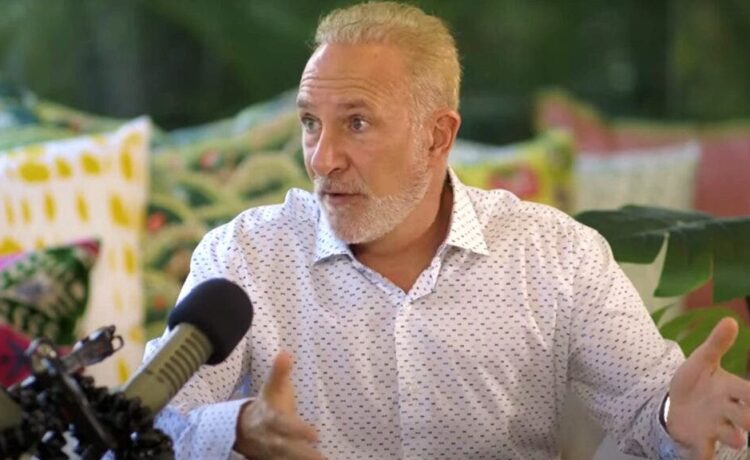

Amidst growing economic uncertainties, Peter Schiff, a renowned investment strategist and economist, has voiced a compelling prediction: central banks around the globe are gearing up for a transition back to a gold standard. This assertion sheds light on the shifting dynamics of the world’s financial system and raises questions about the future of the U.S. dollar as the global reserve currency.

During a recent interview, Schiff highlighted the aggressive gold accumulation by central banks, particularly those of Russia and China, as a clear indicator of a strategic move away from the U.S. dollar. “Central banks are buying gold because they can see the writing on the wall. The dollar’s days as the reserve currency are numbered,” Schiff remarked. This accumulation points to a preparation for a system where gold, once again, plays a central role in global finance.

Don’t Miss:

What A Shift To A Gold Standard Could Mean For The U.S. Economy

The U.S. dollar has enjoyed its status as the dominant reserve currency for decades, facilitating international trade and investment. However, with central banks diversifying their reserves and increasing their gold holdings, there’s a growing speculation that the dollar’s reign might be challenged. According to the World Gold Council, central bank net purchases of gold in 2023 amounted to 1,037 tonnes, nearly matching the record set in 2022.

The potential move to a gold standard could have profound implications for the U.S. economy. A decrease in global demand for the dollar could lead to higher interest rates and reduced financial flexibility for the U.S. government. Schiff warns, “If the world returns to a gold standard, the U.S. will have to reckon with its massive debt and unfunded liabilities, which could be a painful adjustment.”

The trend towards a gold standard signals a broader shift in the global economic order, with countries seeking to reduce their reliance on the U.S. dollar. This transition could lead to a more multipolar financial landscape, with multiple currencies and assets vying for dominance.

While the transition to a gold standard is far from certain, Peter Schiff’s insights highlight the need for investors to pay close attention to the actions of central banks and the evolving role of the U.S. dollar in the global economy.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article ‘The Dollar’s Days As The Reserve Currency Are Numbered’ – Peter Schiff Says Central Banks Are ‘Preparing For A New Gold Standard’ originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.