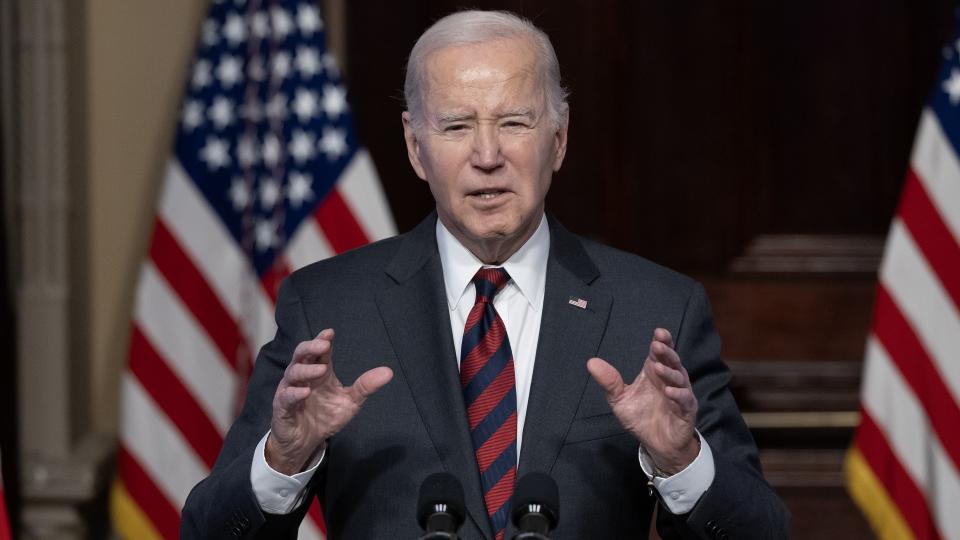

Polls indicate many Americans are not happy with President Biden’s handling of the economy compared with his former and current rival, Donald Trump. If the past is used as a predictor of the future, a second Biden term could mean continued financial trouble — like inflation — for senior citizens, many of whom are baby boomers (born between 1946 and 1964).

Read More: I’m an Economist — Here’s My Prediction for Social Security If Biden Wins the 2024 Election

Check Out: 7 Common Debt Scenarios That Could Impact Your Retirement — and How To Handle Them

Here are five reasons a second term for Biden could spell financial disaster for boomers.

Also see what a Biden win could mean for your retirement savings.

Wealthy people know the best money secrets. Learn how to copy them.

Inflation

According to a CNBC report on the Federal Reserve minutes, “The Fed targets a 2% inflation rate, and all of the indicators showed price increases running well ahead of that mark.”

Biden’s attempts to tame inflation have done little, leaving boomers questioning his ability to turn things around. The price of everything from food to gas is a concern for the majority of boomers who live on fixed incomes.

Wells Fargo projects inflation to stay around 3% through 2025. Boomers have reason to be concerned about how they will pay for things if Biden is unable to address rising costs.

Discover More: 9 Moves for Retirement Planning To Make Now If You’re Worried About the Economy

Social Security

Despite two significant increases to monthly benefits, Social Security improvements are lagging behind inflation and the increasingly high prices for housing, food, healthcare and other important things. Many boomers rely heavily on Social Security, and inadequate improvements to Social Security forces them to make use of savings, credit cards and assistance programs.

Medicare

The Biden-Harris Administration has made a priority of strengthening the Medicare program. They are working to protect beneficiaries — by establishing guardrails against misleading or predatory Medicare Advantage marketing and ensuring that agents/brokers act in the patient’s best interests — and lower prescription drug costs.

That said, not everyone is on board. Boomers enrolled in Medicare Advantage plans will suffer higher patient costs and reduced benefits as a result of Biden’s payment cuts, according to The Wall Street Journal.

These plans are privately administered by government-funded insurers and have been popular for lower-income Americans because they often have lower out-of-pocket costs compared to Medicare’s fee-for-service. Biden is against Medicare Advantage with its aforementioned predatory practices and counterproductive bureaucracy. If Biden is reelected, it may result in further disruption to a program that has been received positively.

Interest Rates and Housing

High interest rates contribute to the troubling state of the housing market. Many voters fear interest rates will remain high during a second Biden term, according to the The New York Times.

It’s a common practice for retirees to downsize — sell their family homes and move into smaller ones. Younger boomers are entering retirement now and, in the next few years and with high interest rates, they may profit less on the sale of their homes as mortgage rates result in lower selling prices.

Moreover, boomers looking to purchase new homes will have a harder time doing so because of the high rates. The problem also extends to rent prices for apartments, which rise with increased demand.

Required Distributions

Biden has proposed changes to retirement savings that would call for required distributions from IRAs with balances exceeding $10 million, serving as a new limit for preferential tax treatment. The plan also would prevent “backdoor” Roth conversions for those making more than $400,000 ($450,000 for married couples), which are ways for individuals and couples to circumvent the income limit of a Roth IRA and make indirect contributions.

The benefit of this would be allowing wealth to grow untaxed. Individuals and couples would be able to do so only if they make more than $161,000 or $240,000, respectively, but less than the proposed limit. Wealthy boomers see this effort as a negative to a second Biden term.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: 5 Reasons a Biden Second Term Could Be a Financial Disaster for Boomers