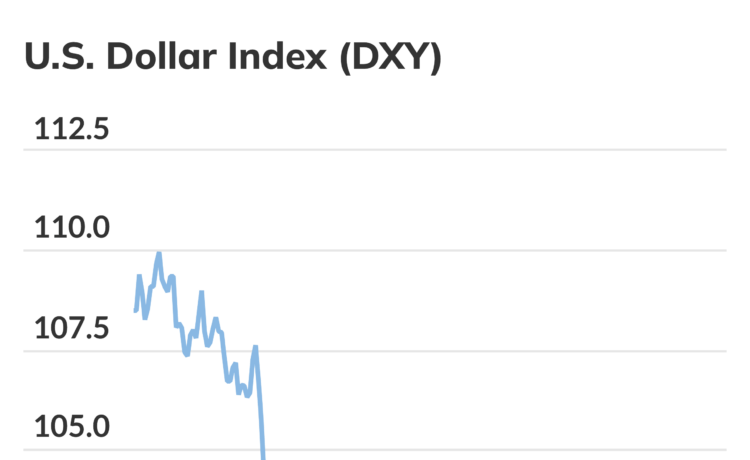

The U.S. dollar has been “flattish” since mid-June, but its recent strength may be short-lived after a slide of as much as 12% from its January high amid anticipation that the Federal Reserve would resume lowering interest rates, according to a Morgan Stanley Wealth Management.

“Based on recent Fed governor rhetoric,” the expected federal-funds terminal rate for December has “broken below 3.0%, potentially a sign that the dollar will resume its downward bias,” Lisa Shalett, chief investment officer for Morgan Stanley Wealth Management, said in a note Monday. She cited the Overnight Index Swap as a market-based measure of rate expectations.

“Since early August, the two-year US Treasury yield is down approximately another 50 basis points, at 3.46%, as the dollar has remained anchored,” Shalett wrote. “While other assets and variables typically correlated with the dollar, like gold and the term premium, have not been as predictive as usual, forward fed funds rates have been.”