(Bloomberg) — The dollar rose, weighing on Asian stocks as risk appetite stayed subdued given the prospect of less aggressive Federal Reserve interest rate cuts.

Most Read from Bloomberg

The greenback was up against all Group-of-10 currencies, after the euro hit the lowest since early August amid bets the European Central Bank will keep lowering rates. The yen weakened as much as 0.5% against the dollar.

A gauge of Asian equities dropped 0.1%, amid declines in Japan and mild gains in South Korea and Australia. Hong Kong stocks opened modestly higher, while those in mainland China fluctuated. US contracts edged lower after the S&P 500 closed little changed.

The lackluster performance of equities comes as investors have pared back bets on rapid policy easing as the US economy remains robust and concerns rise about wider fiscal deficits after the presidential election. In Asia, the stamina of China’s recent stock rally continues to draw attention, after a top government-linked think tank called on authorities to issue 2 trillion yuan ($281 billion) of special government bonds to help create a market stabilization fund.

“Asia is mostly on its back foot,” said Vishnu Varathan, Asia head of economics and strategy for Mizuho Bank. “USD is dominating against a backdrop of Fed speak suggesting more gradual cuts, IMF revisions suggesting relative US exceptionalism holding up, and the absence of follow-through bulls in China.”

The US stock market has rallied this year thanks to a resilient economy, strong corporate profits and speculation about artificial-intelligence breakthroughs — sending the S&P 500 up over 20%. Yet risks keep surfacing: from a tight US election to war in the Middle East and uncertainty around the trajectory of Fed easing.

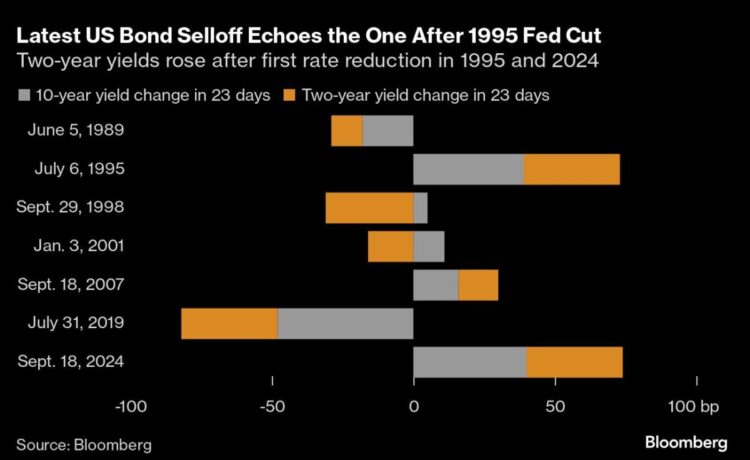

Most Fed officials speaking earlier this week signaled they favor a slower tempo of rate reductions. Policymakers at their meeting last month began lowering rates for the first time since the onset of the pandemic. They cut their benchmark by a half percentage point, to a range of 4.75% to 5%, as concern mounted that the labor market was deteriorating and as inflation cooled close to the Fed’s 2% goal.

Meanwhile, the International Monetary Fund lowered its global growth forecast for next year and warned of accelerating risks from wars to trade protectionism, even as it credited central banks for taming inflation without sending nations into recession.