Image © Adobe Images

Pound Sterling entered the new week with strong impetus, but this has stalled by the midweek session, although two key events could yet prompt further gains against the Dollar and Euro.

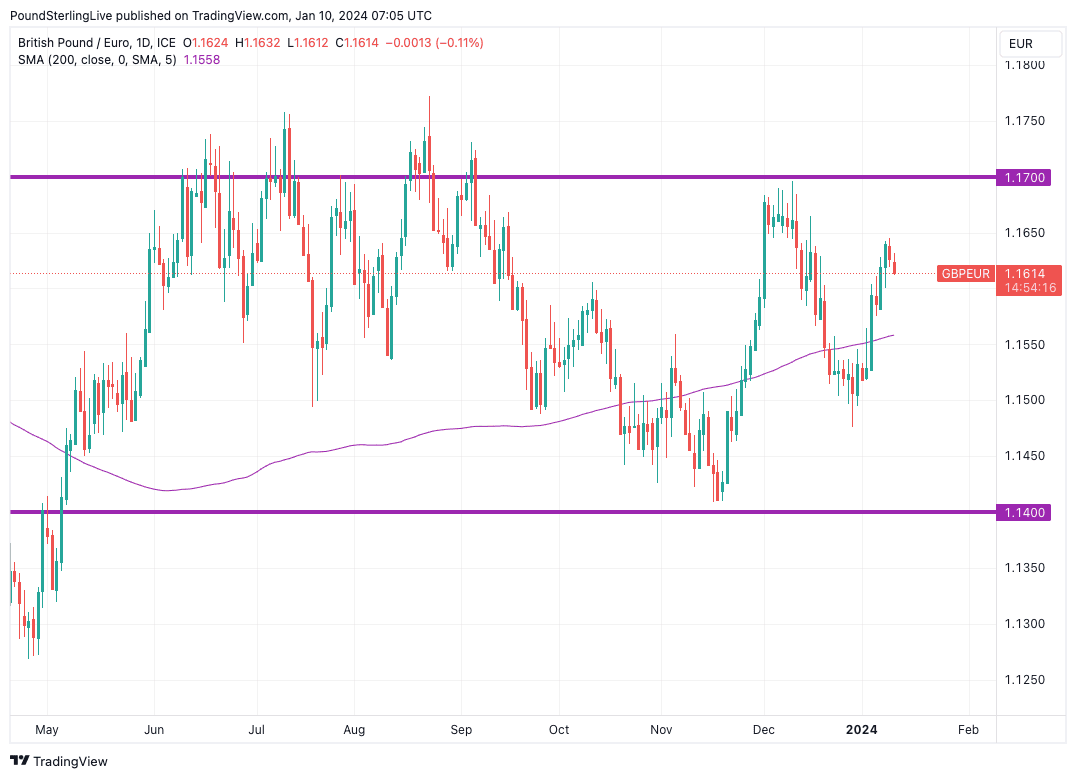

The Pound to Euro exchange rate rose to 1.1650 but has since retreated to 1.1614, taking it back to where it opened the week.

The exchange rate was unable to capitalise on soft German production data, although we note news on Tuesday that Eurozone unemployment reached record lows, which justifies some Euro stubbornness.

Our Week Ahead Forecast said 1.17 was the next major target, and for now this remains a valid assessment for the coming 5-10 days, given Pound-Euro remains above the 200-day moving average and other technical indicators remain broadly supportive.

We also note that 1.17 and levels just above here form a hard barrier. Therefore, we are not looking for a significant upside and expect strength to be sold into.

Indeed, we note significant orders to sell the Pound have been placed in the 1.17-1.1750 area by deliverable FX participants we are in contact with, which could reflect how the broader market is thinking.

Only a break above 1.1750 on a weekly basis would pique our interest and hint that the long-running, multi-month sideways range is about to break in favour of more meaningful Sterling gains.

Above: GBPEUR at daily intervals. A test of the 1.17 barrier is still preferred. Track GBP with your custom rate alerts. Set Up Here.

The next big event for the Pound-Euro will be Wednesday afternoon’s appearance of Bank of England governor Andrew Bailey before a parliamentary committee.

He will be discussing issues of financial stability, but we are confident matters of monetary policy and the UK interest rate outlook will arise.

This can provide some interest for markets, although we do not expect him to deviate away from his long-running message that it is too soon to discuss cutting interest rates.

This can support Sterling.

Friday’s UK GDP release is of interest as it can confirm the economy picked up some momentum into year-end; the market expects 0.2% month-on-month in November, while the year-on-year rate is expected at 0.1%.

The rolling three-month figure is expected to read at -0.1%.

Should the data beat expectations, the Pound can move higher, but disappointments could send GBP lower across the board.

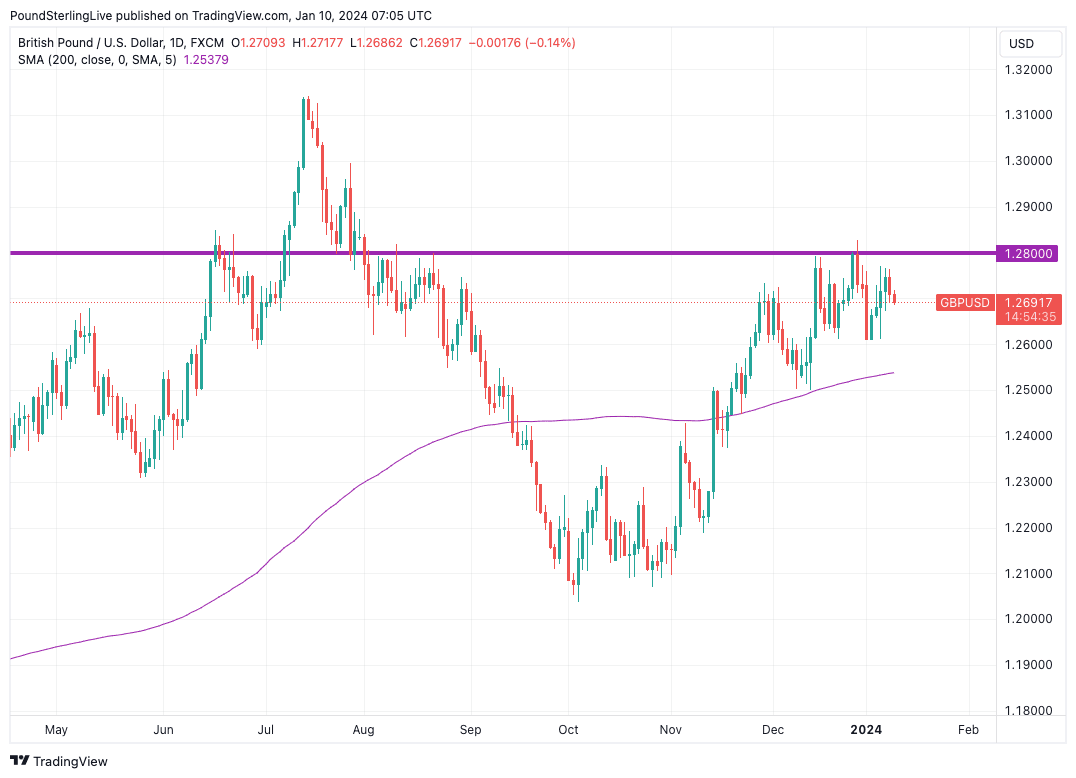

Above: GBPUSD at daily intervals, showing a relatively constructive setup, albeit with waning momentum.

The Pound to Dollar exchange rate has also lost momentum and slipped below 1.27, which is not entirely inconsistent with our Week Ahead update that warned of the significant resistance levels that lie around 1.28.

The foreign exchange market will tread water ahead of Thursday’s U.S. inflation report, which forms the week’s most important event for FX markets.

“The US CPI for December, released on Thursday, is the key event of the week for currency markets. The consensus of US economists estimate the core CPI expanded by a solid 0.3%/mth,” says Kristina Clifton, a strategist at Commonwealth Bank.

“We see the risks tilted to a weaker increase in the core of 0.2%/mth. A weaker outcome can weigh on interest rates and USD on the day,” she adds.

Meanwhile, analysts at OCBC Bank say they expect any bouts of U.S. strength to be short-lived, which, if correct, can support Pound-Dollar over the coming weeks.

“In the broad scheme of things, we are of the view that Fed is done tightening for the current cycle and that Fed can begin with its 1st rate cut in 2Q 2024,” says Christopher Wong, FX Strategist at OCBC.