Image © Adobe Stock

The British Pound dipped as an initial reaction to news UK wages cooled in October, but downside risks to the currency are limited as these data are unlikely to shift the Bank of England’s policy stance on Thursday.

Wages, with bonuses included, rose 7.2% in October said the ONS, well below the expected 7.7%. Countering the downside surprise was news the September figure was revised higher to an eye-watering 8.0%.

Regular pay rose 7.3%, which is shy of the 7.4% expected by markets and lower than September’s 7.8%, which was also revised higher.

Wages are a key component of domestic inflation, and the Bank of England judges that at current levels, they remain too high to be consistent with a fall in inflation back to the 2.0% target.

Although the drop in wage increases will be a welcome development, these data are unlikely to prevent the Bank from warning on Thursday that interest rates must stay at 5.2% for an extended period.

It is this messaging – of a higher-for-longer rate stance – that helped the Pound outperform through the course of November.

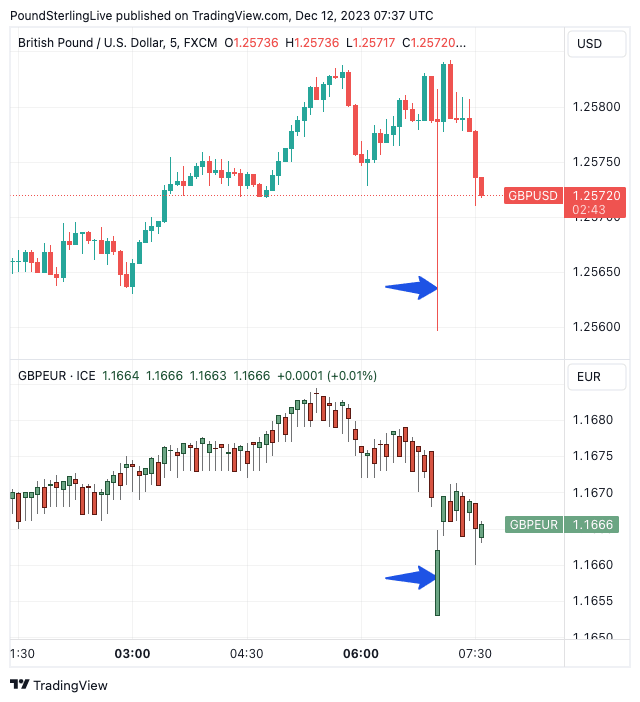

The Pound to Euro exchange rate slid to 1.1653 as an initial reaction to the release before recovering to 1.1670, which ensures it is still higher on the day.

The Pound to Dollar exchange rate also dipped before regaining composure to quote at 1.2579 at the time of writing.

Above: GBPUSD (top) and GBPEUR with annotations showing the initial post-wage data reaction. Note GBP had been falling ahead of the release. Track CAD with your own custom rate alerts. Set Up Here.

“Policymakers are expected to stress that rates will need to remain in restrictive territory for some time,” says Jake Finney, economist at PwC UK. “Despite slower pay growth, inflation-adjusted pay is still growing on a year-on-year basis. This is because headline inflation is falling back at a faster rate.”

PwC’s modelling indicates that the worst of the living standards squeeze is over for the average household.

The odds of the Bank of England turning more ‘hawkish’ in its communication on Thursday remain low as these wage data suggest that a looser labour market is starting to translate into slower pay growth.

Above image is courtesy of Pantheon Macroeconomics.

Between September and October, average pay with bonuses included has declined by 1.6%, compared to an average month-on-month growth rate of 1.1% in the first six months of this year.

The Bank will feel it is on course to lower inflation but will want to see further downshift in wage pressures before considering interest rate cuts.

“The slowdown in wage growth is becoming more established every month, but the MPC likely will wait for signs that this trend will be maintained through the early 2024 pay round before signalling it will reduce Bank Rate soon,” says Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics.

There remains notable uncertainty about whether wage pressures will slow enough over the coming months to prompt the Bank of England into a wage cut.

Pantheon Macroeconomics says the conditions for a cut will likely be in place as soon as May 2024.

But, economists at Royal Bank of Canada (RBC) say, “with UK inflation increasingly domestically concentrated, bringing it down further from here will be more difficult and likely entail a more material slowing of wage growth than hitherto seen.”

RBC continue to see the Bank of England on hold through 2024 with the conditions in which the MPC would feel comfortable cutting Bank Rate only presenting themselves in early 2025.

For the Pound who is right matters: a rate cut in May would require a bringing forward of market-implied rate cut expectations, which would likely send Pound exchange rates lower.

By the same token, a 2025 rate cut would require significant push back on rate cut expectations, which would, on balance, be supportive of Sterling.