Image © Adobe Images

Pound Sterling looks to be recovering against the Euro, and like a moth to a flame, further advances back to the 1.17 level might be expected from here.

The strong selloff that hit the Pound to Euro exchange rate late last week and early this week provided some welcome activity in what has been a moribund market for much of 2024. Those Euro sellers who were quick enough to identify the opportunity will have transacted at the best levels in three months.

But, we felt the move was out of kilter as the narrative for the Pound’s selloff against the Euro didn’t sit quite right. (The selloff against the Dollar, on the other hand, is certainly in keeping with fundamental developments).

To recap:

~ The Pound fell as market expectations for a mid-year rate cut rose sharply

~ This happened as rate expectations everywhere else were more or less static

~ The divergence worked against the Pound as, theoretically, UK bond yields started to look less appealing than those in the Eurozone

Repricing

At the start of last week the market was priced for the first rate cut of 2024 to happen in September. But comments from Bank of England Governor Andrew Bailey and Deputy Governor Dave Ramsden prompted a rapid reappraisal.

By Tuesday morning, the market saw a 50/50 chance of that first cut happening in June while August was fully priced.

The Pound to Euro exchange rate fell by nearly 1.0% in the two days that accounted for this reappraisal of potential interest rate fortunes in the UK. (Track GBP/EUR with your own custom rate alerts. Set Up Here)

But the Move is Overdone

Reality appears to have since set in, with Bank of England Chief Economist Huw Pill saying in a speech delivered on Tuesday that “the outlook for UK monetary policy in the coming quarters has NOT changed substantially since the beginning of March.”

Pill placed emphasis on the word “not” by underlining it, which suggests to me the Pill has watched recent developments regarding the exchange rate (a softer Pound is inflationary as it raises the cost of imports) and interest rate markets and decided some calm was warranted.

Pill’s comments follow the release of UK PMIs for April that showed the economic recovery was becoming entrenched and UK businesses had seen inflationary pressures rise to multi-month highs, a worrying sign for those on the Bank of England who might be getting confident that the ongoing deflationary trend is here to stay.

The combination of Pill’s words and the PMI release has restored some balance to markets, and the Pound has recovered much of its recent declines.

Back to the Comfort Zone

The European Central Bank has clearly signposted it is to cut rates in June and could cut again on a number of occasions before the end of the year.

Assuming the Bank of England follows a broadly similar path, we would find ourselves back at the proverbial ‘square one’ when it comes to UK and Eurozone monetary policy: they are likely to move in tandem.

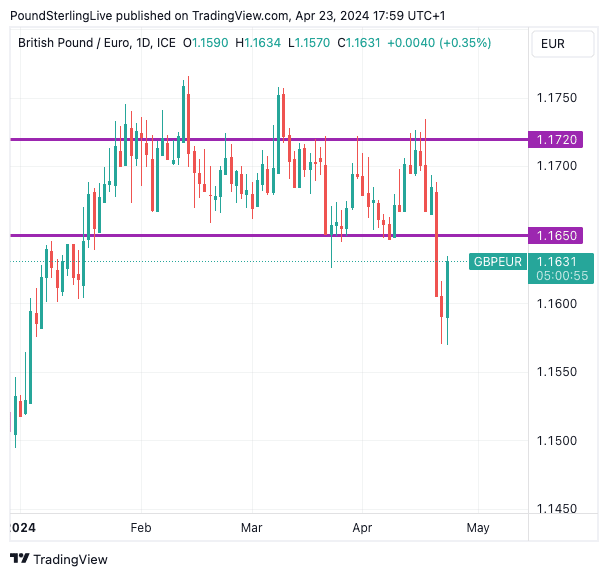

This has been an assumption for much of the year already. And that assumption saw the Pound-Euro rate carve out a clearly defined range, from roughly 1.1650 to 1.1720, with much of the trade in between occurring around 1.17.

The gravitational pull of the 2024 range is strong and we think the exchange rate is heading back there.