The U.S. dollar could be losing its reputation as a safe-haven currency, according to George Saravelos, who is Deutsche Bank’s global head of Foreign Exchange Research. Historically, investors have turned to the dollar in times of uncertainty, but recent trends suggest that this may be changing. It’s worth noting that this shift could have significant implications for investors and businesses, as it would impact investment decisions and global trade.

Discover the Best Stocks and Maximize Your Portfolio:

One key indicator of this shift is the weakening link between the U.S. dollar and risk assets. Typically, when markets get volatile, investors seek safety in the dollar, but lately, that relationship hasn’t been holding up. In addition, both high and low-risk currencies are performing well against the dollar, which is unusual and may suggest that there is a broader loss of confidence in the dollar’s safe-haven status.

This trend is also evident in the relatively poor performance of U.S. assets compared to the rest of the world despite economic uncertainty. And with the U.S. government deficit recently surpassing 4% of GDP, which is a level that’s historically been associated with dollar overvaluation, it’s clear that investors are taking a closer look at the dollar’s value. As a result, the dollar’s safe-haven status is being challenged, and investors are starting to look at other ways of managing risk.

Is the USD Going Up or Down?

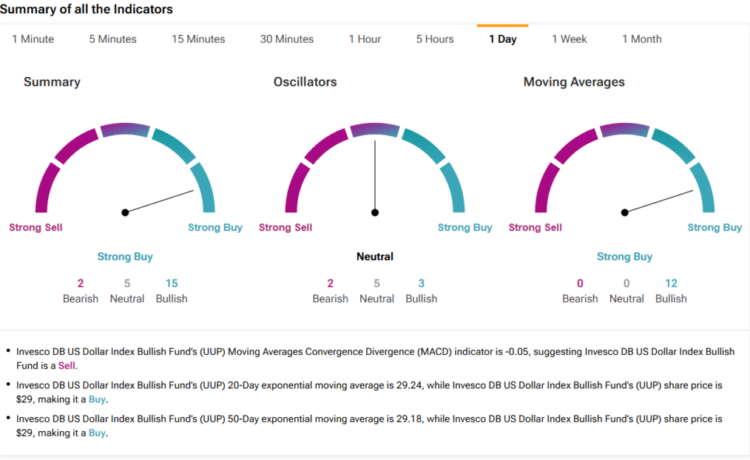

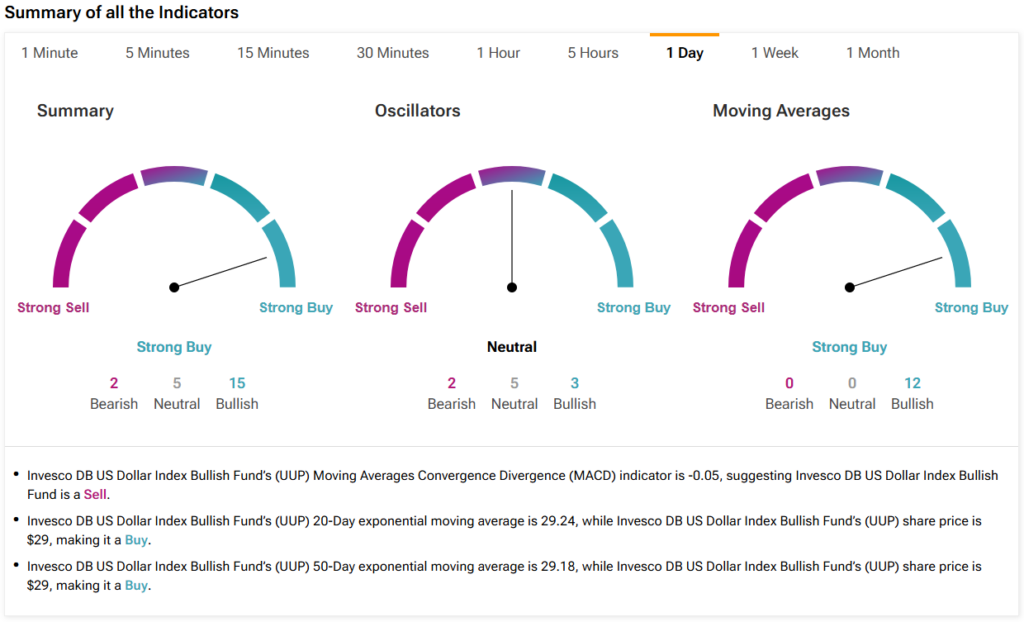

Using TipRanks’ technical analysis tool, the indicators seem to point to a positive outlook for the Invesco DB U.S. Dollar Index Bullish Fund (UUP), at least for now. Indeed, the summary section pictured below shows that 15 indicators are Bullish, compared to five Neutral and two Bearish indicators.

Source link