Image © Adobe Images

The Euro to Dollar exchange rate is forecast to trade at higher levels this week, although the bigger picture remains one of weakness into the 1.05 level.

The Euro is under pressure against the Dollar now that markets see the European Central Bank going it alone and cutting interest rates in June without the cover of similar moves at the Federal Reserve.

The interest rate divergence story is a powerful one, and it will take a string of weak U.S. data releases to convince markets the Fed will cut interest rates on a number of occasions in 2024.

Yet, the Dollar’s recent advance has been rapid and we suspect overbought conditions could prompt some paring of the recent advance, allowing the likes of the Euro the chance to recover.

We are looking for a retest of 1.07 in the coming week as being a higher probability event than a retest of last week’s lows at 1.06.

That said, Euro strength is likely to be limited in duration and the overwhelming evidence points to a weaker exchange rate in the coming weeks, with a number of institutional analysts we follow pencilling in 1.05 as a target.

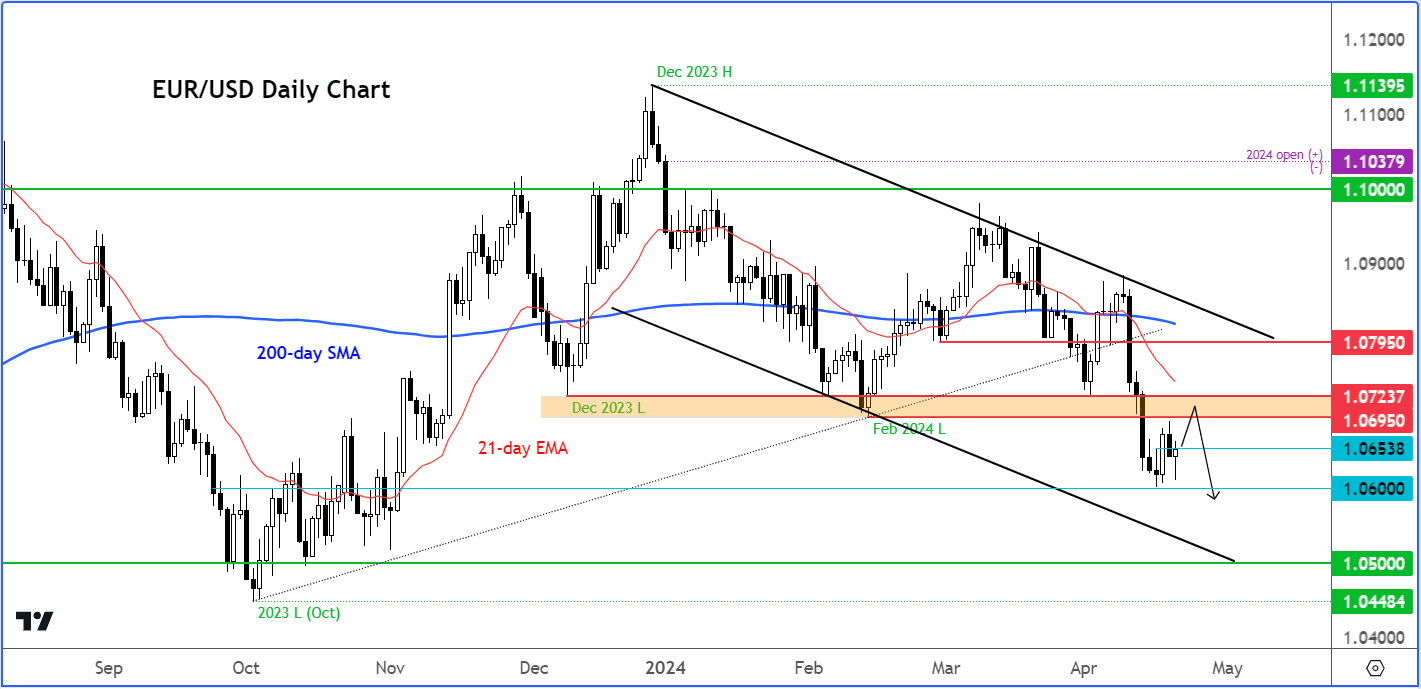

“The EUR/USD remains inside a bearish channel and below all the key moving averages as you can see on the chart,” says Fawad Razaqzada, an analyst at City Index.

Image: City Index. Track EUR/USD with your own custom rate alerts. Set Up Here

“The path of least resistance is therefore to the downside. Key resistance is now seen between 1.0695 to 1.0725 area (shaded in orange on the chart). Potential support comes in at 1.0600 followed by the bottom of the channel around 1.0500 area,” says Razaqzada.

Kenneth Broux, a strategist at Société Générale, says a return to the November 2022 lows (1.0450) is not to be ruled out, “but would require an escalation of current trends”.

Such trends would involve further pricing out of Fed cuts vs. more ECB cuts being priced in.

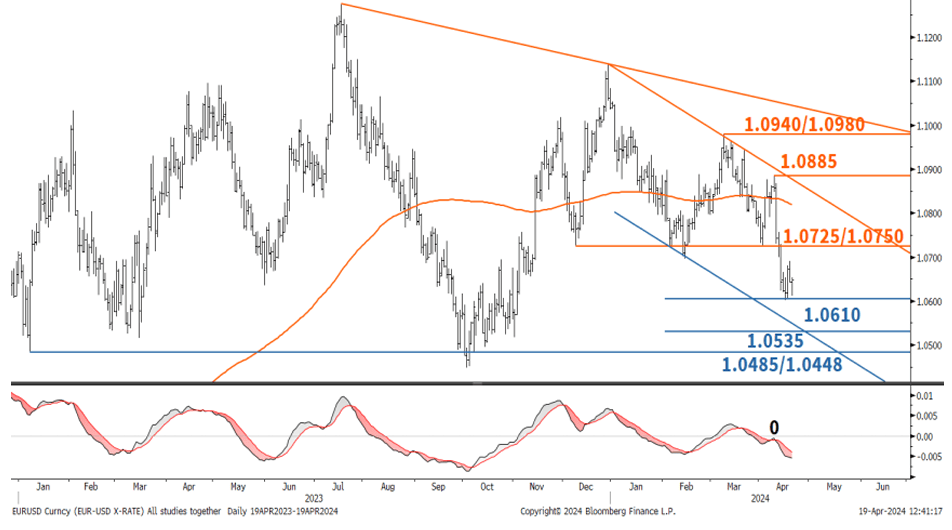

Above: EUR/USD technical levels to watch from Société Générale.

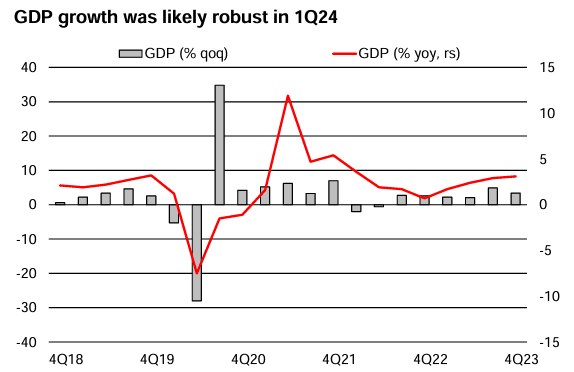

The Euro can rebound against the Dollar in the coming week if U.S. economic growth figures, due for release Thursday, undershoot the consensus expectation for an annualised Q1 growth rate of 2.3%.

A hot reading will only exacerbate the Dollar rally, but given the scale of recent gains, we reckon the bigger FX market movement would follow a disappointing figure.

Image: UniCredit.

The GDP print will likely offer a short-lived impact on FX markets. Instead, the highlight of the Dollar’s week is Friday’s PCE inflation print.

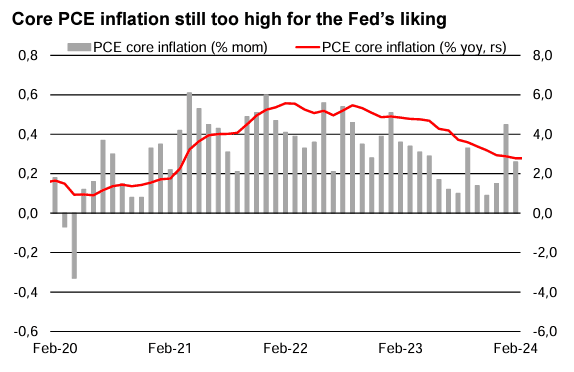

Economists are fond of pointing out that this is the Federal Reserve’s preferred inflation, although evidence from 2024 suggests the Fed is firmly fixating on the hot increases seen in the headline CPI inflation rate.

Nevertheless, PCE numbers could have a market impact on any deviation from the 0.3% month-on-month growth the market expects. Again, we would expect the bigger FX market reaction to follow an undershoot in the figures as this would offer markets the cover to book profit on recent USD strength.

Image: UniCredit.

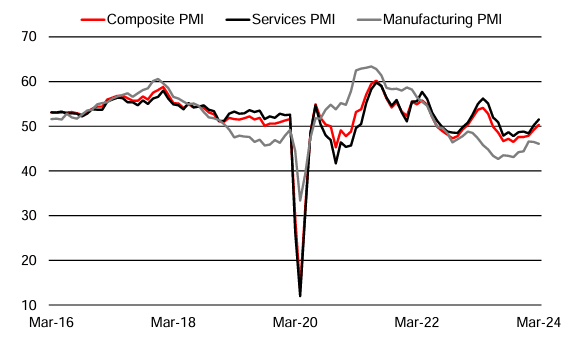

The Eurozone release out on Tuesday at 09:00 GMT forms the highlight for the Euro this week. Markets look for the services PMI to read at 51.9 and the manufacturing PMI (this is important for the Eurozone owing to the centrality of German manufacturing) at 46.5.

Expect a weaker Euro to Dollar conversion if the Eurozone figures surprise and the UK figures disappoint, and vice versa.

Wednesday’s German business climate findings will be in focus, with the Euro potentially reacting to any surprises here. The market looks for the expectations index to read at 88.5 and the current assessment to read at 88.9.

Image: Eurozone PMI trends, UniCredit.