MUMBAI, July 16 (Reuters) – The Indian rupee ended little changed on Tuesday, as dollar sales from exporters and mild inflows helped curb the pressure from weakness in most of its Asian peers, including the Chinese yuan.

The rupee ended at 83.5825 against the U.S. dollar, compared to its previous close of 83.5925. The currency hovered in a tight band between 83.57 and 83.6025 through the session.

Asian currencies were mostly weaker, with the offshore Chinese yuan down 0.1%. The dollar index was little changed at 104.3, while U.S. bond yields declined.

The rupee is expected to see “gradual depreciation,” and is likely to track movement in the yuan, said Dilip Parmar, a foreign exchange research analyst at HDFC Securities.

Meanwhile, dollar-rupee forward premiums rose, with the 1-year implied yield up 4 basis points at 1.73%, its highest since March 12, lifted by the decline in near-maturity US bond yields.

The 1-year Treasury yield was last quoted down 3 basis points (bps) at 4.81%, its lowest since February.

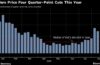

Interest rate futures have fully priced in a rate cut in September, and are indicating a total of 69 basis points of cuts in 2024.

Investors now await the release of U.S retail sales data later in the day alongside remarks from a Fed official for cues on the interest rate trajectory.

Sign up here.

Reporting by Jaspreet Kalra; Editing by Varun H K

Our Standards: The Thomson Reuters Trust Principles.