(Bloomberg) — The cost of borrowing Turkish liras overnight in the offshore market jumped on Thursday before a long weekend as traders exited so-called carry positions amid a steady decline in the currency.

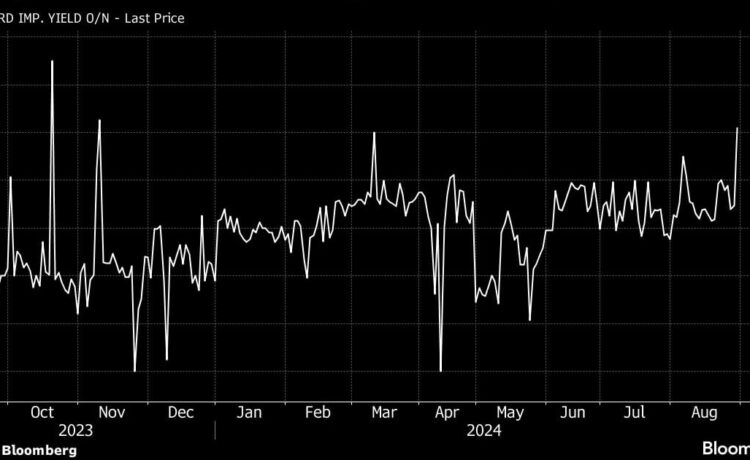

The overnight forward-implied yield on the lira climbed 17 percentage points to 61%, well above the domestic rates of around 50%, signaling that overseas funds likely closed out some long-lira positions.

“This is a carry unwind, I think, not a portent of a fundamental or policy shift,” said Nafez Zouk, an emerging-market debt analyst at Aviva Investors Global Services Ltd. “To us, fundamentally, nothing has changed. The macro re-balancing remains on track.”

Turkey’s state lenders sold dollars to meet rising demand on Thursday ahead of a local holiday Friday, according to traders who asked not to be named, citing policy. When state lenders sell dollars and buy liras instead, it causes a squeeze in the currency’s liquidity abroad, pushing offshore rates higher.

The Turkish lira has weakened 2.7% against the dollar this month, the third-worst performer in emerging markets in the span.

Despite a relatively weak August, Deutsche Bank strategists still see value in the lira carry trade. They recommended sticking long-lira positions as they expect a slowing pace of currency depreciation in coming months. Citigroup also continues to recommend buying the lira.

©2024 Bloomberg L.P.