The pound has performed well in most of its pairs in the last few weeks just as the dollar generally hasn’t done well. British manufacturing and service activity and productivity improved this month while inflation seems to be firmly under control, at least for now, at 2.2% last month.

The Bank of England (‘the BoE’) cut to 5% this month with the smallest possible majority of votes from the Monetary Policy Committee. Like the Fed, the BoE has deployed the rhetoric of sustainable and consistent inflation on target, so the next meeting on 19 September is critically important.

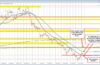

Cable certainly looks overextended with the slow stochastic and Bollinger Bands clearly signalling buying saturation. The price is about to complete seven consecutive up days, which is unusual for a major pair. $1.31 hasn’t been clearly broken yet so there might be a consolidation around this area if there’s no decline below the 0% weekly Fibonacci retracement. $1.309 from 21 August was the highest close for cable in 14 months, so usually it’d be unfavourable for traders to buy at such an extreme.

If there’s a retracement below the 0% Fibo, $1.30 would be the next obvious support which might spur buyers to action. A strong counter-trend reaction could give a good opportunity for daytraders to sell depending on the circumstances, but this doesn’t seem likely until 29 August’s American GDP.

The opinions in this article are personal to the writer. They do not reflect those of Exness or FX Empire.

This article was submitted by Michael Stark, an analyst at Exness.