Trump’s tariffs hit the crypto market hard, causing volatility, but experts say they could boost Bitcoin’s long-term growth amid economic uncertainty.

Donald Trump’s new tariffs have caused turbulence in the crypto market, leading to a sharp drop in total value and billions in liquidations. While uncertainty remains, some analysts believe these trade policies could create long-term opportunities for Bitcoin.

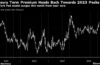

Trump recently imposed tariffs on imports from China, while those on Mexico and Canada were delayed for a month. The announcement led to widespread market reaction, with both traditional and crypto markets experiencing sell-offs. In just one day, the total cryptocurrency market value fell significantly, and Bitcoin and Ethereum saw steep declines. Market liquidations surged, wiping out billions.

A temporary delay on some tariffs helped markets recover slightly. XRP rebounded after its drop, and Bitcoin saw an increase following improved investor sentiment. However, concerns remain about what will happen when the tariffs are reconsidered next month.

Tariffs are used by governments to control trade deficits and protect domestic industries. The U.S. imports more goods from key trade partners than it exports, creating a trade imbalance. Raising import taxes could drive up prices, reduce demand, and hurt profits for companies relying on global supply chains. This economic pressure can push investors to avoid riskier assets like cryptocurrencies.

Despite the initial downturn, some industry experts believe tariffs could ultimately benefit Bitcoin. Historically, economic instability has led investors to seek alternative assets as protection against inflation and market uncertainty. If tariffs drive inflation, Bitcoin’s appeal as a decentralized asset may grow. Analysts suggest that economic pressures could fuel demand for Bitcoin and digital currencies, particularly if the U.S. continues signaling support for integrating crypto into financial strategies.

One key challenge is how these tariffs affect cryptocurrency mining. The U.S. heavily depends on imported mining equipment, especially from China. The new trade policies have already impacted mining companies, with stock values dropping. Higher costs for essential equipment could slow mining operations, forcing companies to explore new technologies and efficiency improvements. Some analysts argue that this disruption could push the U.S. to strengthen domestic production of mining hardware.

There has been growing discussion about reducing reliance on foreign manufacturers in crypto mining. Some U.S. companies have started producing mining hardware domestically, partnering with energy providers to optimize efficiency. However, more investment is needed to compete with major foreign suppliers and develop reliable domestic alternatives.

Beyond crypto, the U.S. is also facing challenges in semiconductor production, a critical industry for technology and artificial intelligence (AI). Semiconductors are essential for powering advanced technologies, including AI and data processing. The U.S. remains one of the largest importers of semiconductor components, relying on suppliers from Asia. As global competition for AI dominance intensifies, securing a stable semiconductor supply chain is becoming a priority.

While tariffs create short-term disruptions, they could encourage more domestic investment in mining, blockchain technology, and semiconductor production. The coming months will be crucial in determining whether these economic shifts will ultimately strengthen or weaken the crypto industry.