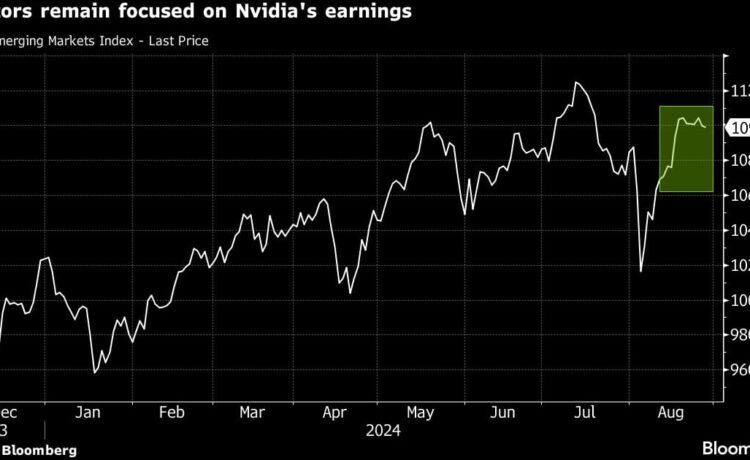

(Bloomberg) — Most emerging-market currencies posted losses Wednesday amid concern the dollar’s recent selloff had gone too far. Stock investors awaited cues from Nvidia Inc.’s results later in the day to gauge the technology sector’s outlook.

Eastern European currencies — the Polish zloty, Czech koruna and Hungarian forint — posted the biggest losses among EM peers as they tracked the euro’s biggest drop since June on a closing basis. Two exceptions were the Mexican peso, which rebounded from the weakest level since 2022, and Israeli shekel, as traders remained hopeful of a cease-fire in Gaza.

Asian semiconductor stocks rose as investors awaited Nvidia’s results amid a raging debate over whether companies investing in artificial intelligence will realize the promised profit upsides quickly enough. The MSCI Emerging Markets Index was little changed, with losses in Chinese technology stocks offset by gains in Taiwan Semiconductor Manufacturing Co. and Samsung Electronics.

“With plenty of focus on Nvidia’s earnings — some say more important than remarks from Federal Reserve Chair Jerome Powell — it’s worth noting that this critical stock sets the tone for the entire tech sector and other asset classes,” said Piotr Matys, a senior analyst at InTouch Capital Markets.

The dollar rebounded on Wednesday, sending the MSCI EM Currency Index lower for a second day. The emerging-market gauge, which measures total returns in currencies including interest income, is still on course for the biggest gains since November.

Even as money markets price in 100 basis points of interest-rate cuts by the Fed this year, investors remain on alert for renewed strength in the greenback given the risks surrounding US presidential elections and global geopolitics.

“Given that Powell hasn’t shifted the odds firmly in favor of a 50 basis-point cut by the Fed at the September meeting, some market participants are of the view that the dollar has weakened excessively,” Matys said. “Domestic factors also set the tone for EM currencies. The Mexican peso is a very good example plunging yesterday in response to a major step made to implement controversial judiciary reform,” Matys added.

The peso traded 0.7% higher on Wednesday, only its second gain in the past eight days.

The Turkish lira traded slightly weaker against the dollar. A brief and sudden plunge in the currency during Asian hours left traders scratching their heads and rushing to cut losses, before the currency settled on a more predictable path.

Meanwhile, Israel’s central bank was set to hold interest rates for a fifth straight meeting, in an effort to balance a weakening economy against inflationary pressures as war spending surges.

Credit default swaps that protect against the risk of default in emerging markets eased, signaling that expectations for Fed easing are helping steady sentiment on riskier assets.

“Even if Nvidia disappoints and we have a risk-off move, I still think that the clear statement by Chair Powell on the start of the Fed easing cycle will dominate EM local bonds and currencies,” said Rajeev De Mello, a money manager at Gama Asset Management.

©2024 Bloomberg L.P.