- Nedbank updates forecasts for , and

- Says domestic issues to overshadow supportive global drivers

- But ZAR recovery possible in second half of year

Nedbank expects the Rand to remain under pressure until the uncertainties around the election and the fiscal trajectory have been resolved.

The South African Rand fell against its major rivals in 2023 largely due to global factors, but domestic influences and political intrigue will matter in 2024.

This is according to Nedbank, one of South Africa’s major lenders and financial services provider.

In a new note detailing Nedbank‘s expectations for the coming year, economist Johannes Khosa says, “local factors are likely to become more prominent. Policy uncertainties will dominate more as the elections approach.”

2023 saw the Rand struggle amidst shifts in global investor risk sentiment linked to speculation about the direction of interest rates in the major economies. Nedbank says this driver will continue to impact the Rand’s movements in 2024, which can support the currency.

This is because the consensus amongst economists is that an environment of falling global interest rates can support cyclical and commodity-linked currencies such as ZAR. “Federal Reserve rate cuts will potentially boost commodities and Emerging Market sentiment, which can help the Rand,” says Huzefa Hamid at Forex Trading South Africa.

“However, local factors are likely to become more prominent. Policy uncertainties will dominate more as the elections approach,” says Nedbank‘s Khosa.

He notes growing speculations that the ruling ANC could lose its outright majority and potentially be forced to form a coalition government with another party.

“A coalition with a left-wing party could result in unfavourable changes in policy direction. The risk of a further deterioration in the country’s fiscal metrics also remains high,” he explains.

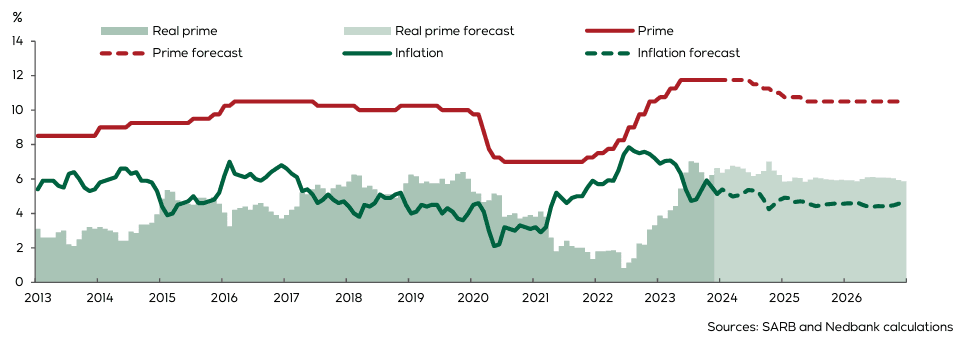

Above: Inflation is forecast to trend lower, creating space for a moderate decline in interest rates in 2024.

Nedbank expects the rand to remain under pressure until the uncertainties around the election and the country’s fiscal trajectory have been resolved.

However, once the political situation resolves Nedbank expects the rand to strengthen as focus returns to improving global conditions linked to falling U.S. interest rates.

Given the list of uncertainties, Nedbank expects the South African Reserve Bank to start cutting in July, reducing the repo and prime rates by a cumulative 75 bps to 7.50% and 11% by the end of 2024.

“The risks to our interest rate forecast are concentrated around the timing and pace of the anticipated easing. SARB could bring the first cut forward to May if the rand holds steady around the elections and the US starts its monetary easing earlier than most expect,” says Khosa.

Nedbank forecasts the Pound to Rand exchange rate at 24.14 in 2024, the Euro to Rand rate at 20.84 and the Dollar to Rand at 18.88.

is forecast to expand by 1.0% this year but will pick up to 1.5% next year and 1.6% in 2026.

is tipped to average 5.0% in 2024, 4.6% in 2025 and 4.5% in 2026.