Lagarde Downplays Neutral Rate, Avoids Forward Guidance

At the press conference, Lagarde dismissed speculation about the neutral rate—the level at which policy neither stimulates nor restrains growth—calling such a debate “premature.” She reaffirmed that the ECB remains in restrictive territory and that future decisions will be based solely on incoming data.

While inflation is moderating, she noted that the economy is still below its potential and that risks remain tilted to the downside. Lagarde avoided providing forward guidance, citing ongoing uncertainty, and reiterated that the ECB is not pre-committing to a specific rate path.

Trade Policy Risks Add Uncertainty to Growth Outlook

Lagarde flagged global trade policy as a major risk factor, warning that potential US tariffs could have a “global negative impact.” She highlighted the complexity of assessing whether tariffs would be inflationary or deflationary, as their effects depend on trade rerouting, retaliation, and broader supply chain shifts.

While the ECB acknowledged improving global demand, Lagarde stressed that export-driven recovery prospects remain fragile. Any escalation of trade tensions, particularly with the US, could weigh on eurozone growth and complicate the ECB’s policy path.

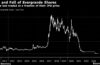

More Rate Cuts Expected, but Internal Debate Could Intensify

Markets are pricing in at least two to three additional ECB rate cuts this year. UBS sees a potential terminal rate of 1.5%, while Capital Economics argues that policymakers may need to ease more aggressively than investors currently anticipate. Meanwhile, BCA Research expects wage growth to slow to 2%, reinforcing the case for further reductions.

However, some ECB policymakers have expressed concerns about cutting rates too aggressively. Inflation remains above the 2% target, and ongoing geopolitical risks—such as potential trade wars—could introduce new inflationary pressures. These factors may lead to a more contentious debate within the ECB about how far easing should go.