Written by Convera’s Market Insights team

Calmer waters after turbulence

George Vessey – Lead FX Strategist

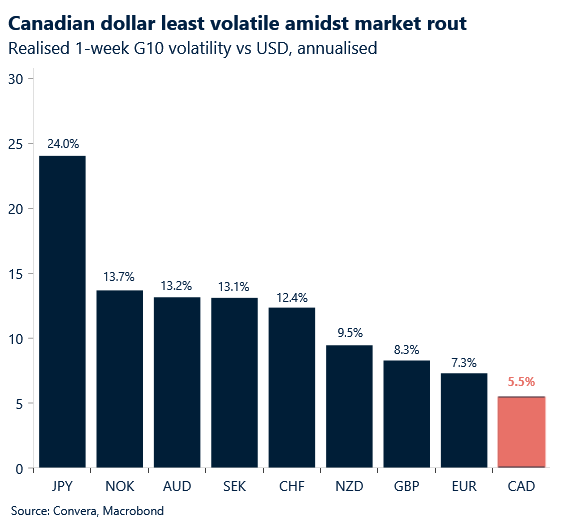

In the span of three weeks, some $6.4 trillion has been erased from global stock markets as fears of a US recession rise, Big Tech’s AI-driven earnings have disappointed, and a great unwind of the carry trades, which has seen the Japanese yen appreciate more than 10% in two weeks, rocked markets globally. The US dollar was mixed on safe haven flows versus weaker growth and high yield appeal.

Currency volatility as measured by Deutsche Bank’s FX Volatility Indicator, has surged to highs last seen in October 2023 and is above its 5-year average, but there is a welcome sign of stabilisation across broader financial markets today. Japanese equities have powered higher, leading gains in Asia, as they retraced some of the 12% losses sustained in Monday’s global rout. Euro Stoxx 50 futures and US equity futures also advanced and Treasuries fell. Sticking with Treasuries, the surge in demand yesterday pushed two-year yields — which are sensitive to monetary policy — below those on the 10-year note for the first time in two years. In other words, the US yield curve briefly turned positive for the first time since July 2022 having stayed inverted for the longest time on record. The yield curve usually resteepens to back above zero right around the time an economic slowdown occurs. However, both yields and equities erased part of their losses yesterday afternoon when the US ISM services PMI beat expectations amid a bounce back in new orders and the first increase in employment in six months.

As a result, an off-cycle rate cut by the Federal Reserve is even more unlikely. Waiting for the September meeting to deliver a 25- or even 50-basis point easing seems like the wiser choice for policy makers. The incoming data will show which one is more likely to play out. But the nervousness rippling through the markets might keep the US dollar strong, particularly against emerging market currencies more broadly.

Loonie rises as investors boost Fed easing bets

Ruta Prieskienyte – Lead FX Strategist

The Canadian dollar gained amid a global market selloff, with the US dollar trading lower on expectations of an aggressive commencement of a Federal Reserve interest-rate easing cycle. USD/CAD briefly dipped below C$1.38 amid positioning unwind flows but is trending higher towards Friday’s C$1.385 level.

The Canadian Treasury benchmark yield curve has shifted sharply downward, in line with a global rush to the bond market. The front end of the curve has seen the greatest rally; the 2-year Canadian bond yield dropped over 40bps in the past 7 days, with over 60% of the move occurring in the past 2 sessions. The US-CA 2-year yield spread briefly narrowed to 52bps, a 1-month low, before widening to Friday’s level amid a pullback in US Treasury bonds. Similarly sharp moves were also observed across the 10-year tenure.

The US calendar is empty today, but early signs of stocks rebounding suggest some upside risks for the greenback as some Fed easing expectations are scaled back. From the Canadian front, balance of trade for June and S&P PMIs are due later today. The market consensus is for a second consecutive month of weakness, which, if confirmed, would put the Loonie back under increased pressure.

Euro second best performing G10 currency in 2024

Ruta Prieskienyte – Lead FX Strategist

The euro has finally found support from the softer US outlook, rallying to an 8-month high amid safe-haven and positioning unwind flows. The pair briefly breached the $1.10 threshold but quickly lost momentum, especially after the better-than-expected US ISM print. This rally reduces the euro’s losses for the year to approximately 0.7%, making it the second-best performer among G10 currencies, behind the GBP. Should the US soft landing scenario be further questioned, the euro could climb higher. However, the rally is unlikely to persist as weaker global growth does not favour the pro-cyclical euro.

The global stock correction has triggered a rush for Treasuries and European bonds alike. German 2-year yields slumped almost 20bps in early Monday trading amid the most aggressive European bond rally since the French snap election announcement. The German front end is trading as though the European Central Bank is poised to cut interest rates imminently. Briefly, traders were betting on as many as 42bps of ECB cuts in September and 94bps of cuts by year-end. Rate cut expectations have since stabilised to Friday’s level, namely 26bps for Sep ’24 and 77bps for Dec ’24. The BTP-bund and OAT-bund spreads widened by 7bps and 4bps respectively as fears of a global recession build.

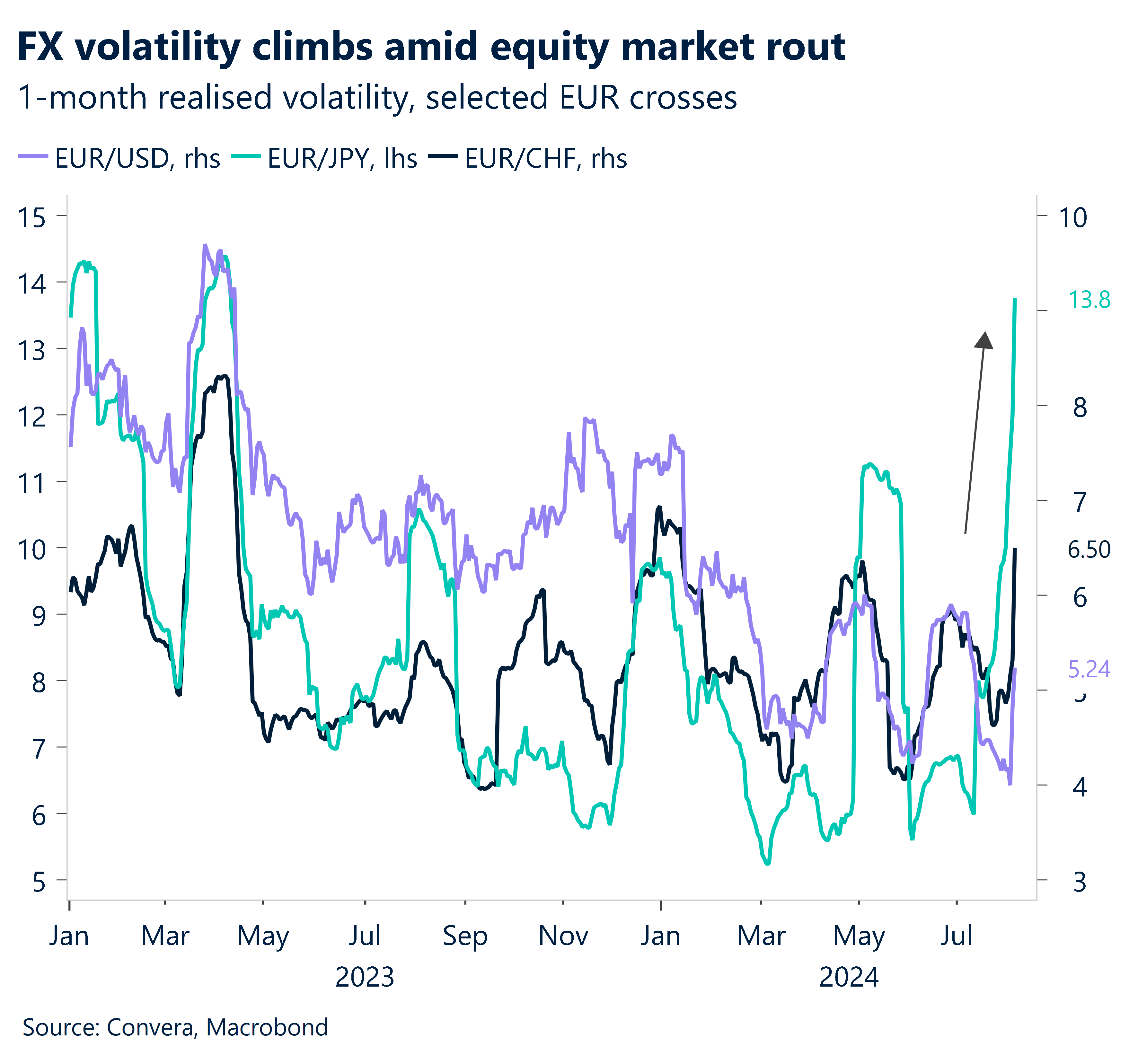

Elsewhere, the euro remains under pressure versus safe-haven flows. EUR/CHF depreciated for the sixth consecutive day amid risk-off sentiment, sending the spot rate near 2024 lows. The euro also posted another single-digit loss against the Japanese yen, amid a continued unwind of short yen positions. The options market exhibits clear signs of heightened market stress too. All G10 euro crosses exhibit an inverted implied volatility term structure; implied volatility on tenures up to 4 months exceed those on longer tenures, with EUR/JPY implied volatility structure now entirely in backwardation. EUR/USD 1-week risk reversal saw the sharpest single-day bullish repricing in two years last Friday. The skew currently stands at 0.373 vol in favour of calls.

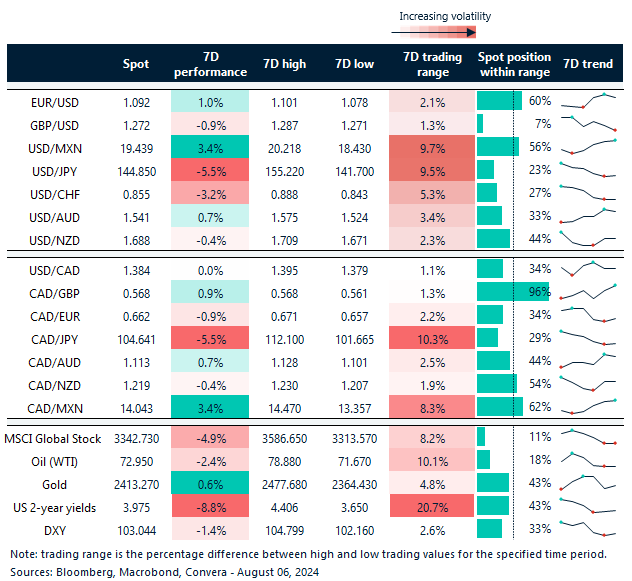

Global stocks down 5% in a week

Table: 7-day currency trends and trading ranges

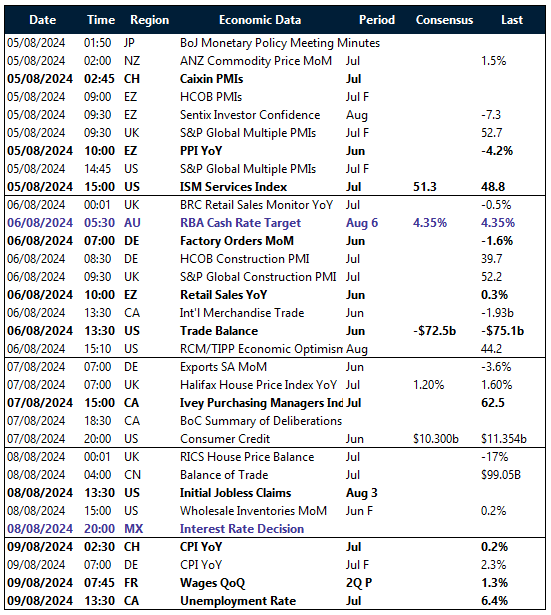

Key global risk events

Calendar: August 05-09

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.