The growing heft of institutional investors and asset managers in several Asian economies has fuelled expansion in outward portfolio investment, mainly in US dollar-denominated assets. This investment is predominantly in long-term instruments but is hedged for currency risk mainly through short-term derivatives. The rollover risk in currency hedges exposes these non-bank investors to stress in dollar funding markets, as occurred in March 2020. Some Asian economies have since strengthened regulatory frameworks to address dollar funding-related vulnerabilities of resident institutional investors and asset managers.1

JEL classification: F21, F34, G15, G23.

External vulnerabilities of emerging market economies (EMEs) traditionally revolved around their ability to service foreign currency debt. An accumulation of such debt, combined with local currency depreciation amid tightening global financial conditions, was at the heart of the Latin American debt crisis in the 1980s and the Asian financial crisis in the 1990s.

In recent decades, however, gross outward investment by residents of several Asian EMEs has been rising rapidly. Increasing wealth and population ageing has fuelled growth in the assets managed by institutional investors, such as pension funds and insurance companies, and other asset managers. This investor base is essential for developing domestic capital markets and makes EMEs less vulnerable to shifts in global financial conditions (CGFS (2019)). At the same time, the associated search for yield and duration in domestic securities markets which are still relatively shallow has driven booms in outward portfolio investment, mainly in securities denominated in US dollars. This has introduced new vulnerabilities in Asian EMEs’ currency exposures that reflect their role as creditors rather than their traditional role as borrowers.

An institutional investor with a globally diversified portfolio of assets typically faces a currency mismatch between the assets it holds and its commitments to domestic stakeholders. For example, pension funds and insurance companies promise safe and stable returns in domestic currency to their beneficiaries and policyholders but invest in a portfolio that includes foreign currency assets. These institutional investors thus use foreign exchange (FX) derivatives to hedge a large portion of the currency risk in their portfolios.

Key takeaways

- The growing heft of institutional investors and asset managers in emerging Asian economies has fuelled expansion in outward portfolio investment in foreign currency assets, mainly in US dollars.

- Such non-bank investors rely on short-term foreign exchange (FX) hedging instruments provided by banks, which exposes them to rollover risk set off by disruptions in dollar funding markets.

- Market disruptions in March 2020 led to policy initiatives to enhance the resilience of FX hedging markets in Asia and to broaden prudential oversight of institutional investors and asset managers.

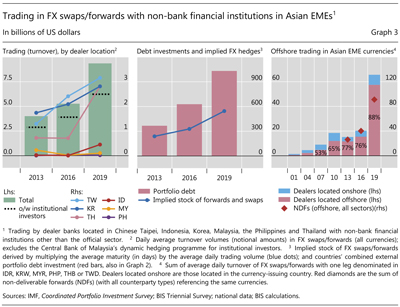

The rapid growth in Asian EMEs’ outward portfolios has boosted demand for FX hedges and, thus, growth in local FX derivatives markets. The intermediaries in these markets are FX dealer banks, including the local affiliates of international banks that source dollars from their headquarters or from international capital markets. Dealer banks interpose themselves between the investors with hedging needs and the ultimate suppliers of dollars, both domestic and foreign. However, the hedging instruments’ maturity is typically short-term, reflecting the bank funding model, which introduces a maturity mismatch between long-term dollar assets and short-term FX hedges. Korea, Malaysia and Thailand are among the EMEs exhibiting the most rapid growth in outward portfolio investment that has been accompanied by hedging for FX risk. Trading in FX derivatives contracts that reference one of these EMEs’ currencies against the US dollar has more than doubled since 2013.

FX swaps are the most commonly used hedging instrument. In a typical FX swap, the investor – an Asian EME asset manager in our context – receives dollars from a bank and pledges local currency, with an agreement to repay the dollars at a predetermined exchange rate at maturity. With the swap in place, changes in the value of dollar assets due to exchange rate movements are matched by changes in the value of dollar obligations. However, the investor faces rollover risk because FX swaps are overwhelmingly of shorter maturity than the attendant investments; if the contract cannot be rolled over, the investor must deliver dollars at maturity.

The dollar’s pre-eminent role as a global currency means that the rollover risk is predominantly for dollar funding. As the dollar funding is provided by banks, it exhibits the well known procyclical property of expanding during tranquil times only to contract sharply during periods of financial stress. The need to hedge dollar portfolios thus exposes a wide range of financial institutions to stresses, as happened in March 2020 with the onset of the Covid19 pandemic. During that episode, the cost of borrowing dollars spiked and liquidity dried up, as dealer banks were less able to accommodate investors’ rollover needs in FX swap markets. The effects were felt especially keenly in those Asian EMEs with a fast-growing institutional investor base with sizeable hedging needs.

The lessons from the March 2020 turmoil have been incorporated into policy initiatives to improve the resilience of local FX markets and strengthen prudential oversight of institutional investors and asset managers. However, policy challenges remain. In most EMEs, current regulatory frameworks for FX management focus on banks and thus may not address the broader structural risks posed by non-banks. In addition, mechanisms to extend foreign currency liquidity beyond the banking sector are largely untested.

This feature proceeds as follows. The next section reviews demographic trends and the growing footprint of insurance companies and funded pension systems in Asian EMEs, which have fuelled expansion in outward portfolio investment. The following sections discuss their role in local FX markets and the hedging practices that make them vulnerable to stresses in dollar funding markets, as occurred in March 2020. The final section concludes with policy considerations.

Institutional investors’ growing heft in external investment

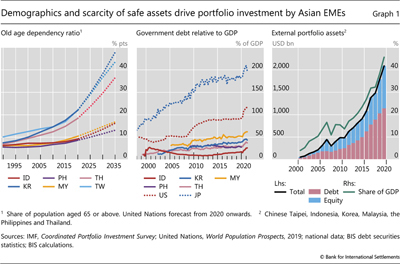

In many economies, demographic trends towards an ageing population, together with the development of funded pension systems and the life insurance sector, have given institutional investors an increasingly important role in the financial system. While populations in many Asian EMEs are still relatively young, old age dependency ratios have risen sharply since 2015 and are projected to edge up further in the coming years, particularly in Chinese Taipei, Korea and Thailand (Graph 1, left-hand panel). Retirement savings managed by institutional investors have grown in parallel.

Asset managers that serve the funded pension system and insurance companies seek investments that correspond to the obligations to pension beneficiaries and life insurance policyholders. In so doing, they seek to acquire long-term assets with cash flow properties similar to institutional investors’ longer-term liabilities, thereby mitigating duration risk.2 However, scarcity of long-dated assets in many Asian EMEs, as evidenced, for instance, by relatively shallow local currency government bond markets (Graph 1, centre panel), has prompted resident investors to acquire foreign assets (IAR (2019)).3 Their outward investment has at times been further spurred by an additional yield pickup even when hedging costs are factored in.

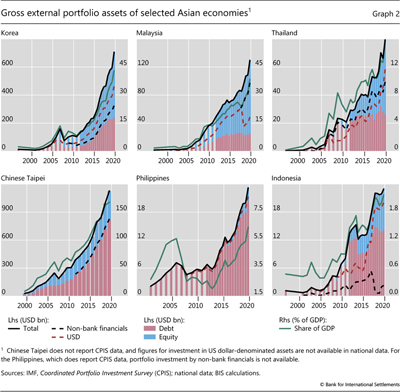

The “search for duration” has thus added to the traditional “search for yield” in fuelling the growth of external portfolio investment by Asian EMEs (Graph 1, right-hand panel). For Chinese Taipei and Korea, total investment has exceeded $900 billion and $700 billion, respectively, a near tripling in six years (Graph 2). The pace of the increases in Indonesia, Malaysia, the Philippines and Thailand was similar. In most of these economies, the accumulation of dollar-denominated assets (dashed red lines) by resident non-bank financial institutions (dashed black lines) drove this growth.4

Hedging practices of resident investors in emerging Asia

Demand for FX hedging services by investors based in emerging Asia has increased along with US dollar asset portfolios, not least because of regulations to curb currency risk. This has spurred growth in Asian FX derivatives markets, with the supply of hedging services provided by banks.

Institutional investors and asset managers typically hold foreign currency assets on a partially hedged basis, to mitigate the currency risk that arises from mismatch between these assets and domestic currency liabilities. In seeking to hedge currency risk, investors rely on banks to take the other side in FX derivatives. Due to the short-term nature of the bank funding model, the hedging instruments tend to be of shorter maturity than the assets, necessitating periodic renewal of the hedge. Hedging instruments include FX swaps and forwards, which are overwhelmingly short-term, and currency swaps, which have longer maturities.5 Of these, FX swaps are the most liquid and widely used (BIS (2019)). They can be used to match the currency composition of assets and liabilities instead of borrowing and lending in the cash market. But unlike cash transactions, they do not appear on the balance sheet and therefore can be thought of as “missing” FX debt (Borio et al (2017)). As a result, foreign currency obligations stemming from FX derivatives positions of institutional investors and asset managers must be inferred from other indicators of banking sector exposures (see the next section).

In general, the degree to which currency risk is hedged depends on the type of asset and the type of investor. Equity portfolios are generally more volatile and have less predictable cash flows than fixed income portfolios, and so are preferred by investors willing to take on more risk in search of higher returns. Furthermore, the US dollar tends to appreciate precisely when US equity markets fall, thereby cushioning investment performance in local currency terms during risk-off episodes when the portfolio is unhedged. Across investor types, those that are more tightly regulated, like insurance companies, tend to have more conservative exposures than other types, such as pension funds and asset managers. Consider each in turn.

In many Asian EMEs, life insurance companies are subject to strict regulations on currency exposure, including some form of risk-based capital (RBC) requirement. Compared with other institutional investors, they allocate a greater proportion of their portfolios to fixed income assets and use FX derivatives to hedge.6 Those in Korea and Thailand, for example, hedge close to 100% of their foreign currency bond portfolios to avoid additional capital charges.7 By contrast, those in Chinese Taipei, where no strict requirements apply, hedge an estimated 50% of their foreign bond holdings.8 As a benchmark, life insurance companies in Japan hedge approximately 50–70% of their bond portfolios.

Pension funds, which face fewer regulatory requirements, hold more equities in their portfolios and hedge currency risk to a lesser extent. Even with less hedging, however, the large size of their equity portfolios implies sizeable demand for dollar funding via FX derivatives. For example, pension funds in Chinese Taipei, Malaysia and Korea altogether held around $264 billion in foreign equities as of 2019 (Mercer (2021)). Hedging even 30% of this with one-month FX swaps would require rolling over more than $80 billion every month.

For their part, asset managers offering mutual funds or similar products that invest in foreign securities have an even greater share of equities in their portfolios. They too face few strict requirements but in practice tend to hedge in order to cater to investors’ tolerance for currency risk. For example, investors in Thai mutual funds are known to have low tolerance for FX-related losses; hence these funds tend to hedge more than half of their holdings for currency risk.9

Growth in FX hedging markets and dollar supply

Trading in FX forwards and swaps in Asian EMEs’ markets has grown in tandem with resident non-bank financial institutions’ portfolio investment. By 2019, resident dealer banks reported close to $9.4 billion in daily trading with non-bank financial institutions, up from $4 billion in 2013 (Graph 3, left-hand panel). These transactions predominantly involved FX derivatives that referenced the US dollar. An estimate derived from the turnover data puts the outstanding amount of these hedges close to $545 billion in 2019 (centre panel, blue line), equivalent to roughly half of residents’ portfolio investment in foreign currency debt securities (red bars).

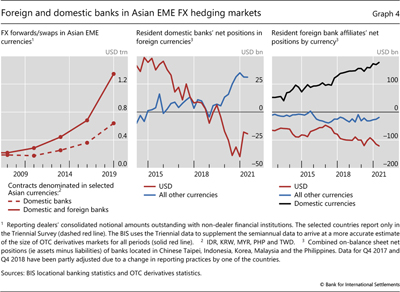

Both the banks headquartered in the region and the local affiliates of global banks are active dealers in FX derivatives markets for Asian EME currencies. By June 2019, banks headquartered in Chinese Taipei, Indonesia, Korea, Malaysia or the Philippines reported a combined amount of almost $600 billion in outstanding FX swaps and forwards referencing their respective domestic currency, roughly double the amount reported in 2013 (Graph 4, left-hand panel, dashed red line).10 Adding to this the positions reported by other banks, the estimated global total for these five currencies exceeded $1.3 trillion (solid red line) in 2019, indicating that foreign banks intermediate at least half of the total.

In their role as intermediaries, FX dealer banks meet the demand for dollars arising from resident institutional investors’ FX hedging activities. Particularly important are the local affiliates of global banks, which source their dollars from capital markets or from their headquarters. Other potential sources of dollars in local FX hedging markets are resident corporates that hedge trade denominated in foreign currencies, and non-resident investors in local currency assets.

For resident bank offices, the approximate size of hedging positions can be pieced together with some detective work. The evidence is indirect but can be reasonably inferred from the apparent currency mismatches on their balance sheets, under the assumption that banks close this gap with off-balance sheet FX derivatives.11 Combined, Asian EME domestic banks’ home offices had more dollar liabilities than assets in mid-2020 (Graph 4, centre panel, red line), suggesting off-balance sheet net dollar lending of roughly $40 billion via FX derivatives. For their part, the local affiliates of foreign banks had an even larger and more persistent currency mismatch. Their net investment in local currency assets (right-hand panel, black line) neared $190 billion at end-2020, and was partly funded with net liabilities in US dollars ($120 billion, red line) and in other non-local currencies. These local currency investments make resident foreign banks natural suppliers of dollars to non-bank investors hedging their foreign currency investments.

In addition to dollar funding from global capital markets and inter-office flows from banks’ headquarters, resident non-financial corporates are also a source of dollars in local FX derivatives markets, although the amounts are comparatively small. Corporates issuing dollar debt in offshore bond markets supply dollars via swaps if they hedge their dollar liabilities into their home currency.12 In addition, importers may hedge their future dollar payment obligations by buying dollars forward.

Finally, dollar-based non-resident investors who hold assets denominated in Asian EME currencies on a hedged basis may also supply dollars in local FX markets. For instance, non-residents account for a sizeable share of dollar supply into the FX swap market in Thailand. However, segmentation between onshore and offshore markets may inhibit this supply in other jurisdictions. Many Asian EMEs have in place some form of foreign exchange controls that result in residents trading onshore and non-residents trading offshore (Tsuyuguchi and Wooldridge (2008); Patel and Xia (2019)).13 The implication is that dollars provided via FX derivatives by foreign investors hedging their EME currency assets may not be accessible in onshore markets. In other words, hedging related to portfolio inflows does not necessarily help meet the dollar demand from resident investors’ hedging of their portfolio outflows.

Data on trading volumes of FX swaps and forwards in Asian EME currencies provide evidence for this market segmentation. In 2019, a full 88% of transactions with non-bank financials were offshore (Graph 3, right-hand panel, red bars). Trading of non-deliverable forwards (NDFs), mainly contracts referencing the Korean won and New Taiwan dollar, has roughly tripled alongside offshore transactions since 2013 (red diamonds).14

The general trend among Asian EMEs is to relax FX controls to deepen FX hedging markets. For example, the Central Bank of Malaysia introduced its “dynamic hedging programme” in December 2016, which eased regulations on FX hedging by resident and non-resident institutional investors and allowed more flexibility in the management of FX risk exposures. Volumes in the onshore FX forward market have since doubled.15 Similarly, the Bank of Thailand is introducing more hedging instruments, easing rules for overseas investment and allowing non-banks to provide FX services (Bank of Thailand (2020)). Finally, Bank Indonesia introduced a domestic NDF in November 2018 to promote the development of the domestic FX hedging market.16

US dollar funding stress in March 2020

Asian institutional investors and asset managers are exposed to disruptions in dollar funding markets through the maturity mismatch between the long-term nature of US dollar assets they hold and their use of short-term instruments supplied by banks for FX hedging. Dealer banks’ balance sheet management conforms to the well documented, procyclical nature of dollar wholesale funding, which tends to expand during tranquil times only to contract sharply during periods of financial stress, especially when accompanied by a sharp appreciation of the dollar (Avdjiev et al (2019)).

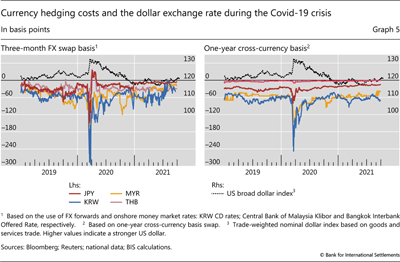

This was evident most recently during the market turmoil of March 2020 due to the Covid-19 pandemic. The cost of borrowing dollars via FX swaps shot up relative to dollar interest rates in the money market – a violation of covered interest parity (CIP), as evidenced by a widening of the basis for multiple Asian EME currencies (Graph 5).17 The impact differed across currencies in part depending on the depth of local FX swap markets and differences in hedging practices.

Further reading

- BIS (2018): “Macroprudential approaches to capital market activities”, Box IV.A, Chapter IV “Moving forward with macroprudential frameworks“, Annual Economic Report, June.

- Borio, C, R N McCauley and P McGuire (2017): “FX swaps and forwards: missing global debt?“, BIS Quarterly Review, September, pp 37–54.

- Shin, H S (2016): “Global liquidity and procyclicality“, speech at the World Bank conference on The state of economics, the state of the world, Washington DC, 8 June.

Most notable during the episode was the widening of Korean won FX swap basis vis-à-vis the US dollar (Avdjiev et al (2020)). Financial institutions’ reliance on short-term hedges meant that the pressure in the market for three-month FX swaps was more acute than in that for one-year currency swaps (Graph 5). A spike in the demand for dollars by securities firms in Korea, under pressure to meet margin calls on their futures and options contracts linked to foreign stock indices, further exacerbated dollar funding pressures (see box).18

On the supply side, banks in Korea may have been limited in their ability to accommodate the surge in demand for dollars by institutional investors and asset managers. First, banks themselves were in need of dollars during the turmoil. Second in 2010 the Korean financial authorities introduced caps on banks’ net FX forward positions relative to equity capital, to curb excessive FX borrowing. During the March 2020 market turbulence, domestic banks’ caps were relaxed from 40% to 50%, and foreign bank branches’ caps from 200% to 250%.

In contrast to the Korean won, movements in the Thai baht basis vis-à-vis the US dollar in March 2020 were short-lived and less severe. One possible reason is that outward portfolio investment from Thailand is much smaller, both in absolute amounts and relative to GDP (Graph 2). In addition, foreign investment funds in Thailand hedge flexibly. In March 2020, they allowed hedge ratios to temporarily fall by not rolling over existing hedges, thus alleviating price pressures in a countercyclical manner. Finally, the Bank of Thailand conducted open market operations in the local FX swap market (EMEAP (2020)), and so was well placed to ensure market depth.19

The expansion of Federal Reserve swap lines with major advanced economy central banks, including the Bank of Japan, mitigated stresses in global dollar funding markets. And the reopening of swap lines with the Bank of Korea and the Monetary Authority of Singapore on 19 March 2020 further narrowed the swap basis in Asian EME currencies. However, even as funding rates recovered on the back of swift policy support, transaction volumes in domestic FX swap markets declined significantly and have been slow to return to pre-pandemic levels (EMEAP (2020)).

Policy considerations

The disruptions during March 2020 put the spotlight on a new element in dollar funding stresses and revealed gaps in traditional policy approaches to FX markets. The new element is institutional investors’ and asset managers’ need for dollar funding liquidity, which adds to the general scramble for dollar funding during periods of financial stress. These non-bank investors have traditionally been subject to less stringent FX liquidity regulation and risk management rules than banks, and financial authorities face challenges in monitoring their funding needs. Particularly thorny issues include strengthening the resilience of these investors in the face of disruptions in dollar funding markets, and integrating them into existing oversight frameworks through expanded coverage.

Monitoring systemic risk posed by non-bank financial institutions: Regulatory monitoring systems tend to be centred on the banking sector; there is a limited view of the activities of institutional investors and asset managers (Bank of Korea et al (2021)). Yet common exposures, dominant investors and interlinkages between banks and non-bank financial institutions can contribute to systemic risk (FSB (2020)). Similarly, the combination of banks’ procyclical supply of wholesale dollar funding and the investment and margining practices of institutional investors and asset managers tends to amplify asset price cycles and swings in investment flows and exchange rates. Authorities need to better understand non-bank investors’ role in those mechanisms that create or propagate systemic risk so that they can take the necessary policy actions to smooth out financial risk-taking over time.

Strengthening oversight of FX funding liquidity risks created by institutional investors and asset managers: In many EMEs, both resident banks and non-bank investors are exposed to disruptions in dollar funding markets. Yet oversight of these institutions, and of foreign exchange markets, is fragmented across the central bank and other regulators, making it difficult to effectively monitor developments and swiftly respond. Policymakers could benefit from a consolidated approach to oversight that encompasses the root causes of dollar funding problems created by institutional investors and asset managers in FX markets (Shin and Shin (2021)). The principle of “same risk, same regulation” would point to more disclosure of FX liquidity risk and enhancements to their FX liquidity regulation and risk management frameworks.20

Calibrating regulation of FX hedging: Many Asian EMEs have adopted risk-based capital (RBC) frameworks in their solvency regulation of insurance companies. To reduce procyclicality, such frameworks can be adjusted to allow for flexible hedging of currency risk in order to mitigate spikes in the demand for short-term dollars in times of stress. Similarly, adjustments that incentivise longer-term hedging (eg up to three years) could reduce reliance on short-term FX derivatives where rollover risk is concentrated.

The need for foreign currency liquidity beyond the banking sector: The March 2020 experience highlighted the importance of central bank swap lines for distributing dollar liquidity to the global banking sector. At the same time, it also illuminated the greater underlying demand for dollar funding from institutional investors and asset managers in EMEs, which is met by banks. Central banks in some Asian EMEs introduced new facilities in March 2020 to provide liquidity to institutional investors and asset managers via domestic banks.21 But in many others, such mechanisms do not exist, reflecting concerns over moral hazard. In any case, the new facilities remain largely untested. Mechanisms to provide liquidity to institutional investors and asset managers during stress periods should be considered only with accompanying regulation, as in the case of banks. Otherwise, they may unleash more FX-related risk-taking during normal times and thus increase the intensity and likelihood of future stress episodes.

References

Avdjiev, S, W Du, C Koch and H S Shin (2019): “The dollar, bank leverage, and the deviation from covered interest parity”, American Economic Review: Insights, vol 1, no 2, pp 193–208.

Avdjiev, S, E Eren and P McGuire (2020): “Dollar funding costs during the Covid-19 crisis through the lens of the FX swap market“, BIS Bulletin, no 1, April.

Bank for International Settlements (2019): Triennial Central Bank Survey of foreign exchange and OTC derivatives markets in 2019, September, pp 1–23.

Bank of Korea, Ministry of Economy and Finance, Financial Services Commission and Financial Supervisory Service (2021): “Plan to strengthen FX macroprudential measures and FX liquidity backstop mechanisms”, press release, 20 January (in Korean).

Bank of Thailand (2020): “The BOT and the development of the new foreign exchange (FX) ecosystem”, box in Monetary Policy Report, December, pp 43–6.

Borio, C, R N McCauley and P McGuire (2017): “FX swaps and forwards: missing global debt?“, BIS Quarterly Review, September, pp 37–54.

Committee on the Global Financial System (CGFS) (2019): Establishing viable capital markets, CGFS Papers, no 62.

Executives’ Meeting of East Asia-Pacific Central Banks (EMEAP) (2020): Study on US dollar liquidity and funding dynamics in the EMEAP region, EMEAP Working Group on Financial Markets, August.

Financial Stability Board (FSB) (2020): Global Monitoring Report on Non-Bank Financial Intermediation 2020, 16 December.

Insurance Asset Risk (IAR) (2019): “Asset risk: biggest risk for Asian insurers“, 2 May.

Lee, H-S (2017): “Financial risks from increasing ELS and DLS: diagnosis and implications”, Korea Capital Market Institute Research Paper, no 17-04 (in Korean).

Lee, H (2021): “Commentary: Shifting vulnerabilities and lessons from macro-financial policy in Korea”, discussant remarks at the MAS-BIS conference “Macro-financial stability policy in a globalised world“, May 2021.

Mercer (2021): “Pension allocation trends in Latin America, the Middle East, Africa and Asia”, Asset Allocation Insights 2021, September.

Milliman (2019): Life insurance capital regimes in Asia: comparative analysis and implications of change – summary report, July.

Patel, N and D Xia (2019): “Offshore markets drive trading of emerging market currencies“, BIS Quarterly Review, December, pp 53–67.

Setser, B and S T W (2019): Shadow FX intervention in Taiwan: solving a USD 100+bn enigma – an exploration into the counterparties to life insurers’ FX hedges, Council on Foreign Relations, October.

Shin, H S (2016): “Global liquidity and procyclicality“, speech at the World Bank conference “The state of economics, the state of the world”, Washington DC, 8 June.

Shin, H S and K Shin (2021): “Lessons from macro-financial policy in Korea”, paper presented at the MAS-BIS conference “Macro-financial stability policy in a globalised world“, May 2021.

Tsuyuguchi, Y and P Wooldridge (2008): “The evolution of trading activity in Asian foreign exchange markets“, BIS Working Papers, no 252.