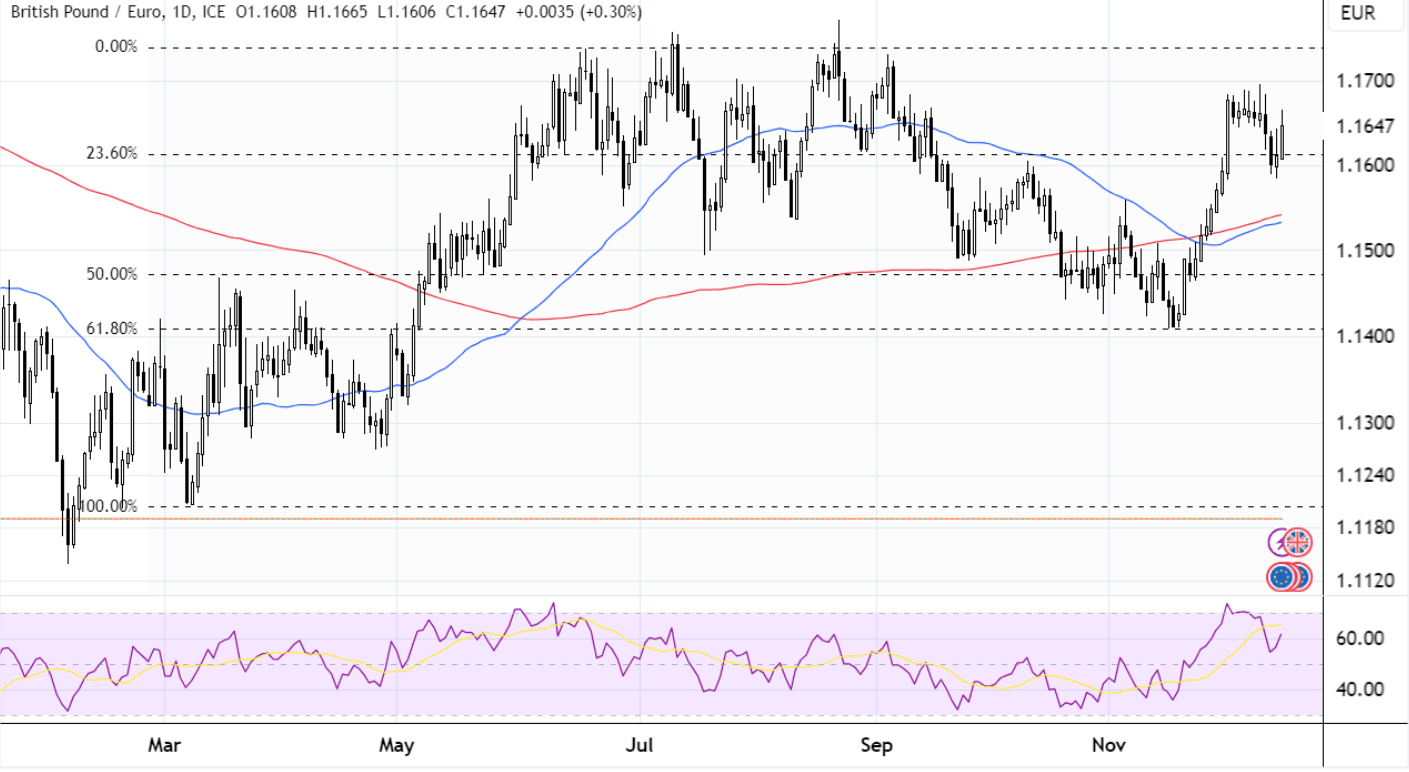

- GBPEUR setup remains positive

- But beware resistance just north of 1.17

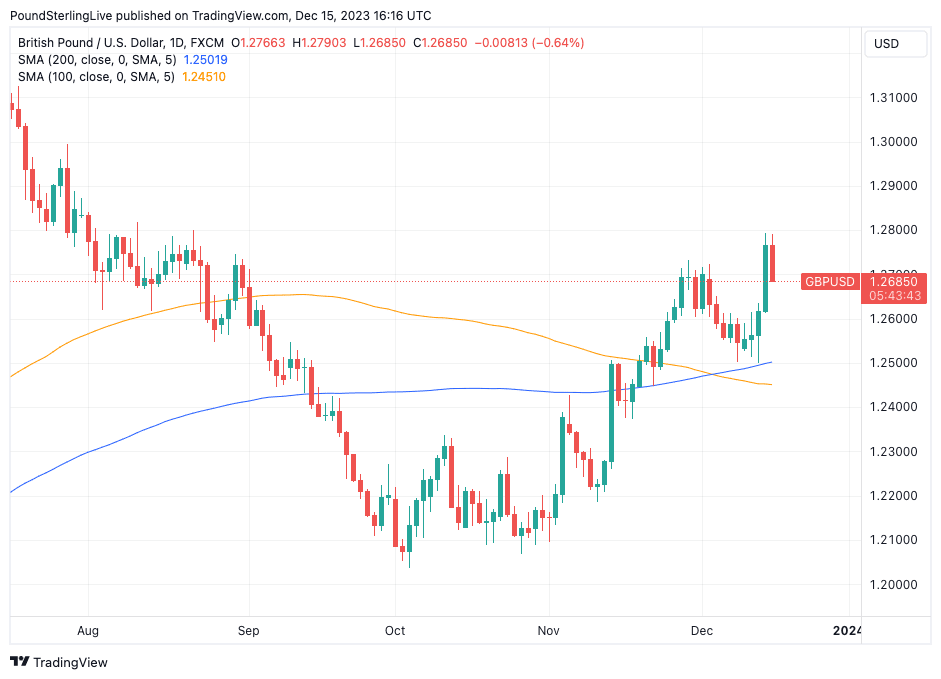

- GBPUSD also positive

- UK inflation release is week’s key event

Image © Adobe Images

The British pound enters the new week with some positive technical momentum that leaves it looking constructive against both the Euro and Dollar, but the release of inflation figures midweek could challenge recent moves.

Our Pound to Euro exchange rate week ahead forecast sees positive short-term momentum owing to Friday’s sharp rally that followed the release of better-than-expected UK PMI data that showed the economy likely grew comfortably in December.

On the other hand, the Eurozone PMIs disappointed and suggested the economy shrank, triggering a rise in Pound-Euro to a high of 1.1668.

Analyst Bill McNamara at The Technical Trader says the pair is pointed higher over the near-term horizon: “Some near-term resistance is still possible at that previous peak but, if it gives way, a return to the 2023 peak (at 1.1743) becomes a realistic expectation.

Nick Rees, FX Market Analyst at Monex Europe, says Pound-Euro could now be well on track for Monex’s year-end target of 1.17.

“We see this as a more positive backdrop for sterling than the euro over coming months,” says Rees.

Those watching this exchange rate should be aware that the Pound-Euro has struggled to break above 1.17 on any meaningful basis in 2023, and we are wary of another failure in the rally above here. Readers with payment requirements should view forays above 1.17 as likely to be short-lived and act accordingly.

Image courtesy of the Technical Trader. Track GBP with your own custom rate alerts. Set Up Here.

The Pound to Dollar exchange rate week ahead forecast is bullish, thanks to the +1.5% surge seen last week, which ensures the momentum dashboard is green and advocating for further gains.

Sure, Pound-Dollar suffered a setback on Friday following the comments of Federal Reserve board member John Williams, who injected a dose of reality into what was becoming an exuberant market response to the Fed’s midweek interest rate decision and guidance update.

But, Pound Sterling is unlikely to suffer too deeply near-term and “dip buyers are likely to emerge as BoE remains more hawkish vs Fed for now,” says Justin McQueen, a Reuters market analyst.

A break below 1.27 opens up support at 1.2670, says McQueen.

Above: GBPUSD at daily intervals.

Shaun Osborne, Chief FX Strategist at Scotiabank, says the balance of risks favours further gains by the Pound.

“Trend dynamics are strongly bullish across short-, medium– and long-term oscillators and the pound is set for a strong close on the week—all of which tilt directional risks clearly towards more GBP gains and a push on to 1.2880/00 shortly,” he says.

The Pound to Dollar exchange rate’s jump back above 1.27 follows last week’s U.S. Federal Reserve guidance that effectively condoned market bets for several rate cuts in 2024, with Fed Chair Jerome Powell saying he was alert to risks of keeping interest rates restrictive for too long.

Track GBPUSD with your own custom rate alerts. Set Up Here.

This pivot weighed on the Dollar more broadly and stands in contrast to the Bank of England’s more ‘hawkish’ tone.

The Pound was boosted by the Bank of England’s latest policy decision and guidance, which saw the Bank warn inflation risks were still tilted higher and it cannot definitively rule out further rate hikes.

The Bank’s message was underpinned on Friday by December PMI figures showing the economy has seen a surprisingly strong pick-up in activity.

Furthermore, the survey revealed price pressures in the services sector remain acute, thereby lending the Bank of England’s guidance some credibility and boosting the Pound.

In contrast to those of the UK, the Eurozone’s PMI figures disappointed, drawing questions about the European Central Bank’s message that rates will stay higher for longer and encouraging markets to expect cuts to come sooner rather than later.

The divergence in fortunes between the UK and Eurozone was reflected in the rise in the Pound-Euro rate.

This week’s UK inflation data can underpin the recent GBP-supportive narrative if it prints at higher-than-expected levels.

CPI inflation is due for release on Wednesday at 07:00 GMT and is expected to print at 4.4% year-on-year, down from 4.6% previously, with the core CPI reading expected at 5.5%.

Should the data undershoot, we could see the Pound come under pressure through the midweek session.

“Base effects in the food category is likely to be the largest source of downward pressure in November. Lower petrol prices should also weigh on headline inflation,” says a note from Oxford Economics.

Retail sales and quarterly GDP figures will cap the week off, with markets looking for retail sales to print at -1.1% year-on-year for November. Quarterly GDP is expected to be flat at 0% quarter-on-quarter in the third quarter.

Note that much of the sting in GDP from a market perspective will have been removed by last week’s monthly GDP release, so this is expected to have a limited impact on the Pound.