The cryptocurrency market experienced a downturn, with the total market capitalization dropping from $2.51 trillion as of May 2024 to $1.95 trillion as of August 6, 2024. The market volume in the last 24 hours has fallen by 13.13%. Bitcoin, the largest cryptocurrency, is currently trading at $55,013, 17.37% down over the past seven days and increased by 8.04% in the last 24 hours. Ethereum, the second-largest cryptocurrency, is trading at $2,447, down by 26.53% in the last seven days.

The cryptocurrency market plunged yesterday, shedding around $367 billion in value over 24 hours. The major cryptocurrencies like Bitcoin and Ethereum saw substantial drops as investors sold out risky assets.

Let us dig deep into it

Featured Partners

Legacy

Over 2 Million Investors Trust Mudrex for Their Crypto Investments

Security

Mudrex is Indian Govt. recognized platform with 100% insured deposits stored in encrypted wallets

Fees

Enjoy zero crypto deposit fees and industry’s best fee rates.

Multiple Award-Winning Broker

Listed On Deloitte Fast 50 index, 2022 Best Global FX Broker – ForexExpo Dubai October 2022 & more

Best-In-Class for Offering of Investments

Trade 26,000+ assets with no minimum deposit

Customer Support

24/7 dedicated support & easy to sign up

Please invest carefully, your capital is at risk

How is the Crypto Market Performing?

The crypto market is in a significant surrendering phase, with Ethereum and Bitcoin experiencing sharp declines. The key market factors include political uncertainty, geopolitical tensions, economic data, and ETF performance.

CoinSwitch Markets Desk said that after seeing one of the biggest crashes in crypto of all time—BTC losing more than 250 billion dollars in market cap in a single day—the world’s largest crypto found support at just below 50k USD and bounced back more than 14% to trade around the 56k USD mark. The crash was primarily triggered by the Middle East escalations of the war between Israel and Iran and the Japanese stock market recording the greatest single-day crash ever since 1987.

He added, however, that the Nikkei index jumped more than 10% today – after losing 12% yesterday to recover most of its losses, which might trigger a rally in global stock markets again. Since this crash can be attributed to the rate hike by the Bank of Japan, it has to be seen whether this pump sustains.

Mr. Sathvik Vishwanath, Co-Founder & CEO of Unocoin, says that the cryptocurrency market is facing its steepest decline since the collapse of the FTX exchange in November 2022, which is in line with the broader global market decline. A key factor behind this decline is the easing of yen-dollar trades. Traders typically borrow in low-interest currencies such as the yen and invest in higher-yielding assets.

He also added that the recent increase in interest rates by the Bank of Japan has made these trades less profitable, leading traders to close their positions. This prompted a significant sell-off in both the stock and crypto markets. Over $1 billion was liquidated in the crypto sphere, mostly from long positions, further accelerating the market’s downward trajectory.

Mr. Himanshu Maradiya, Founder and Chairman of CIFDAQ Blockchain Ecosystem Ind Ltd, said that “the recent sharp decline in the cryptocurrency market, with major assets like Bitcoin and Ethereum falling over 10%, can largely be attributed to the Bank of Japan’s decision to hike interest rates. This move has significantly impacted carry trades, a strategy where traders borrow in low-interest-rate environments, such as Japan, and invest in higher-yielding assets, including cryptocurrencies.

The Bank of Japan’s interest rate hikes, the first in 17 years, have caused the yen to rise, leading to ‘carry trade unwinding.’ Additionally, rising geopolitical tensions and growing concerns about a potential U.S. recession have further exacerbated the sell-off in crypto markets. The combination of these factors has created a challenging environment for cryptocurrencies, which are particularly sensitive to changes in investor sentiment and macroeconomic conditions.

He added that the current correction phase, driven by the Bank of Japan’s monetary policy shift and the resulting yen appreciation, highlights the interconnected nature of global financial markets. Despite the short-term volatility, cryptocurrencies’ fundamental value propositions remain strong. As the macroeconomic landscape stabilizes, we expect a recovery and sustained growth in the crypto market.”

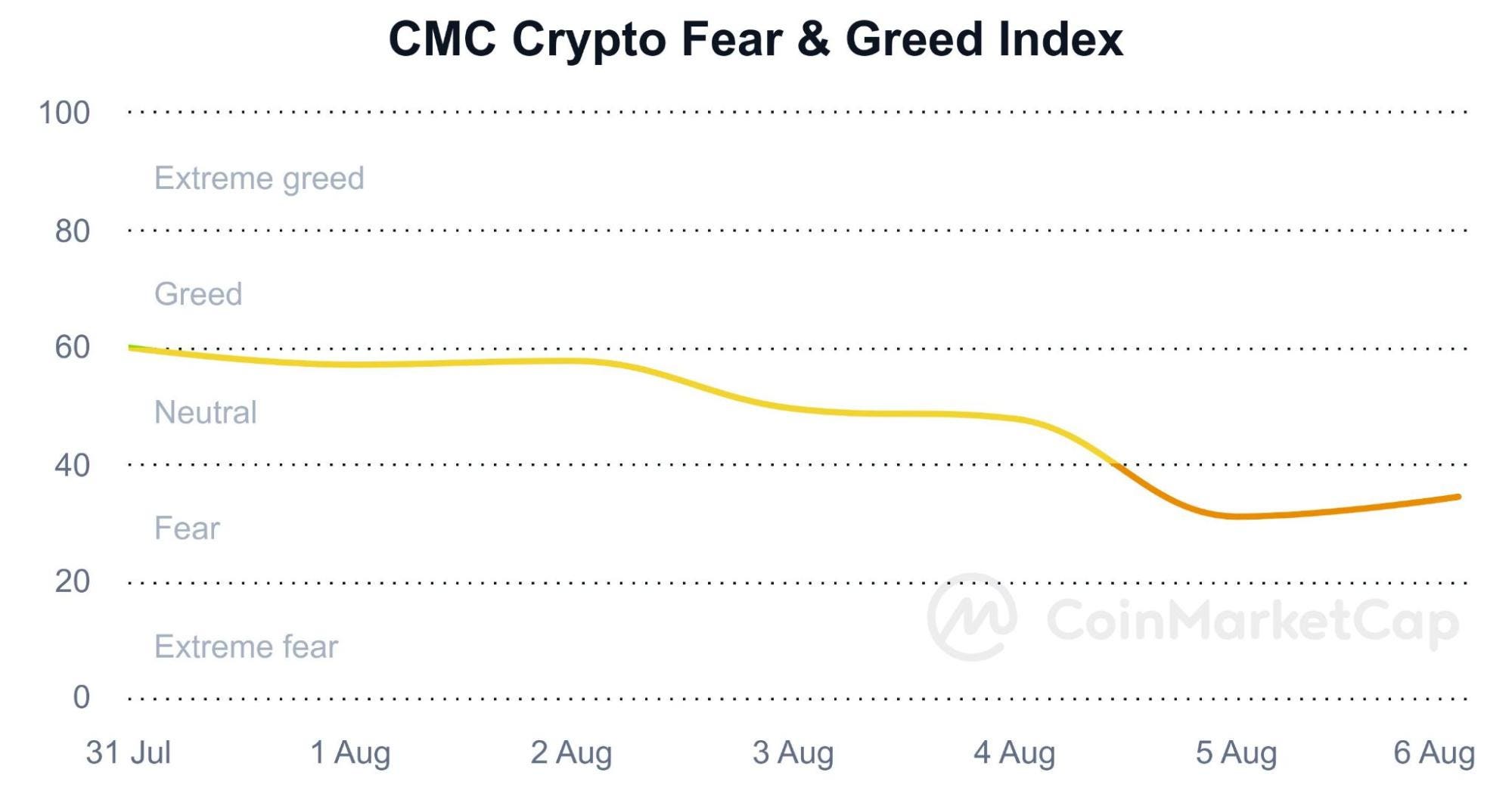

As of August 6, 2024, the Fear and Greed index stands at 34, indicating a fear state.

The largest cryptocurrency by market capitalization, Bitcoin has fallen nearly 17.38% in the last seven days and is trading at $55,004 as of August 6 2024. On the other hand, Ethereum almost dipped by 26.85% and is trading at $2,447.

The price of Bitcoin fell, hitting below $50,000 on Monday, while Ethereum dropped by almost a third to $2,340 over the past week. Altcoins didn’t escape the rout: Cardano plunged around 27%, Solana by 36%, Dogecoin by 34%, XRP by 23%, Shiba Inu by 30%, and BNB by 25.7%.

Cryptocurrency’s bloodbath appears to be part of a broader flight to safety. After last week’s worse-than-expected unemployment report, the economy entered a technical recession, according to a measure called the “Sahm Rule.” It marks the beginning of a recession when the unemployment rate’s three-month average rises by at least half a percentage from its lowest point in the last year.

In response, the S&P 500 is nearly down by 2%, the Nasdaq by 2.5%, and the Dow by 1.5%. However, considering the Monday bloodbath overseas, this may be just the beginning of a broader rout.

Is Investing in Cryptocurrency Safe?

The cryptocurrency market has seen the good side as well as the worst side of the market, be it post-Russia-Ukraine effects, Terra-Luna crash, FTX collapse or tightened tax regulation, it has witnessed roughest storms during the past few years.

The year 2023 gave a fresh start to the crypto world, showing positive signs of recovery. Crypto investors believe that in situations like this, investing in stable digital currencies like Bitcoin and Ethereum in SIP format is a safe choice. Crypto experts consider that in the overall portfolio, investors should just look at investing just the 5% exposure to cryptocurrencies. The most important part is to invest only a miniscule amount and not all your life savings as the market is highly volatile and there are chances of you losing it all.

Steps On How To Invest In Indian Cryptocurrency Market

Step 1: Select the best cryptocurrency: Choose a cryptocurrency you wish to invest in. Like any other asset class, crypto has its own fundamentals and different blockchain networks back them, intrinsic value and mining techniques. Make sure that you research and analyze before investing as the crypto market is highly volatile. Choose an exchange that is FIU-registered.

Step 2: Select a crypto exchange: After you made up your mind about a cryptocurrency it’s time for you to find a perfect crypto exchange platform for yourself. It is a necessity to have a functional account in a crypto exchange which will help you to buy and sell cryptocurrencies. Check out our article on the best cryptocurrency exchanges in India.

Step 3: KYC: Once you select a crypto exchange you need to register yourself by providing personal details like name and address and complete the entire KYC formalities. After setting up your account you’re ready to invest in cryptocurrency.

Step 4: Choose payment mode: For buying a cryptocurrency you need to select a payment option that you find comfortable. You can choose peer-to-peer, bank transfer, online payment mode or a crypto wallet.

Step 5: Purchase cryptocurrency: After adding the funds to your account you can smoothly buy your selected cryptocurrency. All you have to do is press on the “buy” tab and you can easily buy the cryptocurrency of your choice.

Step 6: Storage: After you purchase the crypto coins, don’t forget to store your currencies securely because they are not regulated and you must keep them safe as there’s always a risk of hacking or theft. You can check out the crypto storage options from here.

Step 7: Selling cryptocurrency: This is as important as buying as this helps you make money out of investing. You can sell the cryptocurrency the same way you purchased it, just click on the tab “sell” in your portfolio. You can fully or partially sell your crypto investment based on your choice but don’t forget to timely book your profits.

Featured Partners

Legacy

Over 2 Million Investors Trust Mudrex for Their Crypto Investments

Security

Mudrex is Indian Govt. recognized platform with 100% insured deposits stored in encrypted wallets

Fees

Enjoy zero crypto deposit fees and industry’s best fee rates.

Multiple Award-Winning Broker

Listed On Deloitte Fast 50 index, 2022 Best Global FX Broker – ForexExpo Dubai October 2022 & more

Best-In-Class for Offering of Investments

Trade 26,000+ assets with no minimum deposit

Customer Support

24/7 dedicated support & easy to sign up

Please invest carefully, your capital is at risk

Bottom Line

It is a wise choice to observe the crypto market prudently with the uncertain environment and slow recovery of macroeconomic situations in the world. Do not make any reckless decisions as it is a good time to observe the market closely and analyze it.

One may never know, but the observation will eventually help the investors to make smart decisions and might have a favorite digital asset at a fair value, once the chaos situation fizzes out completely.

More Resources in Cryptocurrency

Explore Our Top Cryptocurrency Picks

Learn More About Cryptocurrency

Coins Prediction

Price Analysis Articles

Crypto Buying Guides