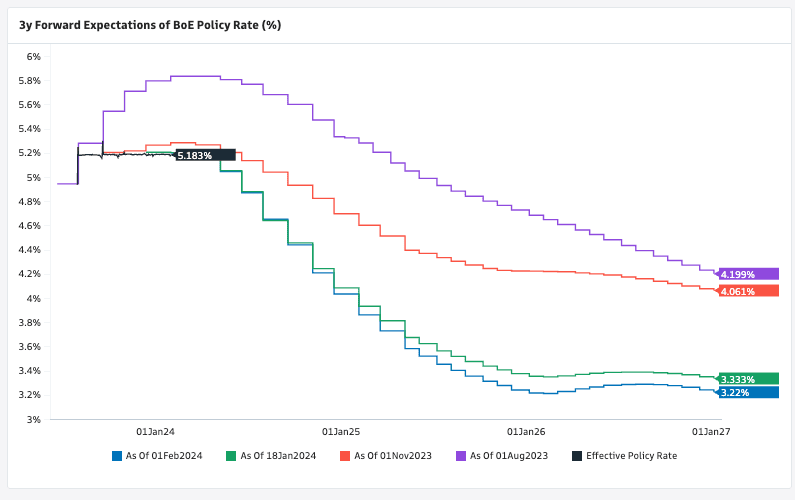

Last week, we heard from the Bank of England that the next move on interest rates would be a cut, but the overwhelming message was that this cut was still some way off.

The market lowered expectations for a May rate cut after the Bank said it needs to see what pay trends will do in the coming months before finally wielding the knife.

“While I often criticised the BoE last year for being too hesitant, its current reluctance to cut rates should be seen in a different, positive light. If it maintains this stance, the pound should remain supported,” says You-Na Park-Heger, an analyst at Commerzbank.

Track the GBP amd EUR with your own custom rate alerts. Set Up Here

UK Week Ahead: Bank of England Talking Heads

There is no front-line data on tap, but the Bank of England remains in focus with Monetary Policy Committee (MPC) members Breeden, Dhingra and Mann due to speak.

“Each will be interesting in their own right, particularly after Thursday’s decision. Two of the three of Thursday’s dissenters, Catherine Mann and Swati Dhingra will be speaking,” says Ellie Henderson, an economist at Investec.

Above: The market has priced in more and more rate cuts since mid-2023.

Mann voted for a further hike, while Dhingra voted for a cut, making her the first MPC member to vote to reduce interest rates in nearly three years.

“Their contrasting reasonings for the respective decisions will likely be insightful,” says Henderson.

Should the market push back against rate cut bets following these appearances, then the Pound can find further support via the interest rate channel.

There are no significant calendar events due from the Eurozone this week.