As macro investors, we are often inundated with flashy headlines, and recently Japan has been front and center.

Yet with all this noise, it’s easy to miss the forest for the trees.

That’s why in this piece we will:

-

Explain what really drove the recent moves in ;

-

Discuss the real underlying macro trends in Japan;

-

Assess what the is likely to do next;

-

Cover the implications for global bond markets and the Yen.

The outsized moves in JPY and Japanese bond markets have been catching headlines recently – the common narrative is that Japan is finally there to unwind its super-easy monetary policy and that pushes yields higher and the Yen stronger.

Evidence says the move in JPY has more to do with something else.

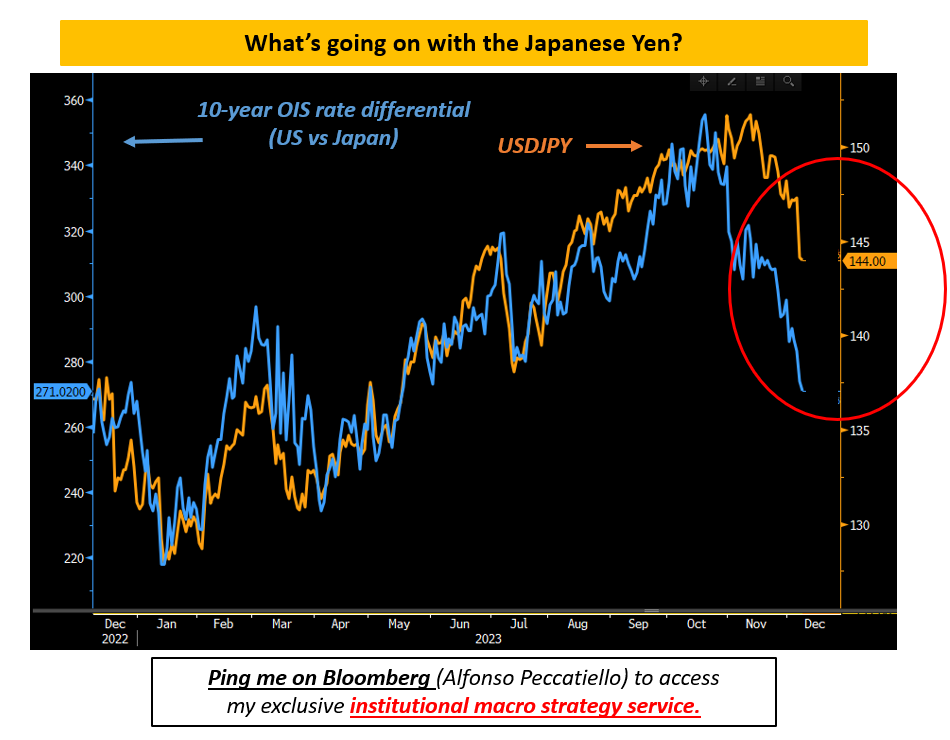

The chart above shows the very tight relationship between US vs Japan yield differentials (blue, LHS) and USD/JPY (orange, RHS): if yield differentials shrink rapidly, the Yen gets a boost.

It’s really simple and intuitive FX pricing theory: wide yield differentials and low volatility will make people interested in borrowing JPY and buying USD, and when yield differentials narrow like today this ”carry trade” will unwind and the JPY strengthens.

Why are yield differentials narrowing? Because of the BoJ?

Not really.

Bonds have been catching a bid globally since October: the rapid decline in the blue line from 350 bps to 270 bps is almost exclusively due to Treasuries (not Japanese bonds).

And now mind the gap in the red circle.

At this level of yield differentials, USD/JPY should already be at 140.

Back in July, the 10y yield differential between Japan and the US was 280 bps and USD/JPY was 138.

Today it’s 270 bps (lower!) and USD/JPY is 144 (higher!) yet people seem to find the JPY move out of whack.

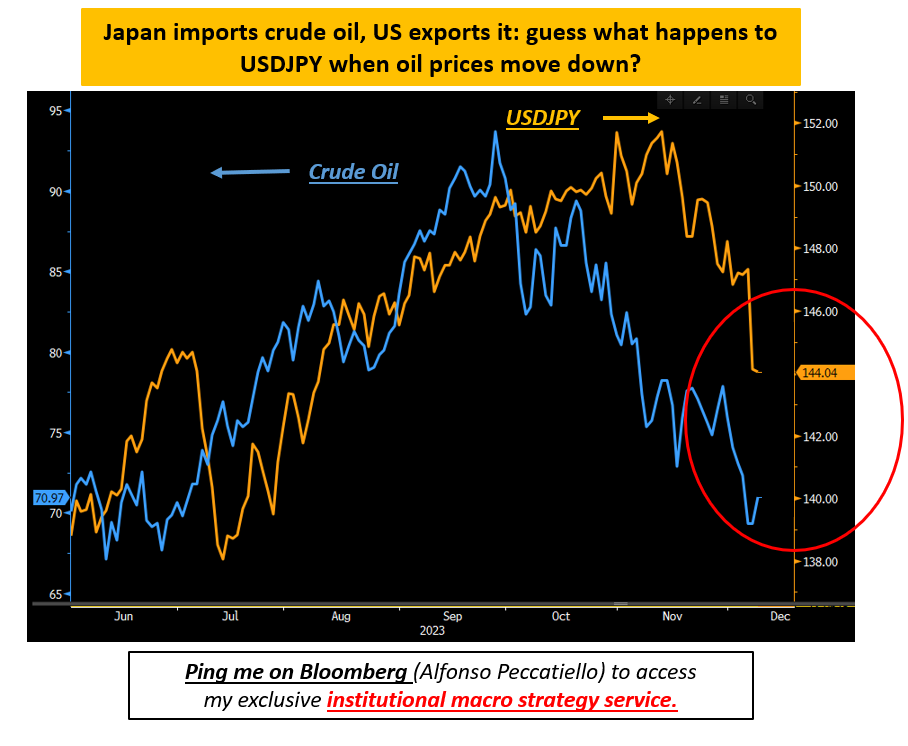

The other important global macro driver of JPY price action has been .

Japan is a net importer of crude oil, and the US is a net exporter: guess what happens to USD/JPY when the price of oil goes down rapidly?

USD/JPY goes down: the Yen appreciates because the terms of trade for Japan become more favorable.

In other words: the Yen is adjusting to international macro fundamentals, not reacting to Japanese macro or an immediate risk of a BoJ hawkish shift.

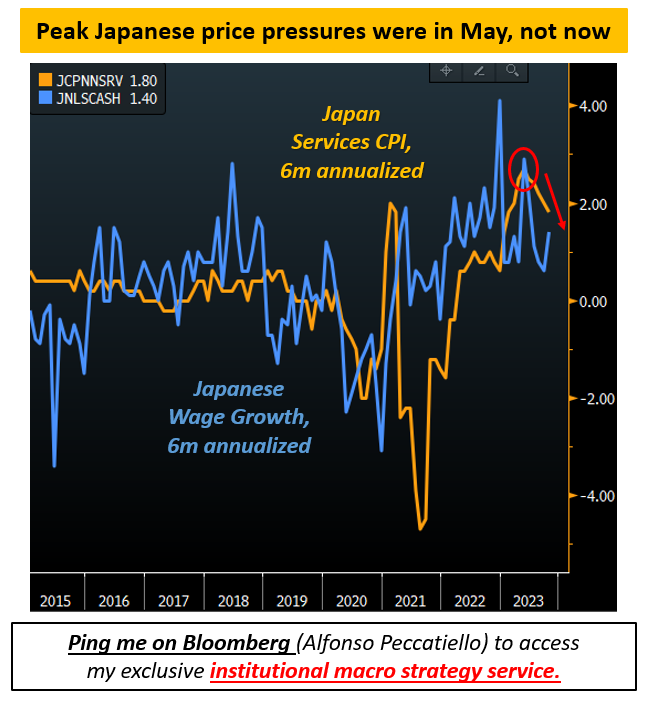

Japanese services inflation (orange) was running at 3% in May but it’s now back below 2%, and nominal wages (blue) are growing at only 1.4%.

If Ueda and the BoJ wanted to react to immediate price pressures, April/May was the moment to do so – the situation is much less urgent today.

Imagine this.

After 20+ years of ZIRP and QE the Bank of Japan tightens policy now, but global inflationary pressures continue to subsidize.

The Yen strengthens rapidly, and it kills any hope for Japanese inflation and wages to actually settle at 2%.

The deflationary mindset kicks in again, and Ueda doesn’t look great.

Ok, quick recap:

-

Services inflation and wage growth in Japan don’t justify a BoJ hawkish shift;

-

Yet the JPY has been rallying rapidly: that’s a function of two things;

-

A global bond rally which compressed yield differentials;

-

Oil prices collapsing which helps Japan as a net importer of crude;

The last piece of the puzzle to assemble here is the impact these crucial Japanese developments might have on global bond markets.

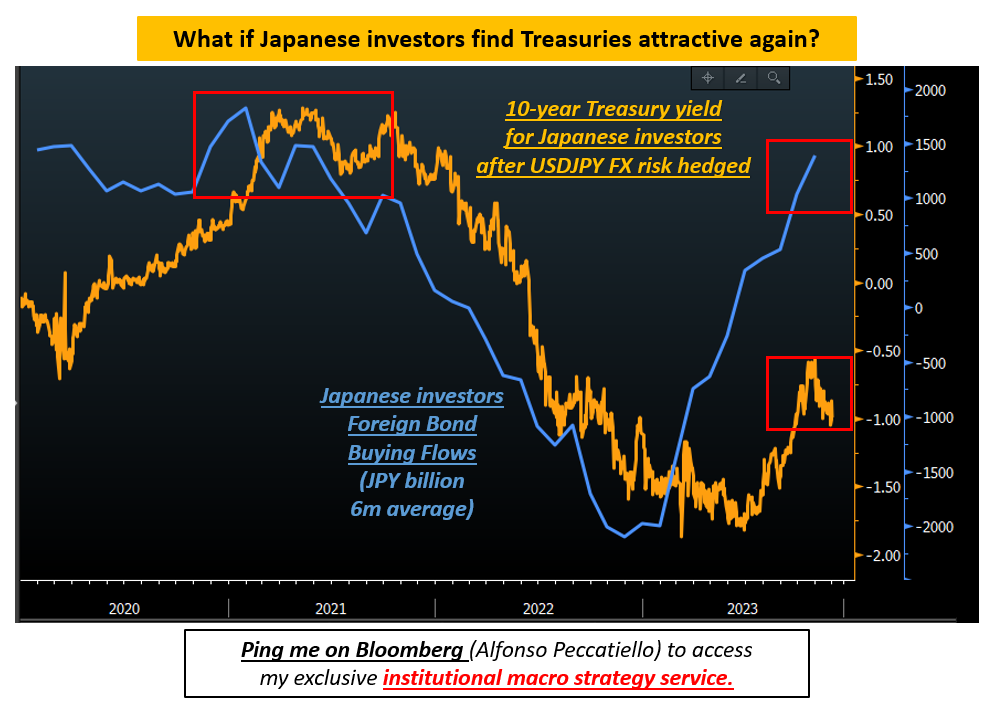

Japan is a massive exporter of capital: Japanese investors own trillions of dollars of foreign assets and they are big in Treasury markets.

What are they doing there?

Japanese investors have been absent from Treasury markets since late 2021 and actively selling a ton of bonds in 2022.

They are now back at buying Treasuries – what drives them?

Japanese investors involved in buying foreign bonds will also face FX risks.

To buy Treasuries they need to convert JPY into , buy the bonds, and at some stage revert back the FX transaction.

This means USD/JPY will largely affect the P&L of their bond transaction.

This is why they generally look at Treasury yields in a different way: the orange line shows 10-year Treasury yields in the eyes of a Japanese investor which also hedges USD/JPY risk for 12 months to cover that FX risk for a reasonable time.

You can see the relatively tight correlation between the attractiveness of FX-hedged Treasuries (orange line up = more attractive) and the actual net buying flows in foreign bonds from Japanese investors (blue line up = they buy more).

In 2022 Treasury yields went rapidly up but Japanese investors were on strike because the USD/JPY FX hedging costs were prohibitive.

Things are a bit better today, and Japanese investors are already back at buying.

The Fed drives these USD/JPY hedging costs more than the BoJ, and once again it’s global macro drivers that matter more than some flashy headlines about Japan itself.

Get US growth and inflation right, get macro right.

Don’t miss the forest for the trees.