As FOMC rides into the sunset until March, the is left to fend for itself amid the hawkish (or at least not yet dovish) echos of Jerome Powell’s assertion that the market should not expect rate cuts in March. Well duh, we know that already, sir.

The only benefit the would be left with, assuming the ‘not yet dovish’ policy does not turn hawkish again, would be the potential for a counter-party bid.

An impulsive bid by risk-soaked casino patrons suddenly jerking to a safe haven. Which USD surely is, much like . The difference being that USD is a safe haven tool as long as public confidence in debt paper remains. Gold is a safe ‘value’ haven, long-term.

As a tool and with the herd’s confidence implied to be intact, by virtue of its global reserve status USD receives incoming (forced) ‘investment’ when herds flee the asset racket, which has been set up counter the US dollar by decades of US and global inflationary monetary policy.

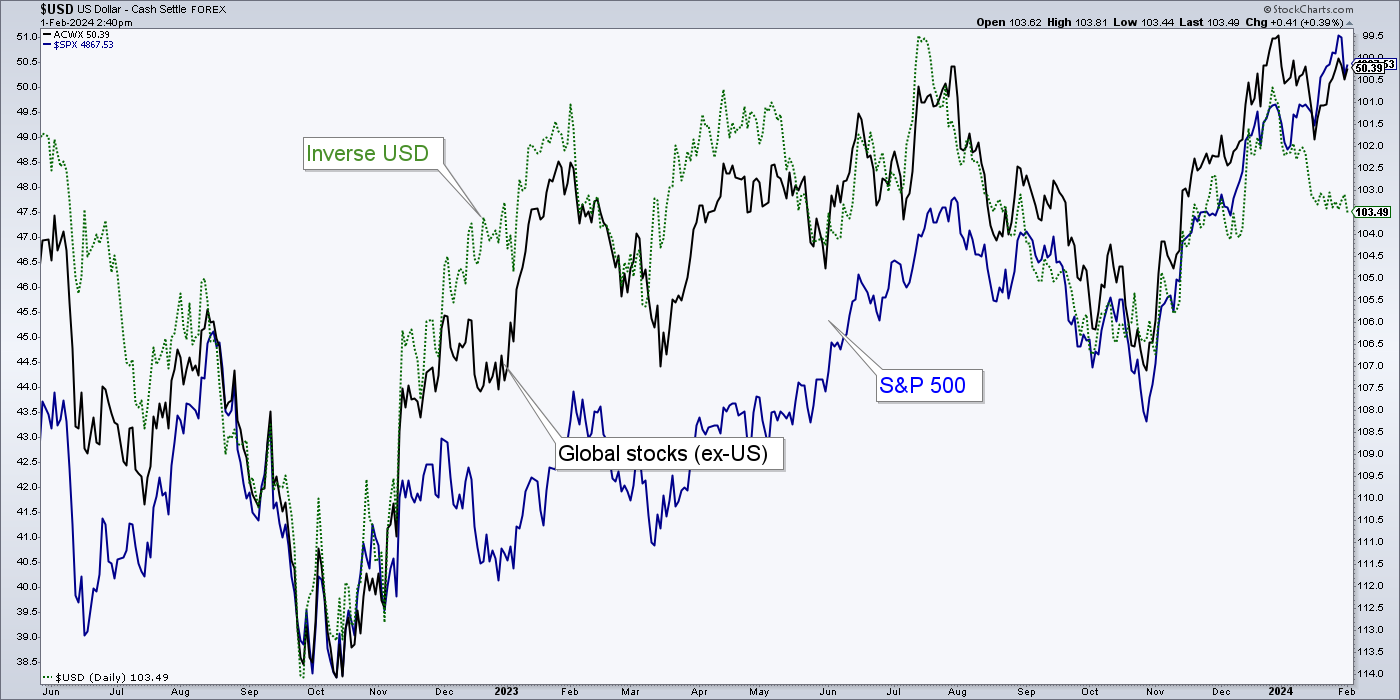

Yet here we find a recent disconnect between stocks ( and global, ex-US) and inverse USD. Either USD is going to drop (inverse rise back in line with stocks) or just maybe we might have the start of something important in the form of a fundamental change of character in the macro markets.

That could mean market rotation, a stock bear market (SPX has finally joined the ‘new all-time highs!’ contingent, after all, a preferred ingredient to making a sentiment-fueled top) or, if USD continues to bounce (inverse continues to drop) even a slippery slope into a market liquidation (again, reference all that ‘soft landing’, ‘no landing’ Goldilocks consensus out there in the mainstream financial media for a potential contrary setup).

The Gold/Silver ratio (GSR) is still perched constructively to attend USD upward, after all. If gold were to rise impulsively vs. silver the inflation trades would be ‘off’ and the market liquidation trades could be ‘on’.

is less monetary, more speculative, and more cyclical/inflation-sensitive than gold. If the GSR breaks down from this constructive perch, the inflation trades would benefit.

Moving on, let’s take a brief look at the technical status of the anti-market, the US dollar index (DXY). Much like the bull trap from September to November felt like it took forever and a day to resolve, today’s meeting with resistance is a persistent little bugger.

Grinding, chewing, and instigating to take out resistance at 103.50. As advised to my subscribers several weeks ago, the key level to exceed and hold (for USD to go bullish) is the December high at 104.27. But first USD is buzz-sawing the resistance area and the important daily SMA 200.

The weekly chart provides the perspective that a level of caution, for inflation traders, is provided by the fact that the index held a higher low to the ‘bear trap’ low with the bounce starting from clear long-term support.

Bottom Line

If the US dollar index fails to make a higher high to the December high and instead turns down (and silver leads gold upward), then the broad rally can continue, especially in the more traditional ‘inflation trades’ like commodities and equities that produce commodities/resources, and resource-rich regions within Emerging Markets.

If the US dollar index takes out the December high and holds it, and the Gold/Silver ratio follows its current constructive pattern upward, you might want to do a thorough check of the investment pool. The might be a turd in there!

To add a third dynamic, there was a blessed phase from 2001 to 2004 when the Gold/Silver ratio rose (non-impulsively), the US dollar declined and the gold mining sector had its most fundamentally pure macro backdrop for years previous and now 20 years since. After that commodities and stock markets rallied as well and the gold miners entered a bubble amid degrading fundamentals. But even a 2 to 3-year phase would be quite profitable.