Above: Federal Reserve Chairman Jerome Powell. Image © Federal Reserve.

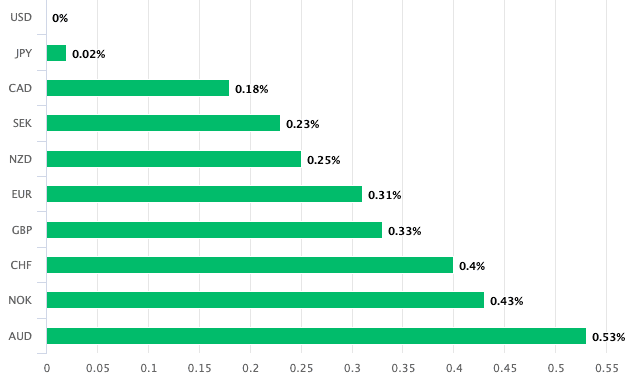

The Dollar is outperforming the majority of currencies in the wake of the Federal Reserve’s message that it is too soon to cut interest rates.

Market odds for a March Fed rate cut were pared to about 1 in 3 and the Pound to Dollar exchange rate traded lower after Fed Chair Jerome Powell said interest rate cuts in March are unlikely.

According to Powell, it is better to wait for further data before loosening monetary policy.

Stock markets sold off as investors anticipated interest rates in the U.S. staying higher for a while longer; the Dollar is up against all G10 peers on the day, pressuring Pound-Dollar lower by 0.30% to 1.2650 .

“The Fed did not rush on rate cuts, as expected, and in FX this ultimately allowed the USD to recover some ground after a really choppy trading session following the FOMC meeting,” says Roberto Mialich, FX Strategist at UniCredit Bank.

To be sure, the Fed dropped its tightening bias in favour of a more neutral stance, as it said the risks to achieving its goals were “moving into better balance”.

This can ensure market expectations for interest rate cuts in the first half of 2024 won’t dissipate completely and could ultimately limit USD strength.

Committee members said there was a need for “greater confidence” that inflation was moving sustainably towards 2% before it could cut rates.

“The US Federal Reserve won’t rush with interest rate cuts,” says Thomas Gitzel, Chief Economist at VP Bank. “Although inflation rates have fallen noticeably, they are still some way off the 2% target. At the same time, the U.S. economy has not yet shown any clear signs of weakness. An interest rate cut does not yet fit into the current picture.”

Powell said he does not expect the data to point to the need for a rate cut by the time of the March meeting.

The Federal Reserve’s policy decision now sets the scene for the Bank of England’s decision, due mid-day.

The pushback against rate cut expectations will likely be repeated by the Bank of England, which will potentially take a cue from the Fed and say it is better to wait for further data before lowering interest rates.

“The BoE is set to flag that it is too early to talk about rate cuts, a message that is likely to help GBP-USD consolidate back above 1.27,” says Mialich.