Image © Adobe Images

The British Pound dipped against the Euro and Dollar after the UK reported an unexpected rise in unemployment, but weakness will be limited by surprisingly firm wage increases that will maintain an air of caution at the Bank of England.

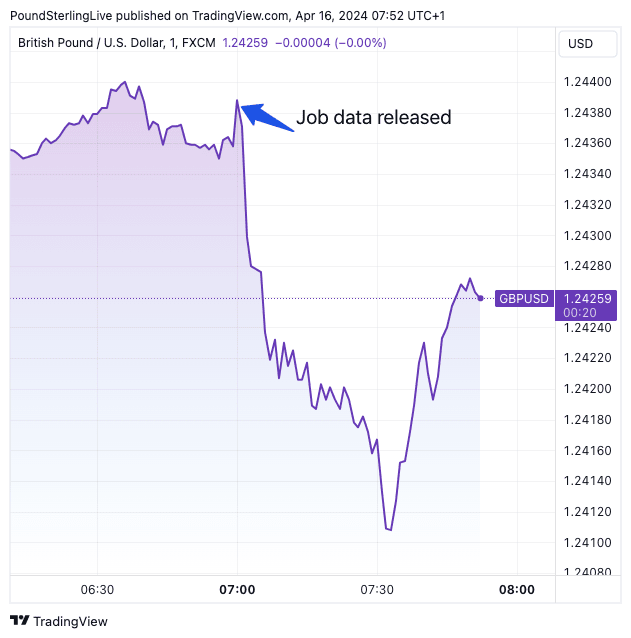

Sterling lost value after the ONS reported the unemployment rate in the UK rose to 4.2% in February from 3.9%, which was higher than the 4.0% expected by the market.

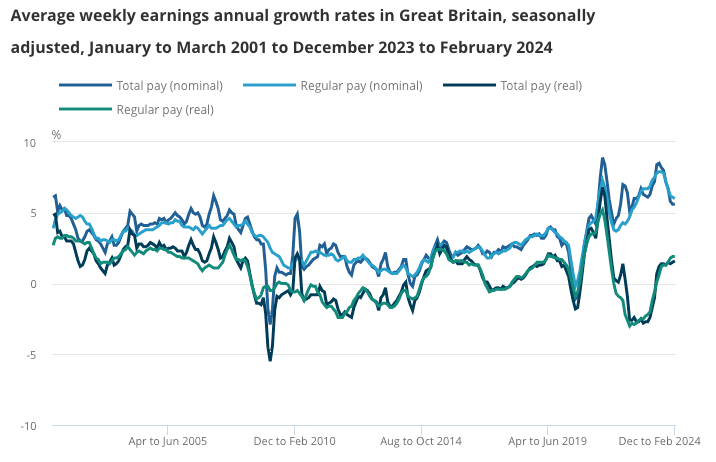

The important average earnings figure (with bonuses included) stayed steady at 5.6% in February said the ONS, but this was above the 5.5% expected by markets. Without bonuses, average earnings rose 6.0%, down from the previous month’s 6.1%, but above the 5.8% expected by the market.

Track GBP with your own custom rate alerts. Set Up Here

“There was further evidence of a slowdown in wage growth. This uptick in unemployment, coupled with gradually falling wages, is indicative of a sluggish economy,” says Richard Carter, head of fixed interest research at Quilter Cheviot.

The Pound to Euro exchange rate fell to 1.17 in the minutes following the data, having been at 1.1710 ahead of the release, hinting at mild selling pressure. The Pound to Dollar exchange rate fell to 1.2418 from 1.2438, but we also see EUR/USD is under pressure this morning, suggesting another broad Dollar rally is underway.

“Overall, I don’t see any clear directional signals for the pound in this report. Wage growth is still far too high to justify cutting rates imminently,” says Kyle Chapman, FX Markets Analyst at Ballinger Group. “This figure is going to have to come down significantly if policymakers are going to be comfortable that the risks of inflationary persistence have subsided.”

According to Andrew Sentance, a former Bank of England Monetary Policy Committee member, UK regular pay growth is still running “way above” the 3-4% that would be consistent with 2% inflation.

“Pay growth has fallen by less than 2 percentage pts from a peak of 7.9 pc last year. A long way to go before wage increases fall back to a sustainable rate,” he says.

The stronger-than-expected wage numbers should therefore provide a layer of protection under Sterling.

Pay is still elevated by historical standards, which can lead to persistently elevated inflation. This will keep some members of the Bank of England guarded against lowering interest rates.

These data will reinforce existing market expectations for the Bank of England to cut interest rates in either June or August, which would put it close to the European Central Bank’s first rate cut, which should limit Pound-Euro weakness. But the Federal Reserve might not cut interest rates at all in 2024, meaning Pound-Dollar is vulnerable to further weakness.

Another fall in job vacancies was further evidence of a loosening jobs market, which the Bank of England considers disinflationary.

Vacancies fell to 916K in the three months to March, marking the 21st consecutive decline. However, they remain above pre-COVID levels, suggesting the rise in unemployment will be limited.